- Analytics

- News and Tools

- Market News

- EUR/USD corrects sharply lower to 1.0440 post-Payrolls

EUR/USD corrects sharply lower to 1.0440 post-Payrolls

- EUR/USD now looks offered well below 1.0500 on NFP.

- US Non-farm Payrolls surprised to the upside in November.

- The unemployment rate held steady at 3.7%.

EUR/USD comes under further downside pressure and rapidly breaks below the 1.0500 in the wake of the US jobs report on Friday.

EUR/USD: Gains appear capped near 1.0550 so far

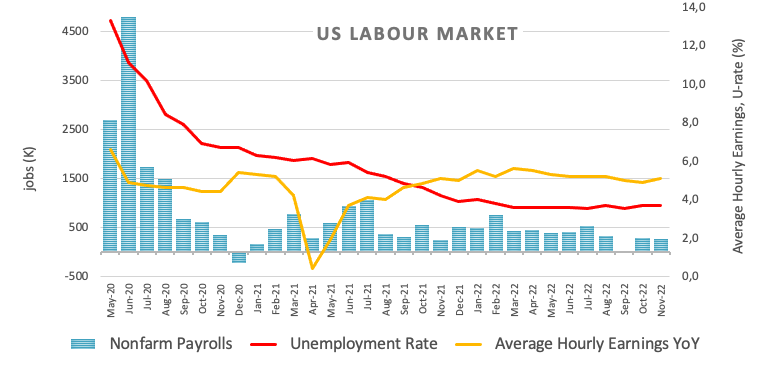

EUR/USD picks up extra selling pressure after the release of the Nonfarm Payrolls showed the US economy added 263K jobs during November, surpassing initial estimates for a gain of 200K jobs. In addition, the October reading was also revised up to 284K (from 261K).

Further data saw the Unemployment Rate unchanged at 3.7% and the key Average Hourly Earnings – a proxy for inflation via wages – rise 0.6% MoM and 5.1% from a year earlier. Additionally, the Participation Rate eased a tad to 62.1% (from 62.2).

What to look for around EUR

EUR/USD’s upside momentum faltered ahead of 1.0550, or multi-month peaks, amidst persistent optimism in the risk complex and intense weakness in the dollar ahead of US Payrolls.

In the meantime, the European currency is expected to closely follow dollar dynamics, the impact of the energy crisis on the region and the Fed-ECB divergence. In addition, markets repricing of a potential pivot in the Fed’s policy remains the exclusive driver of the pair’s price action for the time being.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: ECB Lagarde, Germany Balance of Trade (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is losing 0.82% at 1.0440 and a breach of 1.0365 (200-day SMA) would target 1.0330 (weekly low November 28) en route to 1.0222 (weekly low November 21). On the upside, there is an initial hurdle at 1.0548 (monthly high December 2) ahead of 1.0614 (weekly high June 27) and finally 1.0773 (monthly high June 27).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.