- Analytics

- News and Tools

- Market News

- CFTC Positioning Report: EUR net longs dropped to multi-month lows

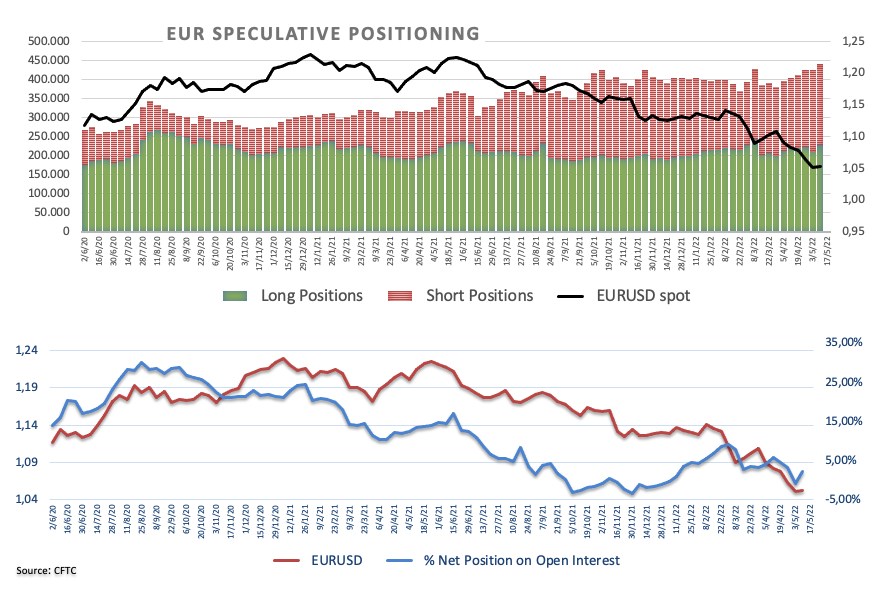

CFTC Positioning Report: EUR net longs dropped to multi-month lows

These are the main highlights of the CFTC Positioning Report for the week ended on May 10th:

- The speculative community reduced its net longs to the lowest level since early January, while the percentage of the net position on open interest also retreated to multi-month lows around 2.30%. The well-telegraphed 50 bps rate hike by the Federal Reserve coupled with the unabated march higher in US yields and the confirmation of a tight labour market (as per NFP results) kept the European currency and the rest of the risk-linked galaxy under further pressure amidst some range bound trading in EUR/USD just above 1.0500 the figure.

- Net longs in the dollar climbed to levels last seen in early March. Indeed, speculators added to their positive view in the buck following the move on rates by the Fed and the subsequent upside in US yields despite Chief Powell disregarded a 75 bps rate hike in the very near term at his press conference. In addition, another solid print from April’s Nonfarm Payrolls also lent extra legs to the greenback. The US Dollar Index (DXY) extended the move higher well north of the 103.00 mark, or fresh cycle tops.

- Net shorts in the British pound rose to an area last visited in later September 2019. The dovish hike by the BoE on May 5 coupled with a somewhat gloomy perspective for the UK economy in the medium term put the quid under extra pressure and dragged GBP/USD to fresh lows in the sub-1.2400 area.

- In the safe haven universe, net shorts in CHF climbed to levels last seen in early November 201, while USD/CHF kept the bullish stance unchanged and with the next target at the psychological 1.0000 mark. Net shorts in JPY increased to 4-week highs helped by the Fed’s move and higher yields, all motivating USD/JPY to edge higher and print new 2-decade tops past 131.30 (May 9).

- Speculators reduced the gross longs in the Aussie dollar and prompted net shorts to advance to 6-week peaks despite the start of the hiking cycle by the RBA at its May 3 event. The improvement in the sentiment surrounding the greenback deteriorated the price action in the commodity space and directly affected AUD, forcing AUD/USD to break below the psychological 0.7000 mark for the first time since January and record new lows for the year.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.