- Analytics

- News and Tools

- Market News

- US Dollar bears jumping the gun towards a run to 104.50s DXY

US Dollar bears jumping the gun towards a run to 104.50s DXY

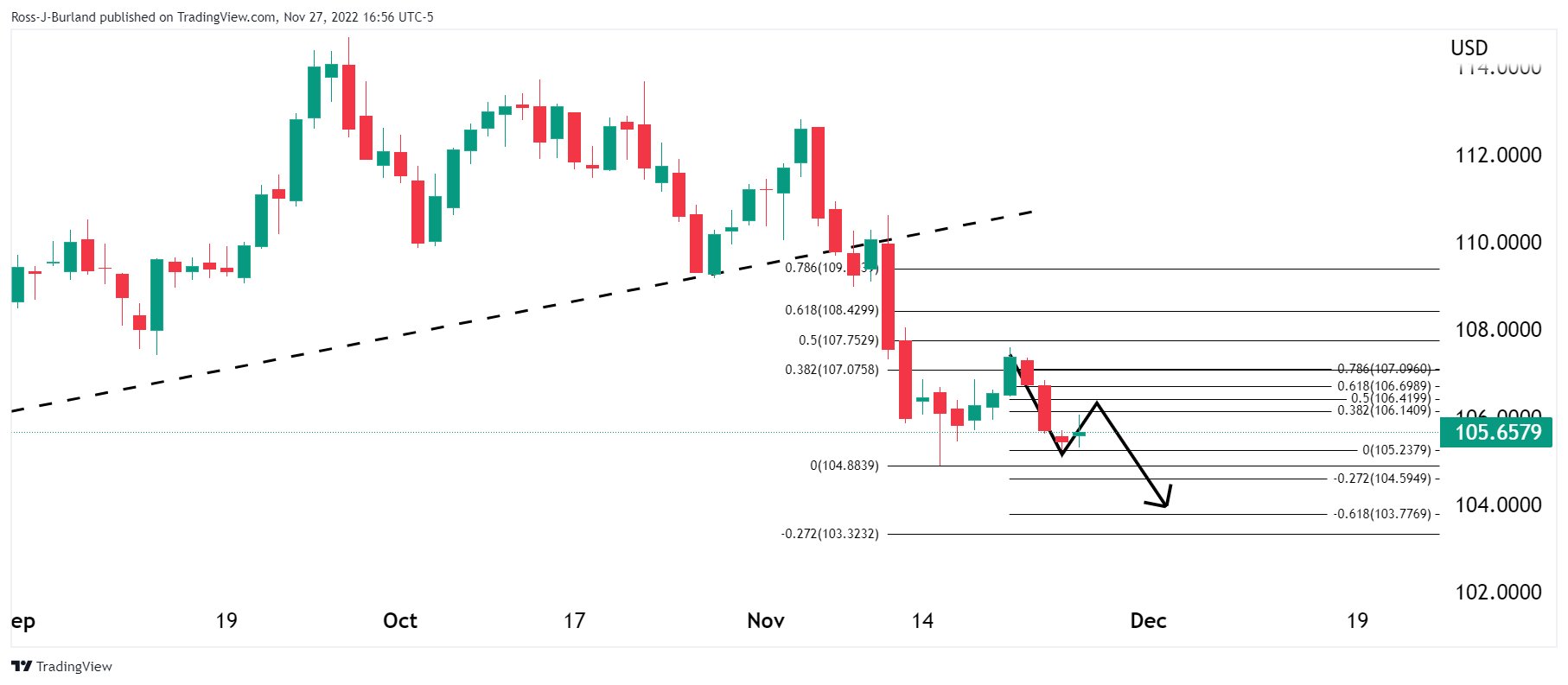

- US Dollar bears head toward the mid-range of the 104 area that guards a slide into the 103s and 101s.

- Are investors putting the cart before the horse?

The US Dollar is falling to test a 16-week low in the DXY, an index that measures the greenback vs. a basket of currencies. The August 11 low was made at 104.64 and today's low reached 104.66 so far. The index has fallen from a high of 105.89 and has been pressured on the back of Wednesday's dovish remarks from the Federal Reserve's chair, Jerome Powell.

Fed's Powell gave a speech on Wednesday while strongly indicating that the Fed would ease the historically-high pace of interest rate rises at its next policy meeting in December. “The time for moderating the pace of rate increases may come as soon as the December meeting,” Powell said in remarks at the Brookings Institution, his last public appearance before the central bank enters a blackout period ahead of its December 13-14 policymaking meeting. Consequently, the US Dollar dropped, US yields eased and stocks rose. The S&P 500 ended its three-day losing streak and closed up 2.7% while the Dow officially entered a bull market.

Meanwhile, on Thursday, easing inflation supported the Fed chair's indication that rate hikes could slow. Data has shown that in the 12 months through October, the personal consumption expenditures (PCE) price index increased 6.0% after advancing 6.3% in September compared with the Fed's 2% target.

In current trade, Benchmark 10-year yields are down 1.5% to 3.5565 and the more Fed sentiment-sensitive 2-year note yields are down 0.6% to 4.287%. Fed funds futures are pricing that the Fed’s benchmark rate will peak at 4.91% in May, up from 3.83% now. The traders had priced for a top of over 5% before Powell’s remarks on Wednesday.

However, investors who are expecting a full pivot may be putting the cart before the horse. Prior to Powell's speech, St. Louis Federal Reserve President James Bullard warned that the stock market is underpricing the risk of a continually aggressive Fed. Powell’s admission that “the path ahead for inflation remains highly uncertain” leaves prospects on the table for a protracted period of rate hikes. Additionally, the US dollar tends to perform around the sentiment of a US recession. Powell said on Wednesday that there is still a chance the economy avoids recession but the odds are slim. “To the extent we need to keep rates higher longer, that’s going to narrow the path to a soft landing,” Powell warned. US PMIs on Thursday were testimony to such rhetoric.

The bottom line is that “by any standard, inflation remains much too high,” and “it will take substantially more evidence to give comfort that inflation is actually declining,” as per Powell's comments on Wednesday. However, for now, despite such hawkish jaw-boning, and signals that the Fed will keep hiking well into 2023, for now, investors don't mind and that is weighing on the greenback.

US Dollar and yields technical analysis

The 2-year yield has carved out an H&S topping pattern and is on the verge of a break of the long-term trendline as seen on the weekly chart above and the 4-hour chart below

US Dollar daily chart

As per prior analysis, US Dollar is firm in a risk-off start to the week, whereby the US Dollar was expected to correct higher before the next slide, the greenback is following a bearish trajectory below the prior bullish trend"

Prior analysis:

Update:

The price is headed to a test into the mid-range of the 104 area that guards a slide into the 103s and 101s.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.