- Analytics

- News and Tools

- Market News

- When is the RBA and how might AUD react?

When is the RBA and how might AUD react?

The statement on the outcome of the RBA Board meeting is released at 04.30 GMT today, Tuesday, May 5. It is universally expected that the cash rate will be held at a record low of 0.1%.

Analysts at Westpac explained that the focus will be on any shift in language in the decision statement, especially the final sentence of the March statement declaring that "Board is prepared to be patient."

''Inflation is now back in the target band and the unemployment rate, at 4.0%, will soon move below 4% for the first time since 1974,'' the analysts explained.

''However, the RBA has stated that it will not lift rates until inflation is “sustainably” within the target band – which requires a lift in wages growth from current relatively modest levels. We anticipate that by August, with the benefit of additional information on inflation, wages and unemployment, the case will be made for the tightening cycle to commence.''

How will AUD react?

Positive global risk sentiment underpinned AUD which made a new yearly high overnight, running deeper into weekly resistance. The question is, will it continue beyond here?

''The most crucial aspect of the post-meeting statement is whether it repeats the longstanding reference to the Board being 'patient as it monitors how the various factors affecting inflation in Australia evolve,''' analysts at ANZ Bank said.

''We would interpret the removal of any reference to patience as a hawkish development that points to the May Board meeting as being live,'' they argued. This would then be expected to drive the Aussie forward.

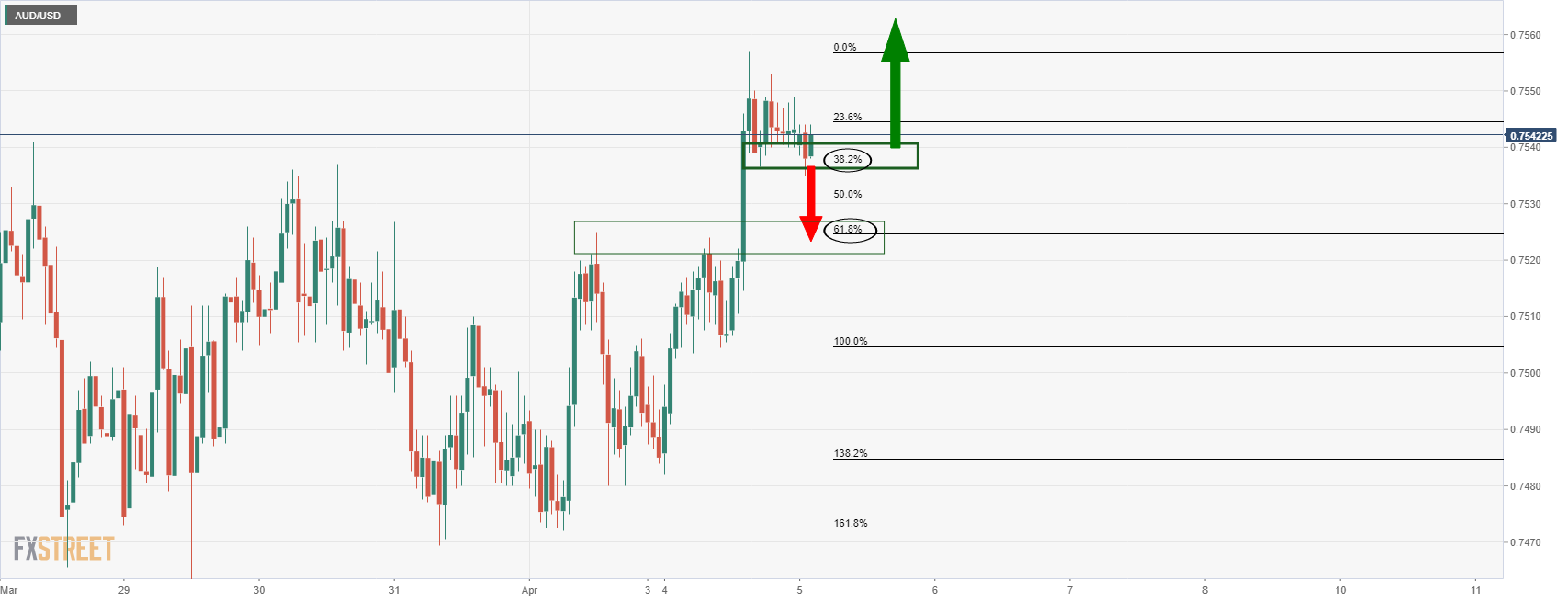

AUD/USD H1 chart

Support is found at the 38.2% Fibonacci level near 0.7535. A break here will open the risk of a quick move into the prior resistance near 0.7525 that meets the 61.8% Fibonacci retracement area. Conversely, a hawkish outcome will send the pair up to test weekly resistance around 0.7560 and far beyond with 0.7650 eyed.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.