- Analytics

- News and Tools

- Market News

- EUR/USD remains cautious above 1.0200 prior to US CPI

EUR/USD remains cautious above 1.0200 prior to US CPI

- EUR/USD exchanges gains with losses in the 1.0210 region.

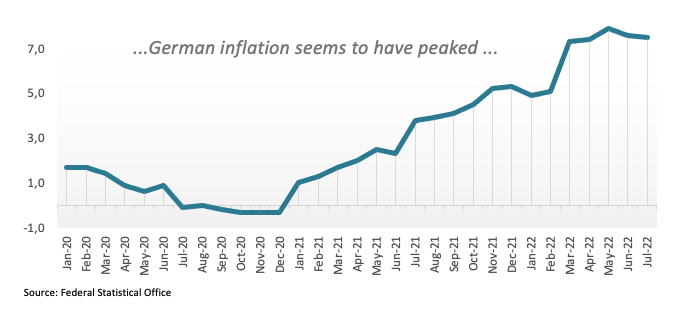

- Final Germany CPI rose 7.5% YoY in the month of July.

- US CPI is expected to show a slowdown in the inflation in July.

The single currency struggles to gather traction and motivates EUR/USD to remain stuck just above the 1.0200 yardstick so far on Wednesday.

EUR/USD stays vigilant ahead of US data

EUR/USD’s upside momentum appears to be taking a breather after climbing as high as the 1.0250 region on Tuesday, as investors show increasing prudence ahead of the key release of US inflation figures during last month. On this, consensus expects the CPI to have lost some momentum and rise 8.7% over the last twelve months (from 9.1%).

In the meantime, the energy crisis – particularly exacerbated after the Russian invasion of Ukraine – remains as a key drag for the growth outlook in the broader euro area as well as a source of elevated inflation, all amidst the start of the normalization process by the ECB and its plans to tighten its policy further in September.

In the domestic calendar, final CPI in Germany showed consumer prices rose at an annualized 7.5% in July.

Later in the NA session, MBA Mortgage Applications, Wholesale Inventories and the Monthly Budget Statement are all also due.

What to look for around EUR

EUR/USD so far keeps the 1.0100-1.0300 range unchanged against the backdrop alternating risk appetite trends.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerges the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges and the incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Final Inflation Rate (Wednesday) – EMU Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is gaining 0.01% at 1.0214 and faces the next up barrier at 1.0293 (monthly high August 2) seconded by 1.0377 (55-day SMA) and finally 1.0615 (weekly high June 27). On the flip side, a break below 1.0096 (weekly low July 26) would target 1.0000 (psychological level) en route to 0.9952 (2022 low July 14).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.