- Analytics

- News and Tools

- Market News

- US Dollar Index resumes the downside, back to 95.60

US Dollar Index resumes the downside, back to 95.60

- DXY remains side-lined around the 95.60 region on Friday.

- US yields extends the correction lower along the curve.

- CB Leading Index will be the sole release in the US docket.

The greenback, in terms of the US Dollar Index (DXY), reverses Thursday’s uptick and returns to the 95.60 region, all amidst the renewed consolidative mood.

US Dollar Index looks to risk trends, yields

The index extends the consolidation in the upper end of the recent range, coming under some selling pressure after failing around the 95.80 region once again.

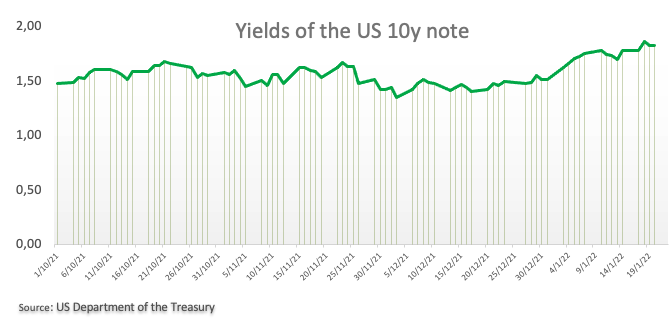

The retracement in the dollar echoes another so far negative session in the US money markets, where yields extend the corrective move lower. On this, yields of the key 10y benchmark note have returned to the sub-1.80% level, some 10 bps down from recent tops just past 1.90% (January 19).

In the meantime, the greenback seems to lack conviction to retest/surpass the key barrier at 96.00 the figure based on the idea that much of the Fed’s tightening this year, including a rate hike in March, appears to be already priced in among investors.

On the US data sphere, the only release will be the Conference Board’s Leading Index for the month of December.

What to look for around USD

The index came under some downside pressure soon after recent peaks near 95.90. In fact, the recovery from as low as the 94.60 area (January 14) almost fully reclaimed the ground lost earlier in the new year, always on the back of the sharp move higher in US yields, firmer speculation of a sooner move on rates by the Federal Reserve, supportive Fedspeak and the strong march of the US economic recovery.

Key events in the US this week: CB Leading Index (Thursday).

Eminent issues on the back boiler: Start of the Fed’s tightening cycle. US-China trade conflict under the Biden’s administration. Debt ceiling issue. Potential geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.13% at 95.64 and a break above 95.83 (weekly high Jan.18) would open the door to 96.46 (2022 high Jan.4) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 94.81 (100-day SMA) followed by 94.62 (2022 low Jan.14) and then 93.27 (monthly low Oct.28 2021).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.