- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD is on the backfoot in the open

Gold Price Forecast: XAU/USD is on the backfoot in the open

- Gold starts out on the backfoot due to a strong US dollar and the Fed.

- Risk-off flows should continue, however, supporting the safe havens.

- XAU/USD to remain bearish amid rising US yields.

At $1,924.27 the low in the open, the gold price is starting out on the back foot on Monday in the Asian open. The yellow metal ended Friday down some 0.62% at $1,925 after travelling from a high of $1,939.62 to a low of $1,918.10.

Investors are having to weigh up the risks of a protracted war in Ukraine and as the peace talks drag on to no avail as well as a US recession against a hawkish backdrop at the Federal Reserve. Analysts at TD Securities explained that gold remains in the crosshairs as the Fed pricing provides a constant dark cloud over the precious metal market.''

''While safe-haven appetite and massive ETF inflows provide a strong offset, keeping prices above CTA liquidation thresholds near $1830/oz, the drag of a hawkish Fed backdrop is increasingly weighing on the upside momentum of the yellow metal.''

On Friday, the US Nonfarm Payrolls were solid for March. 431,000 jobs were added last month, below the estimates of 490,000, although data for February job increases were revised higher. However, the Unemployment rate fell to 3.6%, the lowest since February 2020. This has supported the US dollar. As measured by the DXY index, the greenback was higher for the second straight day after two straight down days and is trading back near 98.50. This month’s cycle high near 99.418 should eventually be tested. The US dollar is bid in the open on Monday, now trading in the 98.60s.

Additionally, Reuters reported that the futures contracts tied to the Fed's policy rate fell after the jobs report, pointing to expectations that the Fed will hike by a half-a-percentage point at each of its next three meetings to deal a more decisive blow to price pressures. ''That would follow a quarter-point hike on March 16, when the Fed embarked on a new tightening cycle.''

Nonetheless, despite the strength in the greenback, analysts at TD Securities argued that ''so long as material progress on ceasefire talks and de-escalation remains elusive, haven flows are likely to keep the yellow metal supported.'

As per the speculation of a US recession, the analysts said, at the same time, ''the 2y-10y curve flirting with inversion has further fueled talk of the recession on the horizon, offering another positive dynamic for the gold market. With that said, while geopolitical tensions and yield curve recession signals re-ignite investor interest in gold, downside risks are more prevalent amid a hawkish Fed backdrop and as negotiators continue to work towards a ceasefire.''

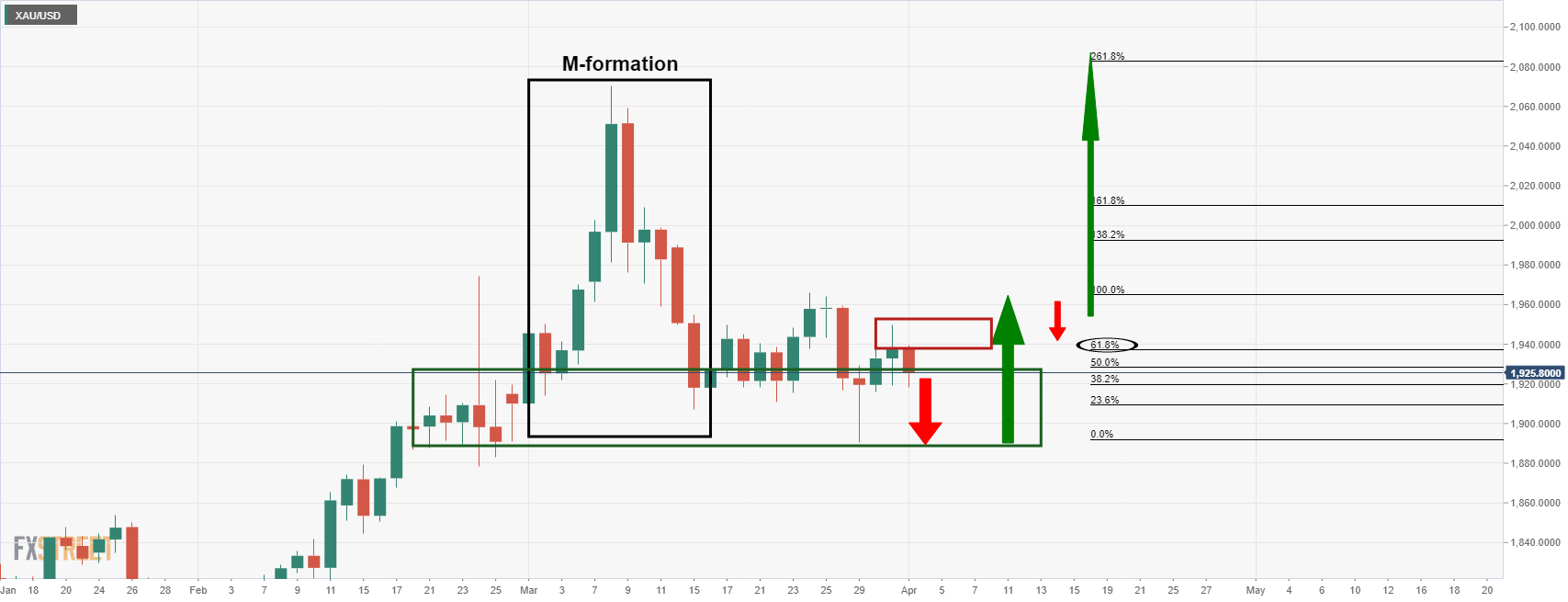

Gold, technical analysis

As per the pre-open analysis, Chart of the Week, Gold: XAU/USD is pressured for the open ...

... the M-formation is a bullish reversion pattern and the price would be expected to be attracted to the neckline between $1,980 and $2,000. However, the sideways consolidation has played out to the point that there appears to be a bias to the downside for the near term where gold is being resisted by a 61.8% Fibo currently.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.