- Analytics

- News and Tools

- Market News

- When is the UK Q1 GDP and how could it affect GBP/USD?

When is the UK Q1 GDP and how could it affect GBP/USD?

The UK Economic Data Overview

The British economic calendar is all set to entertain the cable traders in early Thursday, at 06:00 GMT, with the preliminary GDP figures for Q1 2022. Also increasing the importance of that time are monthly GDP figures for March, Trade Balance, Manufacturing Production and Industrial Production details for the stated period.

Having witnessed a 6.6% YoY jump in economic activities during the previous quarter, market players will be interested in the first estimation of the Q1 GDP figures, expected 9.0% YoY, to back the BOE’s rate hikes. More interestingly, the QoQ figures are expected to ease from 1.3% to 1.0%.

On the other hand, the GBP/USD traders also eye the Index of Services (3M/3M) for the same period, bearing forecasts of 2.0% versus 0.8% prior, for further insight.

Meanwhile, Manufacturing Production, which makes up around 80% of total industrial production, is expected to ease to 0.0% MoM in March versus -0.4% prior. Further, the total Industrial Production is expected to recover from the previous contraction of 0.6% to a positive reading of 0.1% MoM.

Considering the yearly figures, the Industrial Production for March is expected to have eased to 0.4% versus 1.6% previous while the Manufacturing Production is also anticipated to have weakened to 2.3% in the reported month versus 3.7% last.

Separately, the UK Goods Trade Balance will be reported at the same time and is expected to show a deficit of £9.568 billion versus a £12.138 billion deficit reported in the last month.

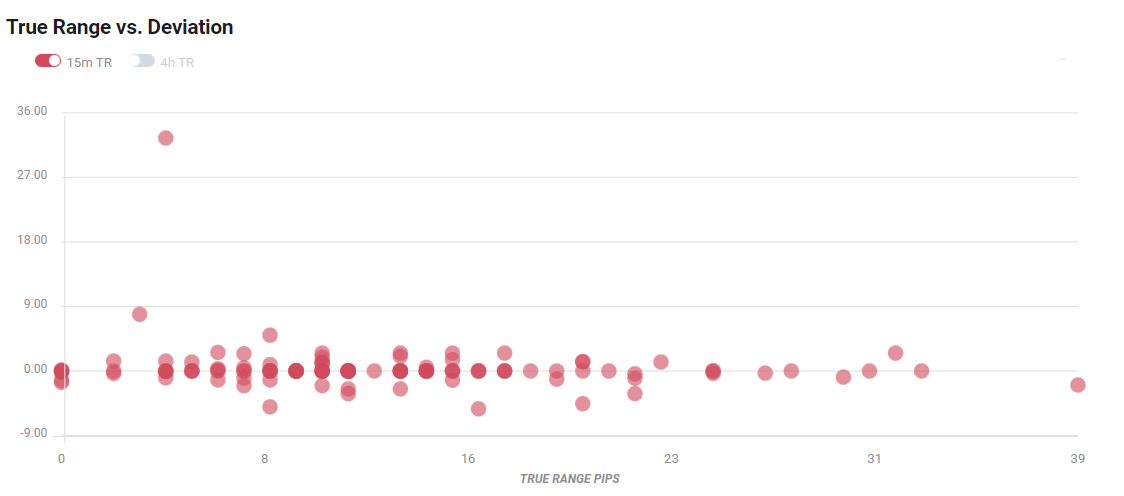

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 10-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 30-40 pips.

How could affect GBP/USD?

GBP/USD remains on the back foot for the sixth consecutive day while refreshing a two-year low around 1.2210 ahead of the key data on Thursday.

The cable pair’s latest weakness could be linked to the US dollar’s broad recovery moves as market sentiment worsens on inflation and covid fears. Also weighing on the GBP/USD prices are Brexit headlines, suggesting further hardships concerning the Northern Ireland Protocol (NIP).

That said, UK Q1 GDP bears downbeat forecasts and chatters over the Bank of England’s (BOE) more rate hikes are on the table, which in turn keeps the GBP/USD pair on bear’s radar. Also, Brexit talks and the US dollar strength are extra catalysts to weigh on the pair.

As the BOE recently flagged recession risks, any major setback in the data will be detrimental to the GBP/USD prices.

While considering this, FXStreet’s Dhwani Mehta said,

All in all, the quarterly UK growth numbers are unlikely to change the gloomy economic picture, which will likely keep GBP/USD as a ‘sell the bounce’ trade.

Ahead of the release, Westpac said,

GDP growth is anticipated to reflect a decent recovery in Q1 although the Bank of England warns of a sharp slowing in activity over mid-year (market f/c: 1.0%qtr, 8.9%yr). Below average trade volumes are likely to sustain the trade deficit in March (market f/c: -£7800mn).

Key notes

GBP/USD dribbles around 1.2250 amid upbeat options market, pre-UK GDP anxiety

GBP/USD to test 1.2260, downside remains favored on higher US CPI, UK GDP eyed

GBP/USD Forecast: Near-term technicals turn bullish

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.