- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD traders await the Federal Reserve Chair Jerome Powell

Gold Price Forecast: XAU/USD traders await the Federal Reserve Chair Jerome Powell

- Gold traders are in anticipation of the Federal Reserve's Chairman Jerome Powell.

- The United States economy will be scrutinised in Friday's Nonfarm Payrolls report.

- China and the Coronavirus spread are keeping markets at bay.

- Gold is poised for a critical technical breakout for the past month of 2022.

Gold prices climbed on Tuesday even as the US Dollar and bond yields rose but were capped as traders get set for the Federal Reserve's chair, Jerome Powell, who will speak on Wednesday. Meanwhile, there is mixed sentiment surrounding the apparent easing of unrest in China over coronavirus curbs. Traders are also apprehensive while awaiting further important data from the US economy on Friday in the form of the Nonfarm Payrolls report.

The Gold price started Wednesday near $1,750, sitting in the middle of Tuesday's range which ended as an inside bar in comparison to Monday's business. Gold is pressured below what could turn out to be a key resistance area of around $1,762. There is a focus on the downside for the day ahead while capped there with eyes on $1,720 as illustrated in the technical analysis at the end of this article. Meanwhile, there are plenty of fundamentals to be aware of for the day ahead and the rest of the week. The clock is now ticking down towards the final weeks of the year and the critical Federal Reserve December interest rate decision.

Federal Reserve's Jerome Powell coming up

Federal Reserve chairman, Jerome Powell, is scheduled to speak on Wednesday. The chair is expected to ''reaffirm the Fed’s unwavering commitment to tackling inflation, the need for more measured rate rises taking account of increased two-way economic risks as policy becomes restrictive, and a degree of optimism that the Fed will be able to pull off a soft landing,'' analysts at ANZ Bank explained.

The tight labour market and elevated services inflation will be hot topics which would be expected to elevate the jobs report on Friday to a more urgent degree on Gold trader's radars. While markets welcome the prospect of smaller hikes, a need to reach an appropriately higher terminal rate due to a tight labour market could be a spanner in the works for Gold bugs ahead of the Federal Reserve meeting held on 13 & 14 of December.

Friday Nonfarm Payrolls outlook

''US Nonfarm Payrolls payrolls likely continued to slow gradually but still advanced firmly in November, falling only modestly below its three-month avg of 290k,'' analysts at TD Securities said. ''The Unemployment Rate likely stayed unchanged at 3.7%, while we look for wage growth to have slowed to 0.3% month over month after accelerating to 0.4% in October,'' the analysts added.

Ahead of that, ADP reports a private sector job estimate on Wednesday and is expected at 200k vs. 239k in October. October JOLTS job openings will also be reported Wednesday and is expected at 10.35 mln vs. 10.717 million in September.

China's Coronavirus hamstrings risk sentiment

China coronavirus protests erupted which has put China's president Xi Jinping and the Chinese Communist Party (CCP) in a bind. Thousands took to the streets in major cities across the nation in recent days, protesting against Covid restrictions.

An exhausted population has been asking how much longer must they endure Xi Jinping's zero-Covid policy. In one of President Xi's biggest political tests yet, the CCP is attempting to negotiate both mounting fury and a deep-rooted fear of Covid, all of which have upended the global economic outlook and added a new element of uncertainty on top of the Ukraine war, an energy crisis and inflation.

US Dollar's vs. Gold's safe-haven appeal

With a number of factors that have fundamentally stripped the US Dollar of its recent safe-haven appeal analysts at TD Securities warned that several catalysts could spark a leg lower in Gold as CTAs run out of dry powder on the bid.

''Systematic trend followers are still covering their shorts in gold markets as downside momentum signals subside. This continues to set the stage for a bull trap in precious metals as the resilient price action, buoyed by CTA short covering, attracts new long interest from discretionary money managers. However, the narrative is chasing prices,'' the analysts warned with respect to Gold's recent bullish correction.

Besides any uber-hawkish commentary from Federal Reserve speakers this week or ahead of the December meeting that could trap Gold bulls, the situation in China remains fluid and a probable catalyst for a flight for safety.

''We continue to downplay any hopes of quicker reopening despite conciliatory comments from mainland health officials,'' analysts at Brown Brothers Harriman argued.

A combination of a hawkish twist in Fed sentiment and continued risks of a prolonged reopening in China would be expected to play into the hands of the US Dollar bulls and strip Gold of its safe-haven appeal

Gold technical analysis

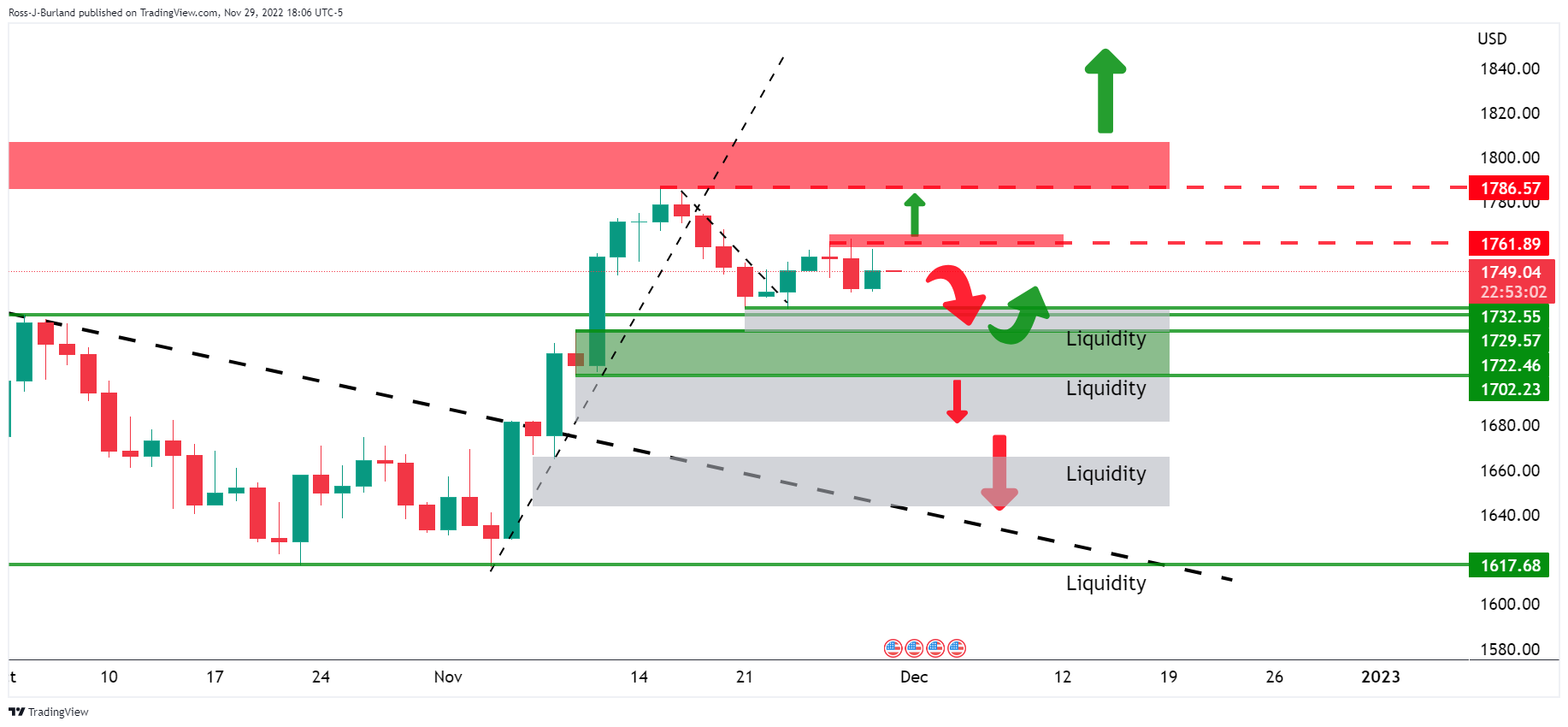

The daily chart shows that the Gold price is attempting to make a clean break to the upside having broken the long-term trendline resistance in a harmonic reversion pattern as illustrated above.

However, on closer inspection, the price is struggling on the bid at this juncture, bounded by both resistance and support. There are in-the-money longs below the spot price and that means liquidity for sellers to target in the meantime.

$1,720 will be an important support in this regard because a break of there opens risk all the way down into liquidity patches below $1,700. On the flip side, a break of $1,762 and then $1,790 opens the way for a deeper bullish correction and potentially a longer-term bull trend.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.