- Analytics

- News and Tools

- Market News

- EUR/USD: The 1.0500 region holds the bearish attempt following US CPI

EUR/USD: The 1.0500 region holds the bearish attempt following US CPI

- EUR/USD gives away initial gains and challenges the 1.0500 region.

- ECB-speakers advocated for a rate hike this summer.

- US CPI rose more than expected in April.

The initial reaction to the release of US CPI sent EUR/USD back to the negative territory in the boundaries of the 1.0500 zone on Wednesday.

EUR/USD looks supported near 1.0500

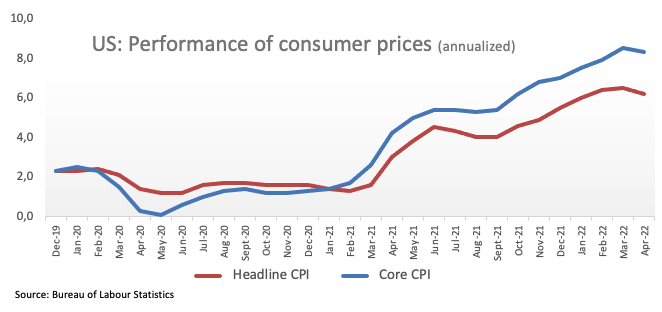

EUR/USD now alternates gains with losses around the 1.0500 neighbourhood after US inflation figures showed the headline CPI rise at an annualized 8.3% in April, and the Core CPI advance 6.2%. Despite both prints came above initial estimates, they eased a tad from the previous readings, hinting at the possibility that consumer prices could have peaked in March.

The higher-than-predicted CPI figures encouraged US yields to make a U-turn and now advance modestly along the curve.

Earlier in the session, ECB’s Lagarde suggested the APP could end early in Q3, while normalization will be at a gradual pace following the initial rate hike. Previous comments from ECB Board members also advocated for the first rate hike at some point this summer.

What to look for around EUR

EUR/USD revisits the 1.0570/80 band following the choppy performance of the greenback on Wednesday. The outlook for the pair still points to the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Occasional pockets of strength in the single currency, in the meantime, should appear reinforced by speculation the ECB could raise rates at some point in the summer, while higher German yields, elevated inflation and a decent pace of the economic recovery in the region are also supportive of an improvement in the mood around the euro.

Key events in the euro area this week: Final Germany Inflation Rate, ECB Lagarde (Wednesday) – EMU Industrial Production (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is gaining 0.05% at 1.0529 and faces the next up barrier at 1.0641 (weekly high May 5) followed by 1.0936 (weekly high April 21) and finally 1.1000 (round level). On the other hand, a break below 1.0470 (2022 low April 28) would target 1.0453 (low January 11 2017) en route to 1.0340 (2017 low January 3 2017).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.