- Analytics

- News and Tools

- Market News

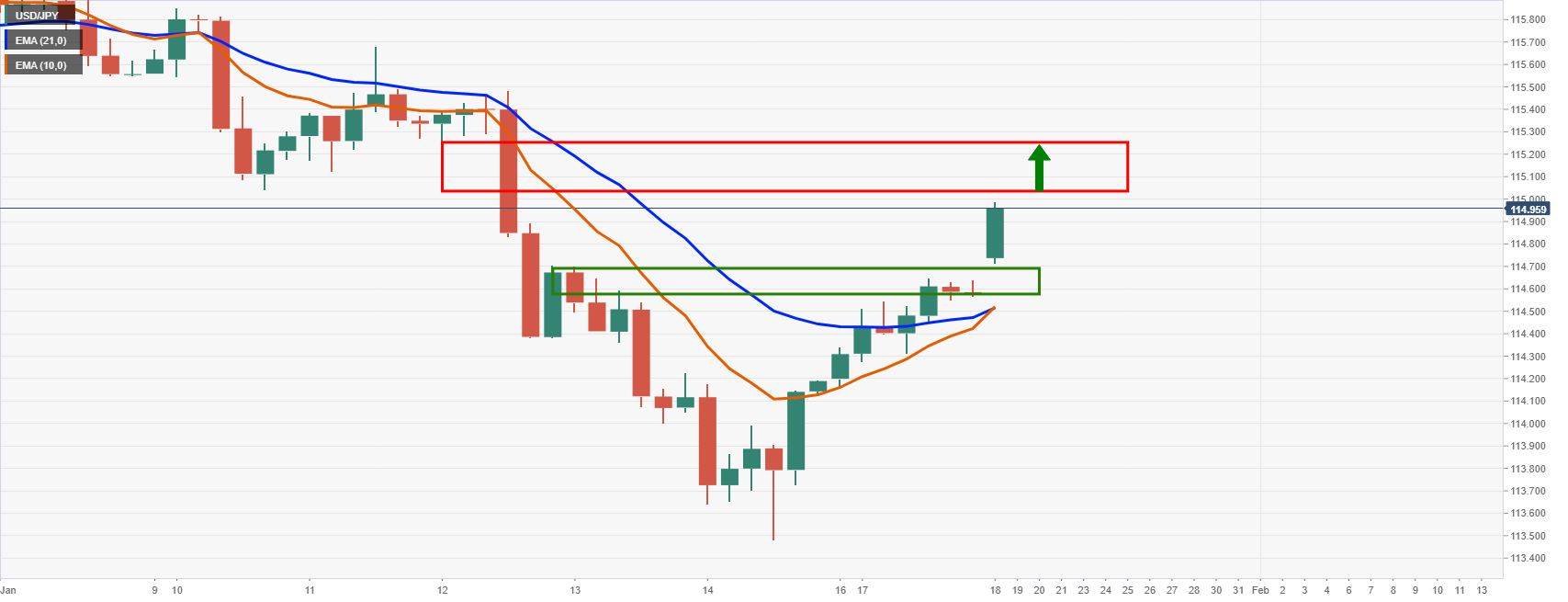

- Risk sentiment sours, USD/JPY runs to 115 (114.99 bid), Russia-Ukraine crisis moved a step closer to war

Risk sentiment sours, USD/JPY runs to 115 (114.99 bid), Russia-Ukraine crisis moved a step closer to war

Markets have soured in recent trade without a known catalyst, so far. Covid spreading and the combination in recent news that Russia has begun emptying out its embassy in Kyiv, the Ukrainian capital. While not breaking news topics, they are fundamentally worthy of note:

An EU diplomat has stated that "Europe is now closer to war than it has been since the break up of former Yugoslavia," according to Katya Adler at the BBC.

''Stark words of warning from the senior EU diplomat I've just been speaking to off the record about current tensions with Moscow, over its huge military build-up on the border with Ukraine.''

She reports that the mood in Brussels is ''jumpy''.

''There's a real fear that Europe could be spiralling towards its worst security crisis in decades.

But angst isn't wholly focused on the prospect of a long, drawn-out ground war with Russia over Ukraine.

Few here believe Moscow has the military might, never mind the money, or popular support back home for that.''

Concerningly, Ukrainian and US officials say the evacuation could be the preparation for a conflict.

''How to interpret the evacuation has become part of the mystery of divining the next play by President Vladimir V. Putin of Russia,'' the New York Times wrote.

''In Washington, US officials say they still assess that Mr. Putin has not yet made a decision to invade. They describe him as more a tactician than a grand strategist, and they believe that he is constantly weighing a host of different factors.''

The article explains that ''the US officials say Mr. Putin may also have concluded that with the United States and other countries arming Ukraine, his military advantage is at risk of slipping away.''

While U.S. officials still believe Mr. Putin is undecided about his next move, officials in Kyiv are assessing what an attack may look like, if it happens. It could come in the form of a full-on invasion, the Ukrainian security official said.

However, for markets, there is a far greater threat than just troops and armour rolling in over Ukraine's border. Nuclear armament and the echoes of the 1962 Cuban Missile Crisis are the most extreme real risks that are being reported on in the media.

''The Russian leader telegraphed that approach himself by warning repeatedly in the past year that if the West crossed the ever-shifting “red line” that, in Mr. Putin’s mind, threatens Russia’s security, he would order an unexpected response,'' the NYT wrote.

“Russia’s response will be asymmetrical, fast and tough,” Mr. Putin said last April, referring to the kinds of unconventional military action that Russia could take if adversaries threatened “our fundamental security interests.”

With all that being said, five of the world's largest nuclear powers, the US, UK, France, and Russia, recently pledged to work together toward "a world without nuclear weapons" in a rare statement of unity amid rising East-West tensions.

However, as the BBC states, ''what Vladimir Putin plans to do next is unclear. But the West believes the Kremlin has invested too much in its very public manoeuvres over Ukraine to back down now, without something to show for it.''

Markets in action

In Asia, equities are off sharply in recent trade as risk appetite sours and the US dollar rallies sending USD/JPY towards the 115 target:

The S&P 500 is down some 0.4%, the US dollar, DXY, is up 0.16% and AUD/JPY has reversed course sharply to being flat on the day. US yields in the 10-years move to fresh two-year highs also.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.