- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears knocking on the door of critical daily support

Gold Price Forecast: XAU/USD bears knocking on the door of critical daily support

- Gold drops into a fresh critical daily support structure.

- The US dollar is bid and making fresh 20-year highs.

- Price pressures are entrenched and investors are seeking out the safe havens.

The price of gold is losing some 1.60% at the time of writing, falling from a high of $1,858.87 to a fresh cycle low of $1,822.27. The US dollar is bid and climbed to fresh two-decade highs on Thursday as investors flock to the safe-haven currency in the face of surging inflation.

Data on Wednesday confirmed expectations for further aggressive hikes in interest rates by the Federal Reserve. The Consumer Price Index climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month. The index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005. However, ''the fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued.

As a consequence, the dollar index (DXY), which measures the greenback's strength against a basket of six currencies, rose 0.4% to 104.92 on Thursday following a jittery day on Wednesday.

"Dollar is rallying as things potentially look negative in the US, which is hurting gold. Also, the market is realising the likelihood of seeing pretty aggressive interest rate increases," analysts at TD Securities said.

However, precious metals are holding up relatively as a drop in the benchmark 10-year Treasury yields, which hit the lowest level in two weeks, has capped some of the bear's progress. The ten-years are down over 3% while the more Fed tentative 2-years are losing 3.7%, weighed by Producer Prices that fell short of expectations.

The US Producer Price Index increased by 0.5% in April compared with a 1.6% jump in March. Excluding food and energy, the core PPI climbed by 0.4%, lagging the 0.7% gain expected. Core PPI grew by 1.2% in March. On a year-over-year basis, producer price inflation surged 11% in April, and core PPI jumped 8.8%, the Bureau of Labor Statistics said Thursday.

''The dollar is gaining today despite falling yields, which illustrates the so-called dollar smile whereby it gains during periods of risk off as well as in periods of strong US data and rising yields. Either way, the dollar’s climb is likely to continue for the time being,'' analysts at Brown Brothers Harriman explained.

Gold technical analysis

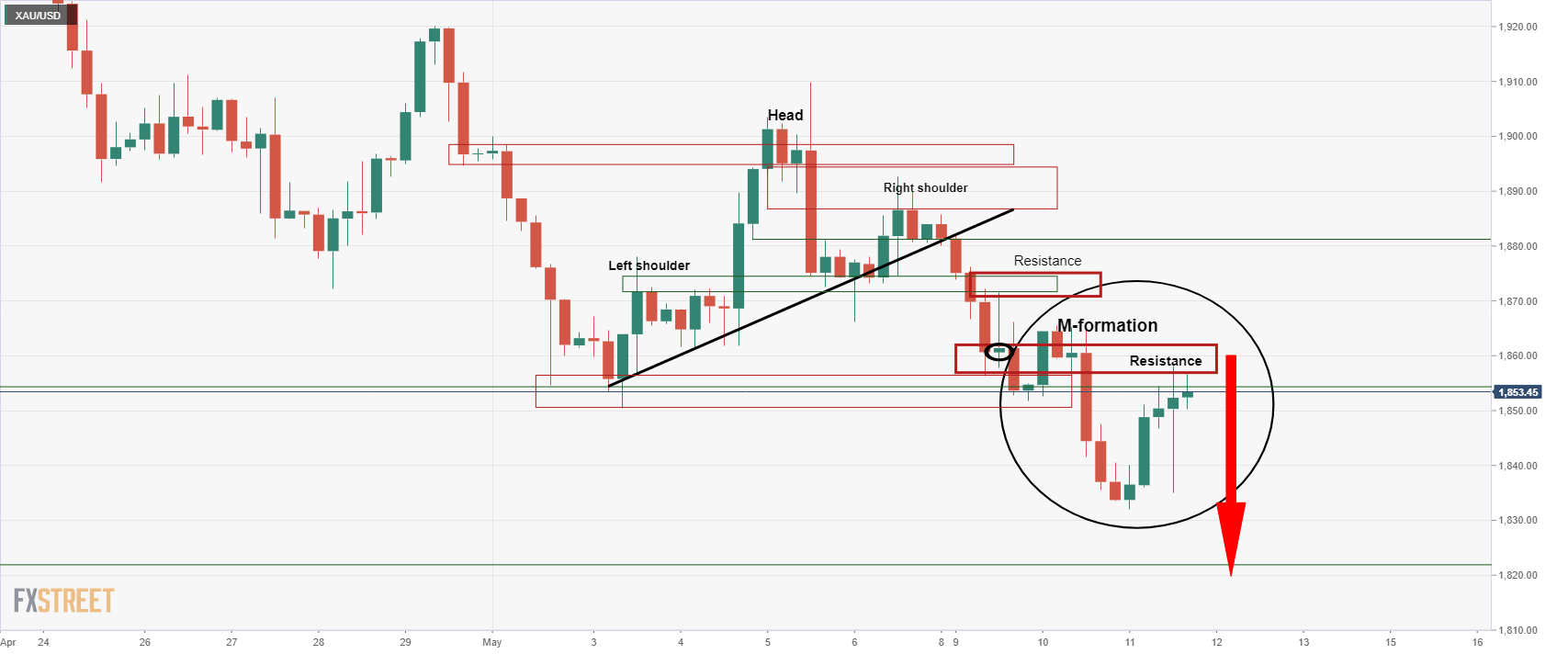

The gold price has fallen from a 4-hour resistance as follows:

Prior analysis:

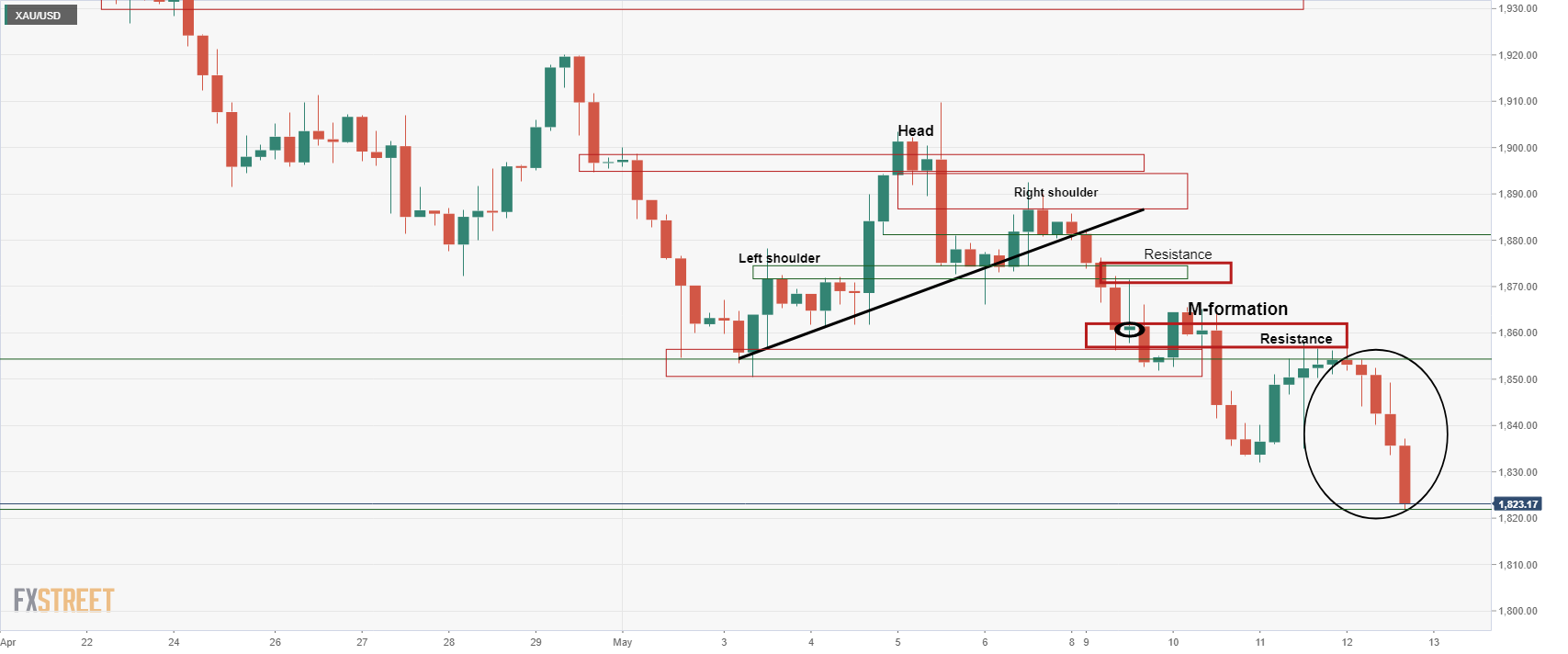

Live update:

A move below the lows of the day will open new territories for the bears and prospects of a test below the psychological $1,800 round figure:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.