- Analytics

- News and Tools

- Market News

- USD/JPY fluctuates at around 135.90s ahead of Powell’s speech

USD/JPY fluctuates at around 135.90s ahead of Powell’s speech

- USD/JPY is trading almost flat following Monday’s session.

- US Federal Reserve Chairman Jerome Powell is expected to reiterate the Fed’s commitment to inflation.

- A weaker US Dollar and rising UST bond yields capped the USD/JPY movement.

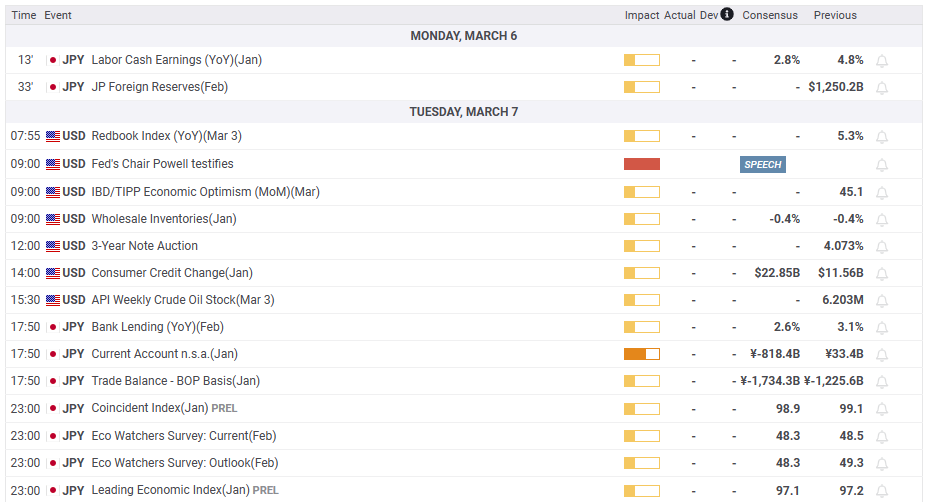

The USD/JPY registers minuscule gains as the Asian Pacific session opens after Monday’s session, printed a doji. A light US economic calendar and Federal Reserve’s (Fed) Chair Jerome Powell testifying before the US Congress will likely keep the pair within familiar levels. At the time of writing, the USD/JPY is exchanging hands at 135.91 after hitting on Monday a weekly low of 135.36.

USD/JPY stays below 136.00 due to USD weakness

Wall Street finished mixed, with the Dow Jones and the S&P 500 gaining between 0.07% and 0.12%. The Nasdaq printed losses of 0.11%. The greenback registered losses, of 0.22%, at 104.292. Contrary to UST bond yields. The 10-year benchmark note rate finished almost unchanged but in positive territory at 3.966%.

On March 7th and 8th, the Chair of the US Federal Reserve, Jerome Powell, is scheduled to testify before the US Congress. Market participants anticipate that he will give a speech reaffirming the Fed’s dedication to controlling inflation and keeping interest rates elevated for a certain period. However, analysts predict that if asked about the Federal Funds Rate (FFR) peak, Chair Powell may not provide a specific answer.

On the Japanese front, the upcoming policy meeting of the Bank of Japan (BoJ), scheduled for March 10th, would be Governor Kuroda’s final meeting. The markets believe he will use this opportunity to initiate policy normalization by adjusting the Yield Curve Control (YCC). Rabobank analysts commented that the BoJ would take a cautious approach to loosen conditions of the YCC, and it would be the first step towards monetary policy normalizations.

USD/JPY Technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.