- Analytics

- News and Tools

- Market News

- USD/JPY Price Analysis: Bears are taking control and eye 135 the figure

USD/JPY Price Analysis: Bears are taking control and eye 135 the figure

- USD/JPY bulls have thrown in the towel again and the focus is on a test of 135 the figure.

- Bears are moving in on the 135.80 psychological support.

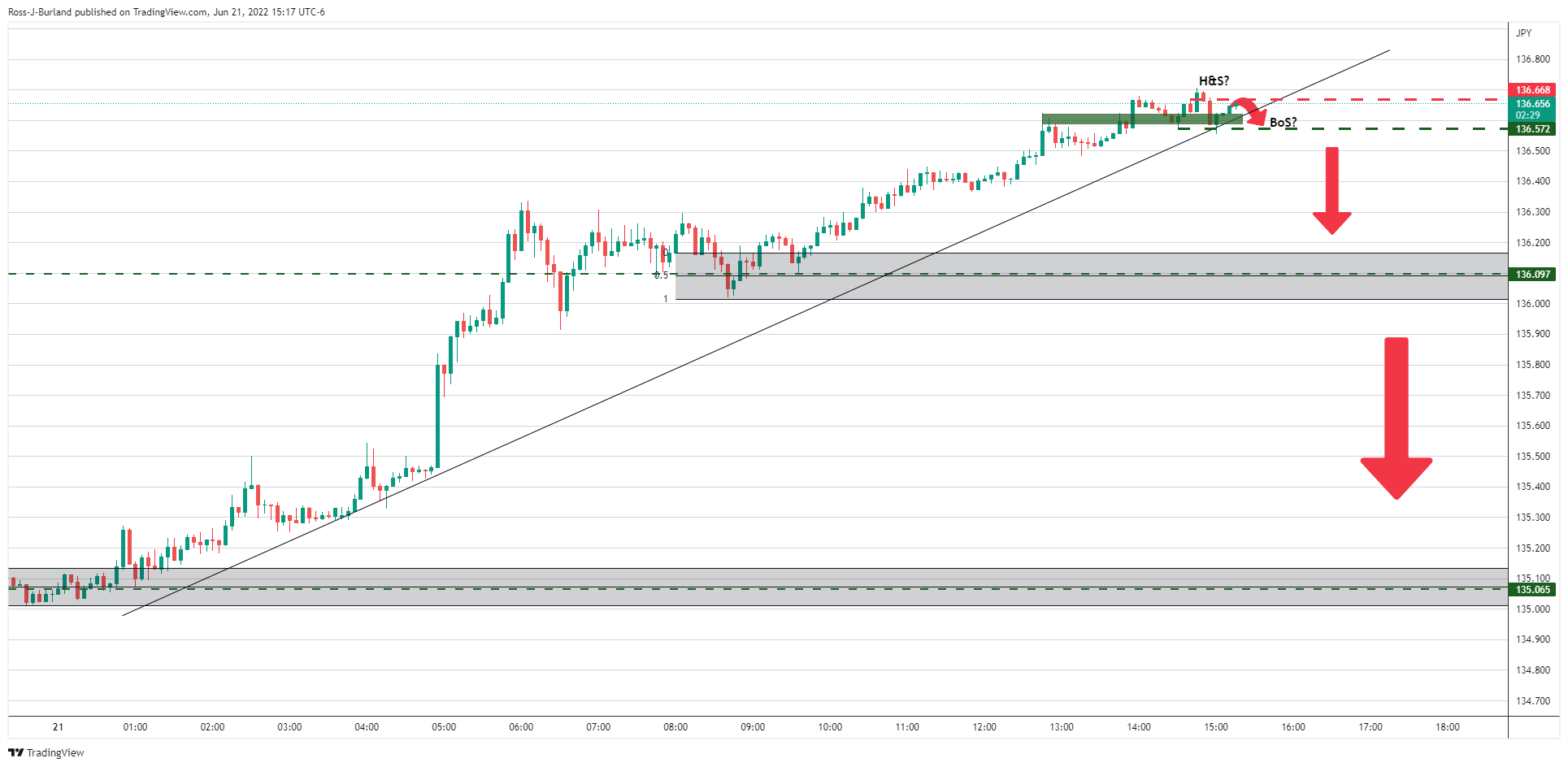

As per the prior multi-timeframe analysis from the Tuesday New York session, USD/JPY Price Analysis: Bears are lurking and a significant correction could be on the cards, a topping formation was highlighted on the 5-min chart:

The price subsequently melted and the bear's committed to the M-formation on the 10-min chart as illustrated in the prior analysis:

If the bears commit at this juncture, then the 36.2% Fibo may be confirmed as a strong enough correction:

The 10-min chart's M-formation's neckline aligns with the Fibo, offering additional conviction to the downside case.

USD/JPY live market update

As illustrated, the price moved in for an accurate test of the target and surged higher from there before melting once again to print fresh lows of 135.68 which leaves lower levels, 135.00/10, as per the original analysis, on the cards for the sessions ahead:

The price is on the path to mitigating the price imbalance as illustrated don the hourly chart above, (PI) and thereafter, the demand area or order block, (OB) could be in the runnings for a test which exposes the risk of a break of the 135 psychological level if bulls do not commit. However, so long as they do, then the upside is still to play for longer-term.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.