- Analytics

- News and Tools

- Market News

- USD/MXN stumbles below $19.00 on risk-on impulse and soft US Dollar

USD/MXN stumbles below $19.00 on risk-on impulse and soft US Dollar

- USD/MXN retreated after hitting a six-week high of around 19.2327.

- Last Friday, US economic data pointed to further weakness in the economy.

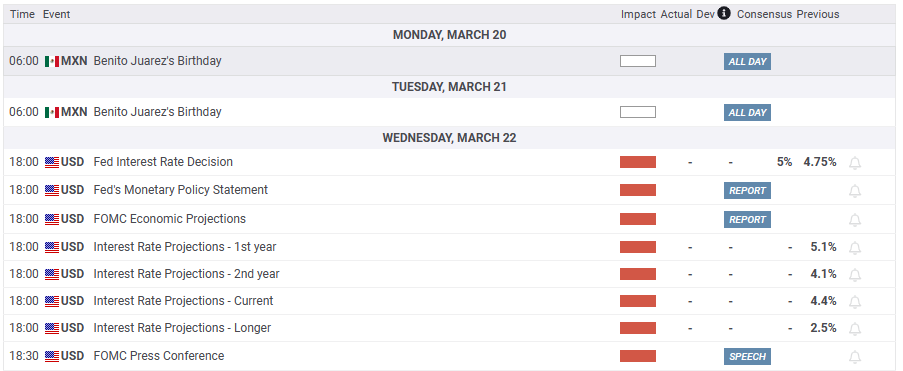

- Traders are expecting a 25 bps rate hike by the Federal Reserve.

USD/MXN is almost flat on Monday, losing 0.18% after traveling from a daily low of 18.8123. But buyers stepped in and lifted the pair above the $19.00 threshold. Nevertheless, the 100-day Exponential Moving Average (EMA) at 18.9929 capped the USD/MXN pair gains. The USD/MXN is trading at 18.8390at the time of writing.

Sentiment improvement bolstered the Mexican Peso

Investors shrugged off fears of the banking crisis after UBS’s takeover of Credit Suisse. Global central banks welcomed the news, though sentiment would remain fragile ahead of the Federal Reserve’s (Fed) interest rate decision this week. Money market futures odds for a 25 basis point rate hike lie at 73.1%, compared to last week’s 65%.

Friday’s data in the United States (US) revealed that Industrial Production for February contracted for the first time in the last 12 months, at -0.2% YoY. The monthly reading came at 0%, below the 0.2% estimates. In the meantime, as measured by the University of Michigan (UoM), March’s Consumer Sentiment in the US dropped for the first time in four months, from 67, to 63.4 in March.

The UOM poll updated American’s inflation expectations for a 5-year from 2.9% to 2.8%, while for one year, it dropped to 3.8% from 4.1%.

That has weighed in the greenback, as shown by the US dollar Index (DXY), falling 0.48%, at 103.371. US Treasury bond yields continue to collapse, a headwind for the USD/MXN

On the Mexican side, the Bank of Mexico (Banxico) Governor Victoria Rodriguez Oceja commented that she’s considering a more gradual approach to interest rate increases after hiking 50 bps in February. She added, “We’ll take into account the decision of the Fed and many other factors to the extent that they affect the inflation panorama.”

USD/MXN Technical analysis

The USD/MXN hit a daily high at 19.2327, shy of testing the 200-day EMA at 19.3888. Since then, the USD/MXN erased those gains and dropped beneath the 100-day EMA, though it found support at 18.8047. For a bearish continuation, the USD/MXN must reclaim the 50-day ENA at 18.6822 to test the 20-day EMA at 18.5487. Otherwise, if the USD/MXN regains the 100-day EMA at 18.99, the pair would be poised to finish the day above $19.00.

What to watch?

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.