- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Bulls make small steps in pursuit of a higher daily high

Gold Price Forecast: Bulls make small steps in pursuit of a higher daily high

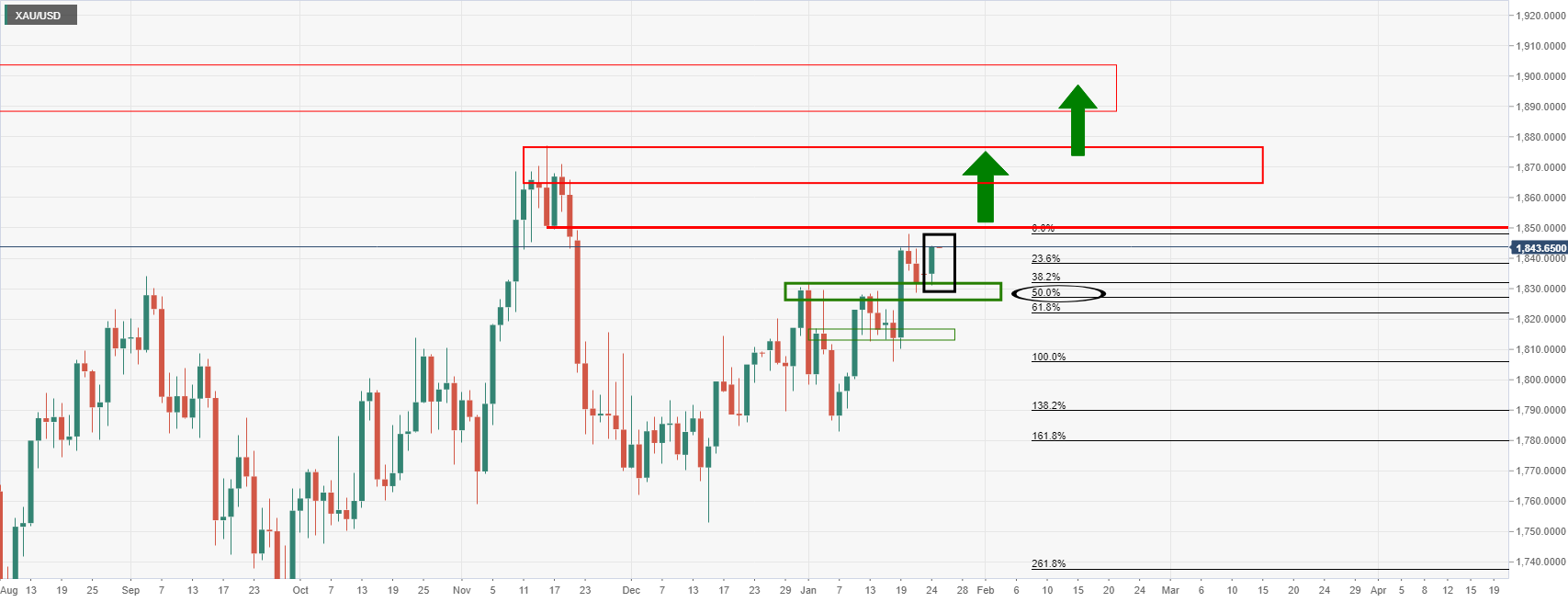

- Gold's safe-haven allure draws in the bulls to target the $1,850s.

- A bid through the prior daily highs will take on the $1,850 and open risk to the $1,870s.

Gold prices edge higher on Monday as safe-haven buying emerged. The precious metal moved in close quarters with the psychological $1,850 area printing a high of $1,844.18 in the NY session and is starting Tokyo a touch under pressure near $1,842.

The drivers in the market are geopolitical, for now, until the Federal Reserve meeting last in the week. Despite rising expectations, the US Fed will raise rates faster than previously expected, investors have been moving into gold for its safe-haven qualities.

Inflows into gold back ETFs continue to surge, analysts at ANZ bank noted. ''SPDR Gold Shares, the largest ETF recorded its biggest net inflow in USD terms since listing in 2004. By weight, 27.6 tonnes were added.''

Gold advanced on Monday as a selloff in Wall Street driven by geopolitical tensions over Ukraine drove demand for the precious metal. Spot gold rose over 0.5% per ounce. US gold futures settled up 0.5% at $1,841.70 after NATO said it was putting forces on standby in eastern Europe in response to Russia's military build-up at Ukraine's borders. Russia denounced NATO's move as an escalation of tensions.

Meanwhile, the US dollar climbed to a two-week high on Monday against a basket of currencies as measured by the DXY index. The dollar index rose 0.67% to 96.12 during the US session. The greenback tends to perform at times of risk-off and owing to the slight yield advantage. It is also set to outperform the likes of the CHF and the yen should tensions escalate.

For instance, antagonising Russia, the United States is considering transferring some troops stationed in western Europe to eastern Europe in coming weeks and US President Joe Biden has already ordered diplomats' families to leave Kyiv.

Eyes on the Fed

As for the Federal Reserve risk, the US dollar index has gained some 1.5% since Jan. 14 in anticipation of a hawkish outcome from this week's interest rate decision. Several banks have raised forecasts for the speed and size of the Fed's policy tightening.

Most expect the first hike to be 0.25% in March and three more to 1.0% by year-end. The Fed has already signalled the start of interest rate hikes in March, but traders will be tuning in to see if the statement indicates how fast it will shrink down its holdings of Treasuries and mortgage debt on the balance sheet from beyond $8 trillion.

Gold positioning

''Gold ETFs recorded a massive inflow totalling nearly 900k oz on Friday, in a sign that equity market turbulence is finally leading to a rise in safe-haven demand for the yellow metal. While the recorded inflows may be distorted by options-related activity, the concurrent rise in volatility also suggests some safe-haven appetite building,'' analysts at TD Securities said in a note.

However, the analysts warn ''with Lunar New Year around the corner, Chinese physical demand may subside just as CTA inflows run out of steam. In fact, CTA trend followers are set to liquidate some gold length should prices break below $1815/oz.''

Gold technical analysis

As per the pre-open analysis this week, Gold, Chart of the Week: Bulls pining for $1,850+, could be just a Fed away, the price has been moving in on critical resistance:

Gold, prior analysis

Gold, live market update

A bid through the prior highs will take on the $1,850 and open risk to the $1,870s in the coming sessions.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.