- Analytics

- News and Tools

- Market News

- EUR/USD extends the downtrend, targets 1.1000

EUR/USD extends the downtrend, targets 1.1000

- EUR/USD meets support near 1.1000 on Monday.

- The dollar extends gains amidst the mixed note in yields.

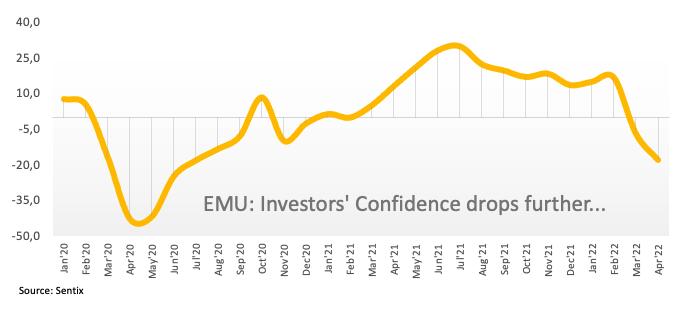

- EMU Sentix Index worsened to -18.0 in April.

Sellers remain in control of the sentiment surrounding the European currency and force EUR/USD to visit the vicinity of 1.1000 early on Monday.

EUR/USD weaker on dollar gains, Ukraine

EUR/USD loses ground for the third session in a row and gradually approaches the 1.1000 neighbourhood, where some initial support seems to have emerged so far.

The continuation of the buying interest around the greenback keeps the pair depressed at the beginning of the week, as market participants continue to gauge Friday’s release of a quite solid US labour market during March. In addition, no news from the geopolitical scenario seems to be good news for the buck, while peace talks remain stuck without any progress for the time being.

The move lower in the pair comes pari passu with another corrective downside in the German 10y bund yields, which return to the 0.50% region, or multi-session lows.

In the domestic calendar, Germany’s trade surplus widened to €11.5B during February (from €8.9B) with Exports and Imports up 6.4% and 4.5%, respectively. In addition, the Sentix Index – which tracks the Investor Confidence – worsened to -18.0 for the current month. In the NA session, February’s Factory Orders will be the sole release.

EUR/USD came under pressure and approaches the 1.1000 area following recent 4-week highs around the 1.1180 region, all in response to the firm performance of the greenback and renewed geopolitical concerns. As usual, pockets of strength in the single currency should appear reinforced by the speculation of the start of the hiking cycle by the ECB at some point by year end, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a rebound in the euro.

Key events in the euro area this week: Eurogroup Meeting, Germany Balance of Trade, EMU Sentix Index (Monday) – Germany, EMU Final Services PMIs, EcoFin Meeting (Tuesday) – Germany Construction PMI (Wednesday) – EMU Retail Sales, ECB Accounts (Thursday) – France Presidential Election (Sunday, April 10).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Impact of the geopolitical conflict in Ukraine.

EUR/USD levels to watch

So far, spot is losing 0.19% at 1.1026 and a drop below 1.0944 (weekly low March 28) would target 1.0900 (weekly low March 14) en route to 1.0805 (2022 low March 7). The next up barrier emerges at 1.1184 (weekly high March 31) followed by 1.1240 (100-day SMA) and finally 1.1395 (weekly high February 16).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.