- Analytics

- News and Tools

- Market News

- EUR/USD appears offered near 1.0220 prior to Payrolls

EUR/USD appears offered near 1.0220 prior to Payrolls

- EUR/USD loses the grip and slips back to the 1.0220 region.

- Industrial Production in Italy surprised to the downside in June.

- The NFP is expected at 250K jobs in July.

Sellers seem to have regain the initiative around the single currency and drag EUR/USD back to the low-1.0200s at the end of the week.

EUR/USD focuses on US data

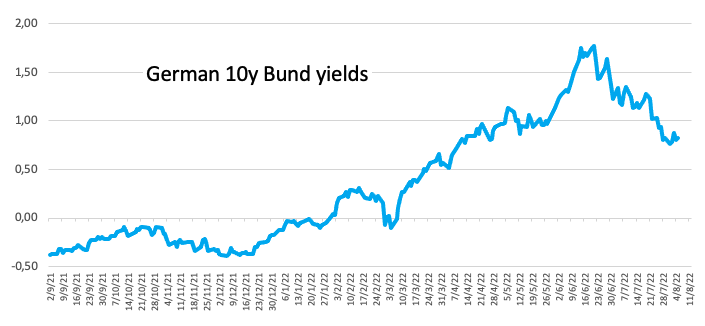

EUR/USD resumes the downside and trims part of Thursday’s noticeable advance on the back of the renewed buying interest around the greenback, while yields on both sides of the ocean remain depressed so far.

Indeed, the appetite for the risk-associated assets appears somewhat subdued on Friday, as usual cautiousness pre-NFP dominates the sentiment among market participants.

In the domestic data space, Italian Industrial Production contracted 2.1% MoM in June and 1.2% from a year earlier. In France, the Industrial Production expanded 1.4% MoM also in June and the trade deficit widened to €13.7B in the same month.

Other than the monthly labour market report, the US docket will include the Consumer Credit Change figures for the month of June and the speech by Richmond Fed T.Barkin.

What to look for around EUR

EUR/USD remains within a choppy range this week ahead of the key release of US Nonfarm Payrolls for the month of July.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerges the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment readings among investors and the renewed downtrend in some fundamentals.

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is retreating 0.16% at 1.0228 and faces the next contention at 1.0096 (weekly low July 26) followed by 1.0000 (psychological level) and finally 0.9952 (2022 low July 14). On the other hand, the break above 1.0293 (monthly high August 2) would target 1.0404 (55-day SMA) en route to 1.0615 (weekly high June 27).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.