- Analytics

- News and Tools

- Market News

- EUR/USD rises on ECB speakers, sentiment improvement, Lagarde’s eyed

EUR/USD rises on ECB speakers, sentiment improvement, Lagarde’s eyed

- As investors shrugged off banking crisis woes, EUR/USD gained traction above 1.0700.

- PPI in German was mixed, with annual reading shooting above 15%< while MoM data shrank.

- EUR/USD: Bullish in the near term but needs to clear 1.0760, to extend its gains.

The EUR/USD breaks the 1.0700 barrier and climbs 0.50% after hitting a daily low of 1.0631. An improvement in market mood and European Central Bank (ECB) speakers lend a hand to the Euro (EUR), while the US Dollar (USD) continues to weaken across the board. At the time of writing, the EUR/USD is trading at 1.0720.

Germany’s PPI and ECB speaking among the factors boosting the Euro

Market sentiment improved after UBS bought its Swiss rival Credit Suisse. The financial market turbulence has spurred speculations that global central banks could pause the pace of tightening. However, traders expect a 25 bps rate hike by the Federal Reserve (Fed) on Wednesday. The CME FedWatch Tool odds for a quarter of a percentage point lift at 73.10%.

The EUR/USD price action has been driven by ECB speakers. The President of the ECB, Christine Lagarde, said that inflation is expected to continue excessively high for a more extended period. She added that there’s no trade-off between inflation and financial stability, and without tensions, the ECB would’ve indicated that additional rate hikes were required.

At around the same time, ECB’s Stoumaras commented the ECB would not give more forward guidance and said that meetings would be data dependant.

Earlier, Germany’s inflation in the producer side, known as the Producer Price Index (PPI), contracted -0.3% MoM, less than estimates of -0.5%. Annually basis, the PPI jumped 15.45, above forecasts of 14.5%.

Aside from this, last Friday’s US economic data revealed that Industrial Production experienced a -0.2% YoY decrease, marking the first contraction in the past year. The monthly reading was 0%, lower than the estimated 0.2%. Additionally, Consumer Sentiment in the US, as measured by the University of Michigan (UoM), decreased from 67 in February to 63.4 in March, the first drop in four months.

The US Dollar Index, a measure of the buck’s value, extended its losses to 0.44%, down at 103.417, a tailwind for the EUR/USD. US Treasury bond yields are recovering but failing to underpin the greenback.

EUR/USD Technical analysis

The EUR/USD has printed three consecutive bullish candles, though it remains shy of testing last week’s high of 1.0759. The daily chart suggests a triple bottom is in place, though it would need to reclaim the latter to confirm its validity. That would pave the way for a rally towards the YTD high of 1.1032, but firstly, traders need to clear the February 14 at 1.0804 before aiming towards 1.1000. Conversely, a fall below the 100 and 200-day EMAs, around 1.0545/1.0569, would shift the EUR/USD bias to bearish.

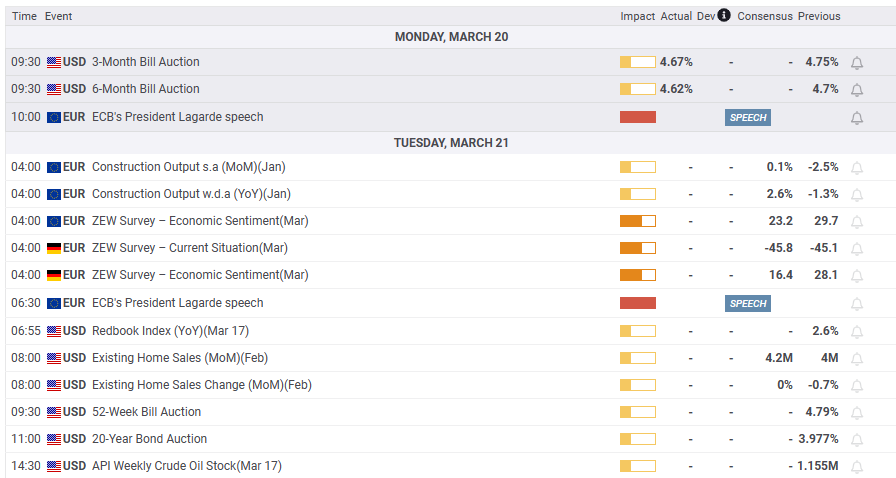

What to watch?

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.