- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bleeds out in Asian markets, sub $1,920

Gold Price Forecast: XAU/USD bleeds out in Asian markets, sub $1,920

- Gold is under pressure on US dollar strength.

- The US dollar is firm as investors price in the Fed and US yields rise.

Gold, XAU/USD, has been pressured at the start of the week while mixed sentiment prevails surrounding the Ukraine crisis vs expectations of rapid-fire from the Federal reserve following last week's Nonfarm Payrolls outcome.

At the time of writing, XAU/USD, is down 0.26%, falling from a high of $1,926.86 and sliding to below Friday's low printing of $1,918.32. The greenback got off to a solid start o Monday, buoyed by a rise in US Treasury yields on the expectations of a series of interest rate rises from the Fed. Following the NFP report, US 2-year bond yields closed at a high for the year in the North American session and the US 10-year yields also rose, weakening investor demand.

Non-farm payrolls increased 431k in March, following a strong upward revision to the February data to 750k. The Unemployment Rate also fell slightly to 3.6% while the average hourly earnings increased 0.4% MoM to bring annual growth to 5.6%. The data was a mixed bag, with hourly earnings for February revised back to 0.1%, which along with the March figure, indicates the heat may be coming off the US labour market. Overall, however, the report has strengthened the Fed’s case to use aggressive rate hikes to tame inflation. Fed funds futures have priced a near 4/5 chance of a 50 basis point hike next month.

Nevertheless, the ongoing war in Ukraine is likely to see demand for safe have assets remain strong, analysts at ANZ Bank argued. ''Our gold valuation model of the spread between fair value and spot gold prices has shot from zero to USD300/oz since Russia invaded Ukraine, suggesting a hefty risk premium. In addition, the secondary impacts of the Russia-Ukraine crisis will provide a strong level of support. The broader isolation of Russia will see a structural shift in the energy sector, which will be inflationary.''

Elsewhere, talk of new sanctions kept the broad mood cautious in early trade, but this too supports the US dollar. Germany's defence minister said on Sunday that the European Union must discuss banning imports of Russian gas after Ukrainian and European officials accused Russian forces of atrocities. Ukraine accused Russian forces of carrying out a "massacre" in the town of Bucha, which was denied by Russia's defence ministry.

''So long as material progress on ceasefire talks and de-escalation remains elusive, haven flows are likely to keep the yellow metal supported,'' analysts at TD Securities said. ''At the same time, the 2-year and 10-year curve flirting with inversion has further fueled talk of a recession on the horizon, offering another positive dynamic for the gold market.''

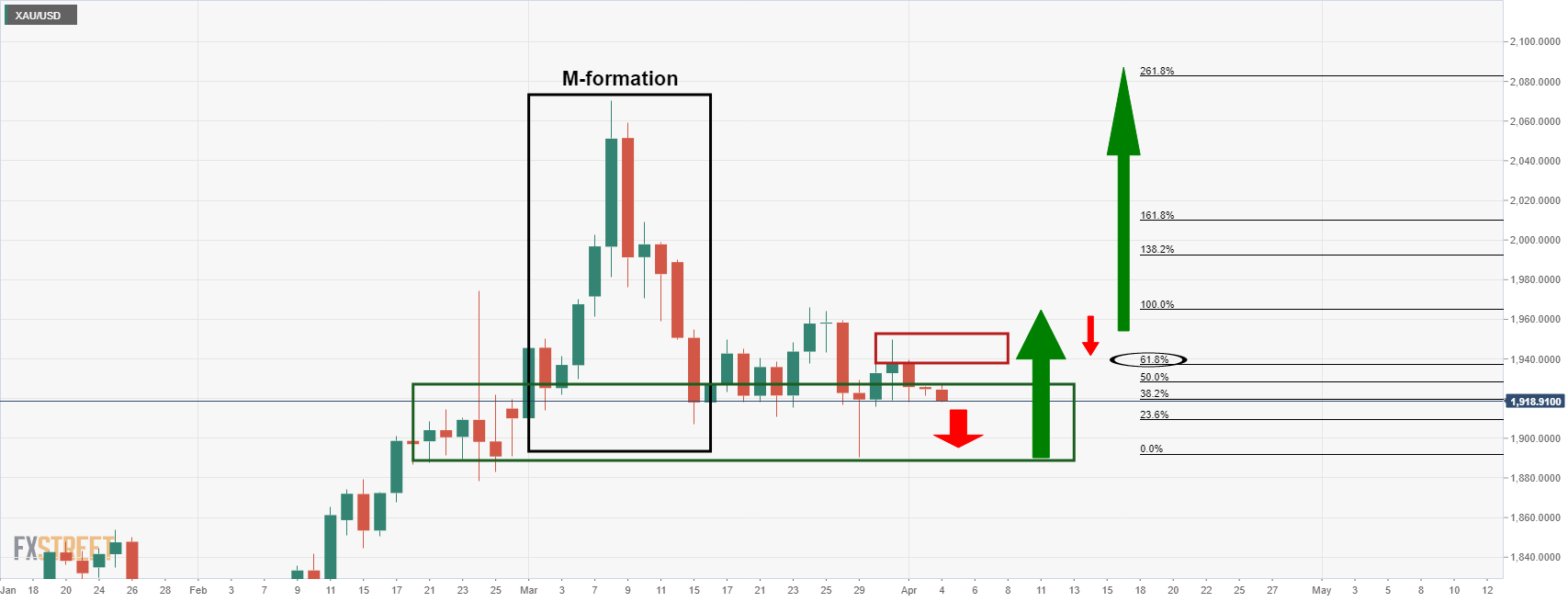

Gold technical analysis

The price is heading deeper into the demand and supporting area following a 61.8% Fibonacci correction of the prior bearish impulse. However, should bulls commit, then there will be prospects of a move beyond the current resistance near $1,950 for the days ahead and the potential for an onward continuation.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.