- Analytics

- News and Tools

- Market News

- USD Index regains the smile and 105.00 on solid NFP

USD Index regains the smile and 105.00 on solid NFP

- The index bounces off multi-month lows post-NFP.

- The US economy added more jobs than expected in November.

- A 50 bps rate hike remains favoured despite robust Payrolls.

The Greenback, in terms of the USD Index (DXY), quickly reclaimed the area above the 105.00 mark following another strong result for US Nonfarm Payrolls on Friday.

USD Index appears supported near 104.40

The index manages to regain strong upside traction following solid prints from November’s Payrolls, which showed both the job creation and wage growth remained far from mitigated.

Indeed, the US economy added 263K jobs during last month (vs. 200K expected) and the Unemployment Rate remained at 3.7%, while Average Hourly Earnings rose more than expected 0.6% MoM and 5.1% from a year earlier. The Participation Rate, however, deflated marginally to 62.1% (from 62.2%).

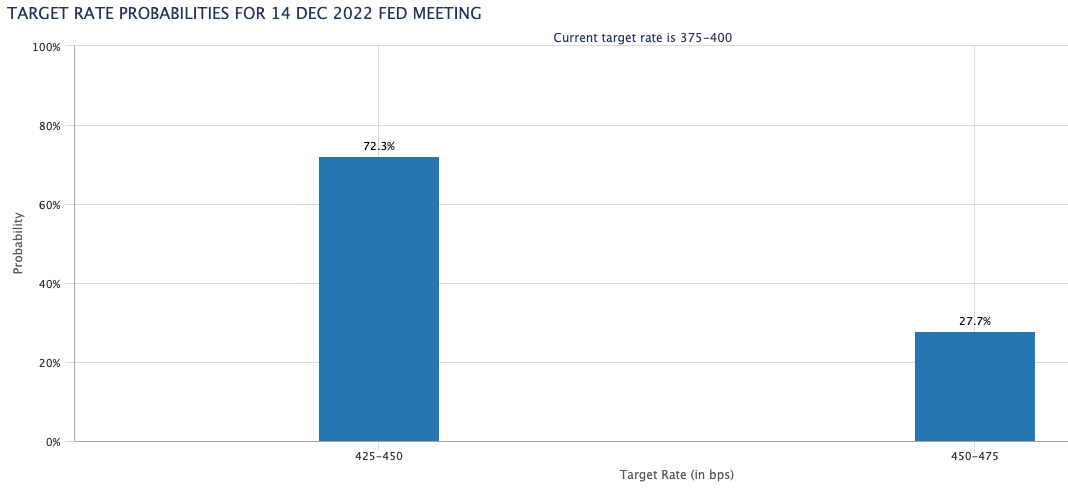

Following the release of the jobs report, the probability of a 75 bps rate hike at the next Fed’s gathering (December 14) improved to nearly 30%, according to CME Group's FedWatch Tool.

Next on tap in the US docket comes the speech by Chicago Federal Reserve President Charles Evans (2023 voter, centrist).

What to look for around USD

The US Dollar seems to have met some decent contention around 104.30 for the time being.

While hawkish Fedspeak maintains the Fed’s pivot narrative in the freezer, upcoming results in US fundamentals would likely play a key role in determining the chances of a slower pace of the Fed’s normalization process in the short term.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Prospects for further rate hikes by the Federal Reserve vs. speculation of a recession in the next months. Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China persistent trade conflict.

USD Index relevant levels

Now, the index is gaining 0.58% at 105.33 and faces the next up barrier at 105.55 (200-day SMA) followed by 107.19 (weekly high November 30) and then 107.99 (weekly high November 21). On the other hand, the breakdown of 104.37 (weekly low December 2) would open the door to 103.41 (weekly low June 16) and finally 101.29 (monthly low May 30).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.