- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls seek a test of daily resistance

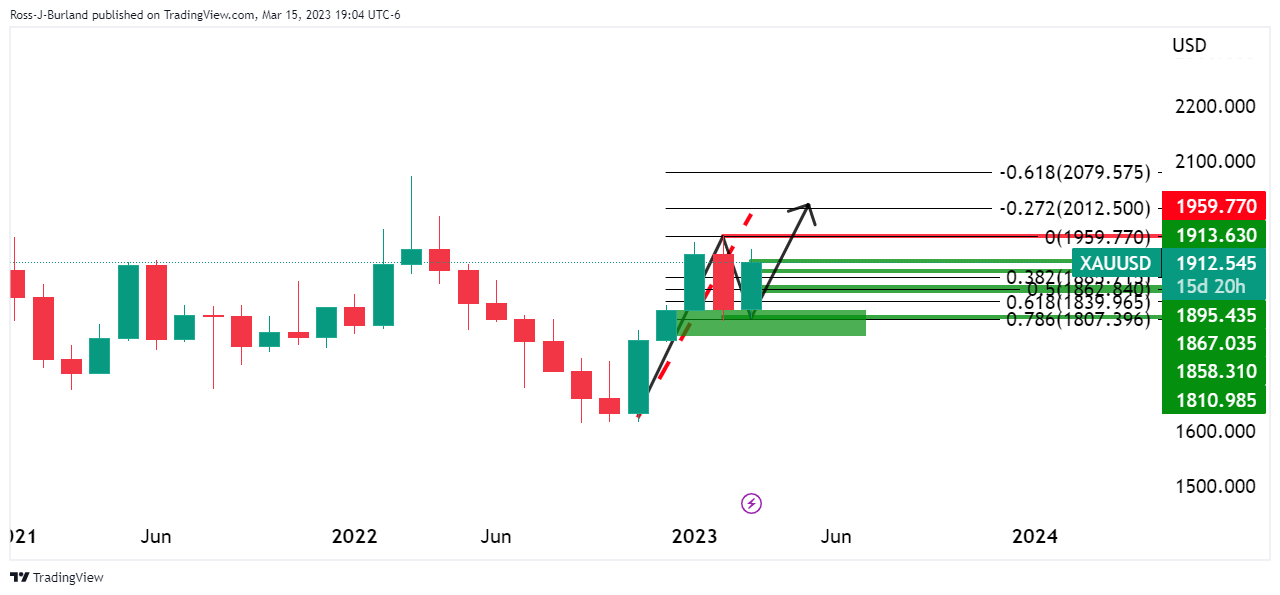

Gold Price Forecast: XAU/USD bulls seek a test of daily resistance

- Gold price bulls in the market as derisking favors the safe havens.

- Bulls eye a break of recent highs and then the $2,000s.

Gold price rallied sharply as investors rushed to have assets. Bank stocks, already reeling from two large bank failures in the past week, were under pressure due to the Credit Suisse crisis. Shares of the Swiss lender dropped more than 20% after the chairman of its biggest backer — the Saudi National Bank — said it won’t provide further financial support. Gold price hit a high of $1,937.

The US Dollar weas also bid on safe-haven flows and despite producer prices in the US unexpectedly falling in February. This comes following strong consumer prices earlier in the week. However, fresh woes at Credit Suisse saw safe haven buying continue to pick up. This was aided by the sharp drop in yields on US Treasuries.

The two-year Treasury notes, which move in step with interest rate expectations, have tumbled 98 basis points in the last five days, the biggest drop since the week of Black Monday on Oct. 19, 1987. On Wednesday, they dropped further from 4.413% to pay as low as 3.72%. Benefitting Gold price, the yield curve, as a result, narrowed its inversion further, with the gap between two-year and 10-year yields contracting to -28.60 bps and the tightest spread since October.

Looking to the Federal Reserve next week, markets are now pricing in an 80% chance of a 25 basis point hike and are pricing in a 50% chance of no change. Moreover, the December Fed funds futures, which reflect the overnight rate that banks use to lend to each other has dropped to 3.62% in a sign that the market expects the Federal Reserve to be cutting interest rates by year's end, if not before.

Gold technical analysis

Gold price bulls are in the market and the bullish close on Wednesday opens prospects of a move to test the 2023 highs near $1,960 that guard a monthly move towards the $2,000s.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.