- Analytics

- News and Tools

- Market News

- USD/CAD Price Analysis: Buyers need validation from 1.3500 to retake control

USD/CAD Price Analysis: Buyers need validation from 1.3500 to retake control

- USD/CAD grinds higher while paring the biggest daily fall in a fortnight.

- 50-SMA, ascending trend line from early September restrict immediate downside.

- Seven-week-old horizontal support area challenge buyers before 200-SMA.

- Bearish MACD signals, steady RSI favor short-term sellers.

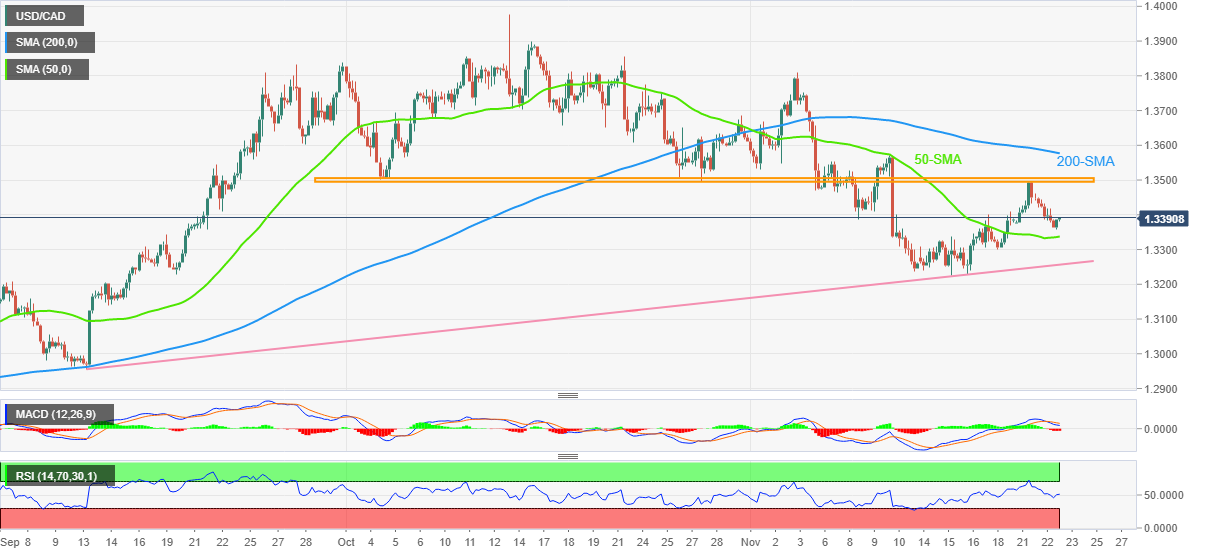

USD/CAD seesaws around the intraday high of 1.3391 as bulls struggle to retake control heading into Wednesday’s European session. That said, the Loonie pair reversed from the 1.5-month-old horizontal resistance the previous day while posting the biggest daily loss in two weeks.

However, the quote’s sustained trading beyond the 50-SMA and an upward-sloping support line from September 13, respectively near 1.3340 and 1.3255, seem to keep the USD/CAD buyers hopeful.

Even so, the bearish steady prints of the Relative Strength Index (RSI), placed at 14, join the bearish signals from the Moving Average Convergence and Divergence (MACD) indicator, to suggest that the quote has limited upside momentum.

As a result, the latest recovery may aim for the aforementioned resistance line surrounding the 1.3500 hurdle. However, any further upside will need validation from the 200-SMA level of 1.3580 to convince the USD/CAD buyers.

In a case where the Loonie pair stays firmer past 1.3580, the odds of witnessing a run-up toward the monthly high near 1.3810 can’t be ruled out.

On the contrary, a downside break of the 50-SMA and aforementioned short-term support line, close to 1.3340 and 1.3255 in that order, could challenge the USD/CAD pair’s fresh declines.

Following that, the monthly low of 1.3226 could act as the last defense of the pair buyers.

USD/CAD: Four-hour chart

Trend: Limited recovery expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.