- Analytics

- News and Tools

- Market News

- US Dollar Index meets some resistance near 95.80 ahead of data

US Dollar Index meets some resistance near 95.80 ahead of data

- The upside momentum in DXY falters near 95.80 midweek.

- US yields keep the march north unabated so far.

- Building Permits, Housing Starts next of relevance in the docket.

The greenback, when measured by the US Dollar Index (DXY), seems to have met some initial barrier around the 95.80 region on Wednesday.

US Dollar Index looks to yields, data

After three consecutive daily advances, the strong rebound in the index appears to have run out of steam near the 95.80 level so far on Wednesday. The greenback looks to have regained the upside pressure following the recent breakout of the 4-month resistance line, today near 95.25.

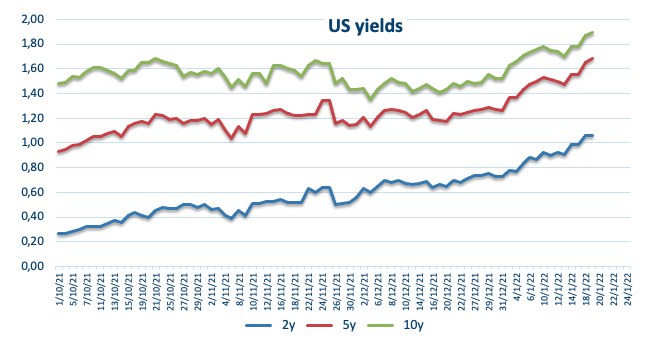

The intense climb in the buck came pari passu with the strong recovery in US yields across the curve, as market participants continue to recalibrate the imminent start of the hiking cycle by the Federal Reserve, with the March meeting a likely candidate as per recent Fedspeak, Powell’s testimony and persevering elevated inflation.

Indeed, yields of the 2y note approach the 1.08% level for the first time since February 2020, while the key 10y note already flirts with 1.90% and the 30y already surpassed the 2.20% mark.

In the US data space, MBA will publish its usual weekly Mortgage Applications into January 14 seconded by December Building Permits and Housing Starts.

What to look for around USD

The index regained composure and reclaimed the 95.00 mark and well above in past sessions, partially reversing the intense selloff witnessed during most of last week. Higher US yields propped up by firmer speculation of a sooner Fed’s lift-off and supportive Fedspeak helped the buck to regain part of the shine lost in past sessions, all against the backdrop of persistent elevated inflation and the solid performance of the US economy.

Key events in the US this week: Building Permits, Housing Starts (Wednesday) – Initial Claims, Philly Fed Index, Existing Home Sales (Thursday).

Eminent issues on the back boiler: Start of the Fed’s tightening cycle. US-China trade conflict under the Biden’s administration. Debt ceiling issue. Potential geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.08% at 95.64 and a break above 95.83 (weekly high Jan.18) would open the door to 96.46 (2022 high Jan.4) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 94.75 (100-day SMA) followed by 94.62 (2022 low Jan.14) and then 93.27 (monthly low Oct.28 2021).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.