- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAUUSD glides across bearish territory in consolidative markets

Gold Price Forecast: XAUUSD glides across bearish territory in consolidative markets

- The Gold price has glided out of the trendline supports and hovers over Tuesday's lows.

- A 100% expansion of the current consolidative range is located at the $1,750 mark for an initial target.

At $1,774.20 currently, 09.23%. the Gold price stalled on Wednesday, gliding across a bearish structure as yesterday's lows of $1,767.13. The yellow metal has traveled between a tight consolidative range of $1,773.99 and $1,785.09 so far on the day. The precious metal sits near a three-month peak and remains buoyed by a softer dollar as investors expect that the Federal Reserve can ease its aggressive interest rate hikes following a round of data that points to slowing inflation.

The safe-haven dollar weakened further on Wednesday despite stronger-than-expected US Retail Sales that have clouded the inflation outlook. Last week, the US Consumer Price Index missed expectations as did the Producer Price Index which both have weighed on the greenback. DXY, an index that measures the US Dollar vs. a basket of major currencies has fallen around 7% in November suffering the bulk of the drop last Friday on the back of the inflation data. Gold has benefitted in a softer US yield environment as a consequence as benchmark 10-year yields were near their lowest since Oct. 5. Rising rates reduce the appeal of non-yielding bullion.

Poland tensions have cooled

Besides the Fed, geopolitics is coming to the fore once again and moving the needle in financial markets having been on the back burner for some time. Bullion moved to the highest since August 15 following reports of a missile killing two people in Poland near the border with Ukraine. An investigation is underway but tensions were high. Nevertheless, so far, the United States has not seen anything that contradicts Poland's preliminary assessment that a missile that landed within its borders on Tuesday was most likely the result of a Ukrainian air defense missile. This comes from US National Security Council spokesperson Adrienne Watson who commented on the situation on Wednesday.

"Whatever the final conclusions may be, it is clear that the party ultimately responsible for this tragic incident is Russia, which launched a barrage of missiles on Ukraine specifically intended to target civilian infrastructure," he said. The cooling tensions have curbed the appetite for both gold and the US Dollar.

''Positioning risks are still skewed to the upside in gold, the analysts at TD Securities said. ''A series of key trend reversal thresholds associated with substantial short covering flow lies just north of the $1800/oz mark. In turn, the pain trade in the yellow metal has room to extend further, which suggests that the return on patience is elevated for those looking to fade the recent rally.''

Gold technical analysis

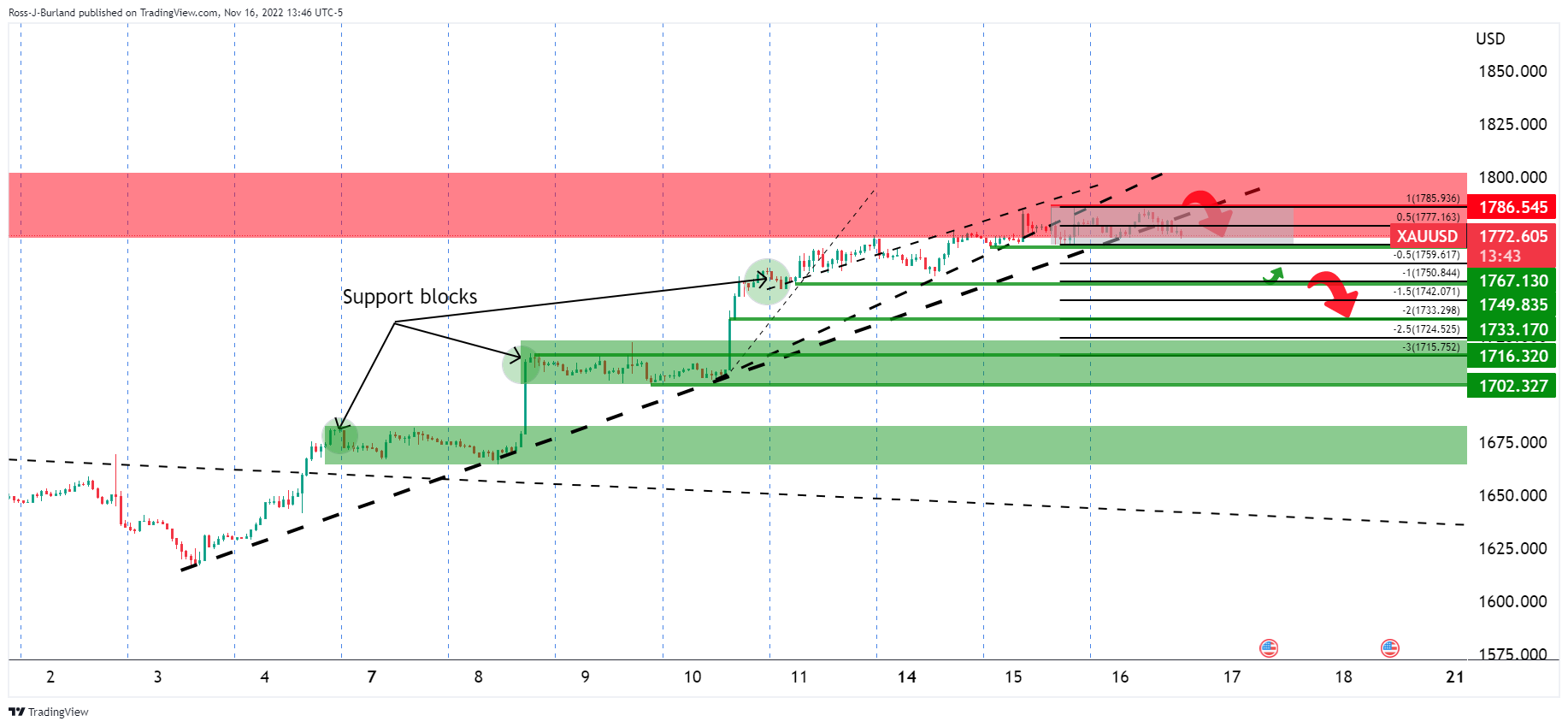

If Gold does not move higher from here, imminently, then the pressures will leave the 38.2% Fibonacci and the 50% mean reversion levels vulnerable around $1,750. However, while on the back side of the broken trendlines, the bias is weighted to the upside with the $1,800's eyed.

If there is to be a meanwhile correction, it could play out as follows on the hourly chart:

The price has glided out of the trendline supports and hovers over Tuesday's lows as the structure that the bears need to break. A 100% expansion of the current consolidative range is located at the $1,750 mark for an initial target.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.