- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAUUSD catches a bid on Poland news, but US Dollar in demand

Gold Price Forecast: XAUUSD catches a bid on Poland news, but US Dollar in demand

- Gold perks up on risk-off turn in markets on Poland news.

- US Dollar could be on the verge of a significant correction, a weight on Gold.

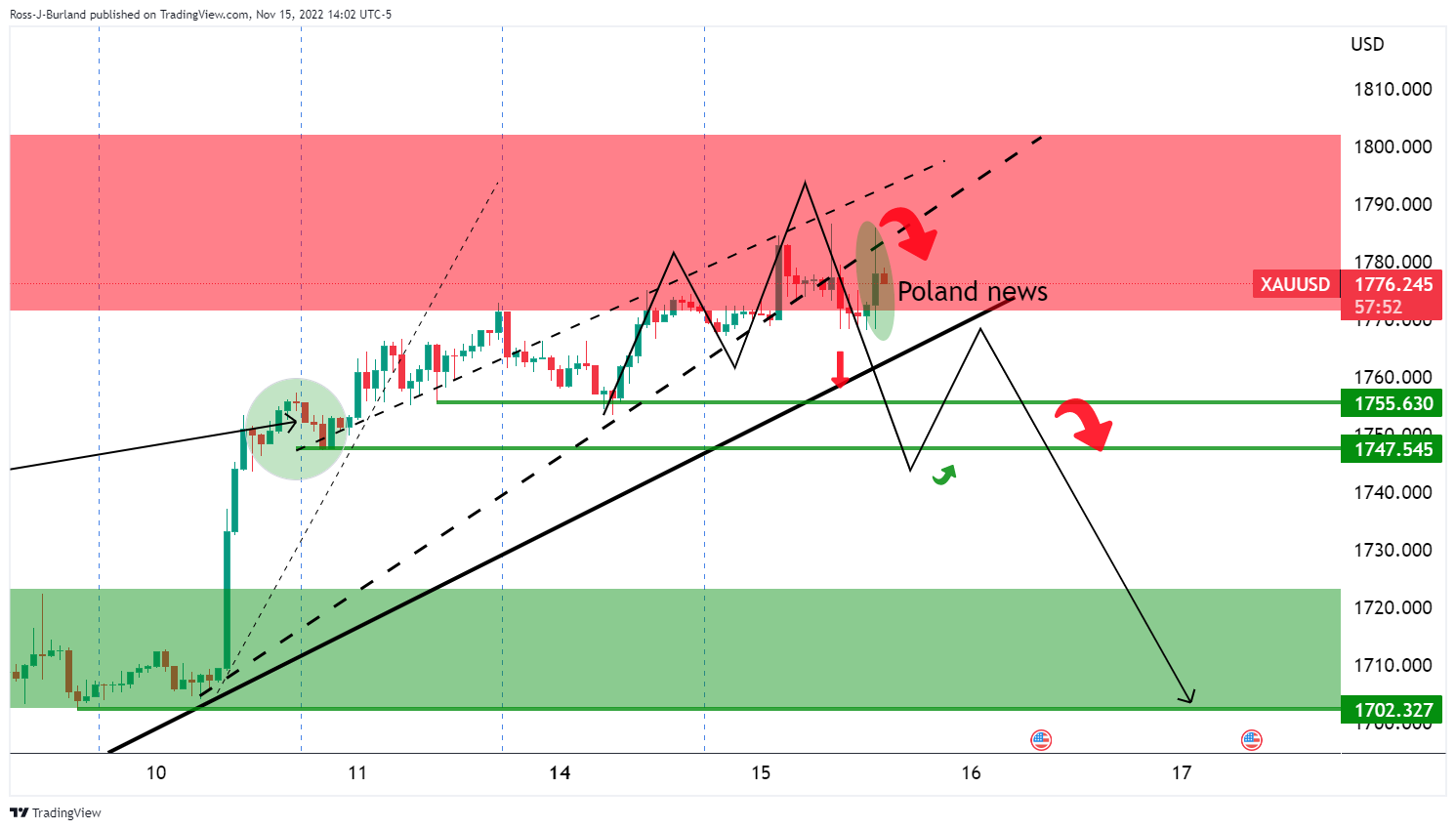

The Gold price is headed higher on the day, now trading at $1,778, up 0.4% on news that at least two are dead after Russian missiles landed in NATO state Poland on the Ukraine border, according to the Express. Poland has convened a national security committee meeting according to a spokesman. Before the news, the yellow metal was sliding.

The US Dollar had been pressured on Monday following Producer Price Index data that mirrored last week's Consumer Price Index. The DXY fell to its lowest since mid-August around 105.35 and was on track to test the August 10 low near 104.636. However, the bulls have moved in and are treading water again. US yields reacted accordingly to the PPI whereby the headline came in at 8.0% vs. 8.3% expected and a revised 8.4% (was 8.5%) in September. The core came in at 6.7% YoY vs. 7.2% expected and actual in September. ''The PPI data will do nothing to dispel the notion that the Fed is moving closer to a pivot,'' analysts at Brown Brothers Harriman argued.

Meanwhile, the US 2-year yield is trading near 4.37%, just above the recent low near 4.29% last Thursday. The 10-year yield is trading near 3.80%, below the recent low near 3.81% last Thursday. ''Yields are likely to continue probing the downside this week until the data say otherwise,'' analysts at BBH argued.

Equity markets had latched onto the PPI data as confirmation of the CPI data but flaked out on the day and started to melt towards the lows of the day, suddenly propelled lower on the geopolitical disruption:

The above is the 15-minute knee-jerk reaction in the SP 500 to the news. When coupled with the China COVID risks and an inverted US yield curve, that indicate that the US economy is likely to go into recession over the next 12 months or so, stocks could continue to feel the pressure. Such a scenario could play back into the hands of the US Dollar bulls and remain a weight on Gold prices in the face of hawkish Fed speakers.

Gold technical analysis

Prior to the news, there were prospects of a downside extension on the 4-hour chart. However, the news has put a bid into the yellow metal as per the following 15 minute chart:

Nevertheless, the state of play is bullish for a correcting US Dollar as seen in the following DXY chart:

This could be the makings of a significant correction as per the daily chart, capping Gold's advances:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.