- Analytics

- News and Tools

- Market News

- Gold Price Forecast: Uptrend intact if bruised ahead of the FOMC meeting

Gold Price Forecast: Uptrend intact if bruised ahead of the FOMC meeting

- Gold price finds its feet after losing almost $60 in 48 hours.

- The next directional move depends heavily on the outcome of the FOMC.

- Gold Futures Open Interest is signaling a possible rebound to $2,000 on the cards, says analyst.

- Longer-term uptrend remains intact if bruised, according to technical analysis.

Gold price finds a floor at around $1,940 in the calm before the FOMC storm on Wednesday. The recent banking crisis appears to have eased temporarily with the completion of the takeover of Credit Suisse by UBS. Markets may have drawn comfort from the news UBS may buy back the AT1 bonds that were sold as a sacrificial lamb to sweeten the takeover.

Despite Gold price’s sell-off over the last two days, the precious metal still remains very much in an uptrend on higher timeframes. Now, much depends on the outcome of the US Federal Reserve’s meeting as to whether the uptrend resumes or bears push Gold price a step lower.

Gold news: Market expectations of 25 bps rate hike firm

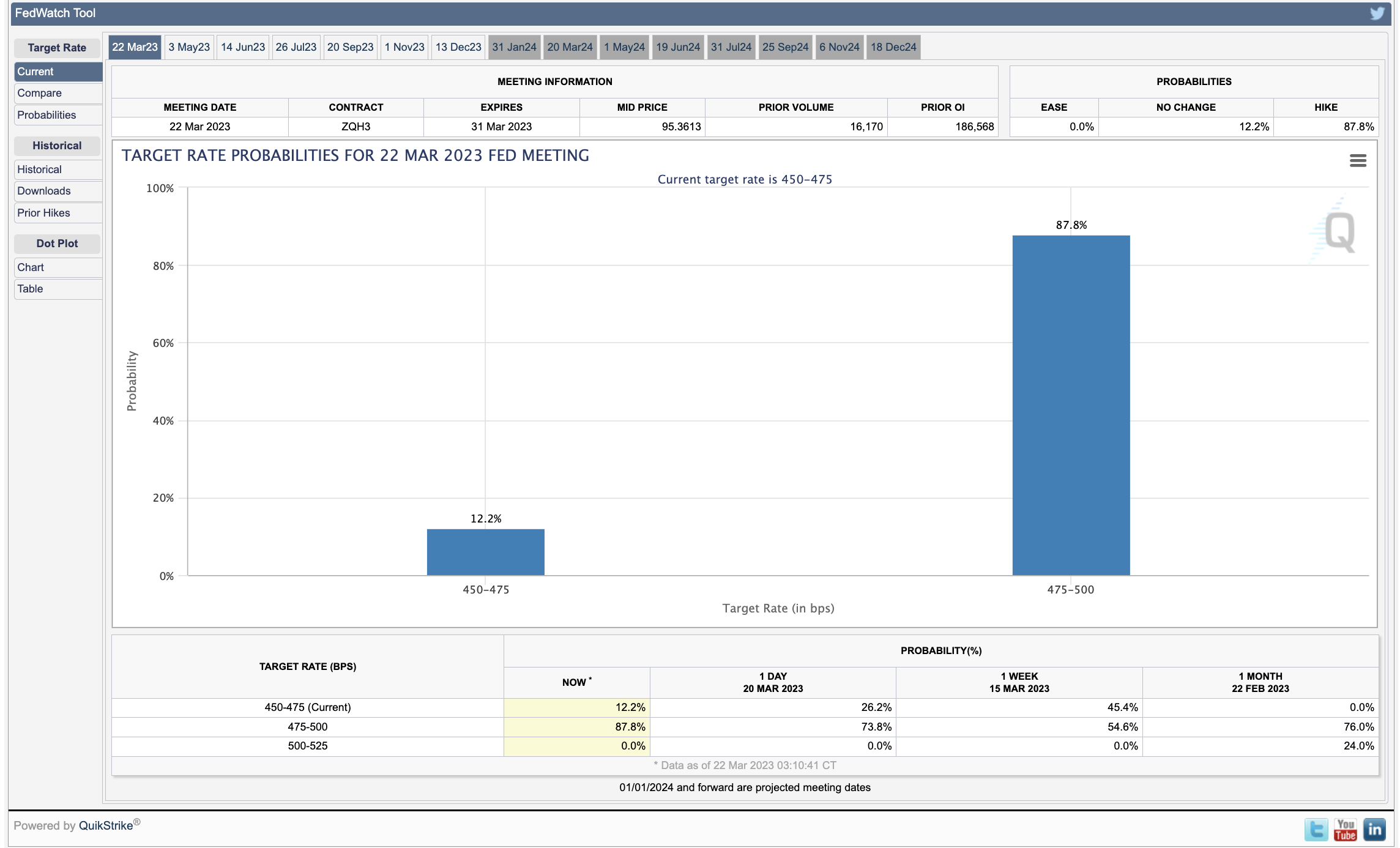

The probability the Federal Reserve will hike the Fed Funds Rate by 0.25% to a target range of 4.75%-5.00% jumped to 88% overnight, according to the CME FedWatch Tool, a highly regarded market gauge of future rate moves based on Fed Funds Futures.

This sets the market expectation heading into the event and leaves the chances of no hike whatsoever at an unlikely 12%.

According to experts, the longer term view is also important. If the Fed expects rates to peak this year with the possibility of a cut before year-end, markets may respond as if the decision was dovish. For the Gold price this will be a bullish result.

On the other hand, a 25 bps rate hike accompanied by a commitment to continue raising rates to a higher terminal rate will be interpreted as hawkish and weigh on the Gold price.

One possibility, suggested by analysts at Commerzbank, is that the Fed may signal a pause whilst the banking crisis passes, before signaling it will resume a more aggressive hiking strategy to combat inflation at a later date.

“The Fed would first have to convince market participants again that it will continue to raise rates after a pause in order to fight inflation. This poses the risk of additional volatility in the markets," said Commerzbank.

FXStreet’s own Yohay Elam believes the Fed may make a hawkish decision followed by softer dovish tones from Fed Chairman Jerome Powell in the meeting, designed to smooth volatility.

“The short version of my scenario is: risk-off on the rate hike and the dot plot, followed by an immediate and slight recovery in response to the statement. Then, Powell would further boost the risk-on mood with promises to react to the situation and with caring words about the labor market," says Elam.

Gold Futures Open Interest suggests a rebound in Gold

Gold price is likely to rebound to the $2,000 level, according to FXStreet Senior Analyst and Editor, Pablo Piovano, based on an analysis of the Gold Futures market.

Tuesday March 21 marked the first day where traders scaled back their Futures positions following three consecutive days of increased open interest, the term used to describe the volume of open positions in the Futures market.

“Gold prices extended the negative start of the week and retreated to the $1,940 region on Tuesday. The strong downtick was on the back of shrinking open interest and volume and suggests that a potential rebound could be in the offing in the very near term,” said Piovano in a note on Wednesday morning.

Gold price technical analysis: Uptrend still intact, if bruised

Gold price touches down at the $1,940s on Wednesday after falling almost $70 in only 48 hours. Whilst the precious metal looks vulnerable on the intraday charts a pan out to the daily chart, shows that the broader uptrend remains intact and there is every chance it could resume on the back of a more dovish takeaway from the FOMC meeting.

-638150764230476395.png)

Gold price: Daily Chart

Whilst the declines over the past two days have been steep, they still don’t wipe out all the gains made on Monday when bank contagion fears peaked. This continues to suggest the downturn, though steep, may just be a correction before bulls resume their push higher. A move back up will likely retouch the $2,009 yearly highs before consolidating.

Nevertheless, Gold price has now broken out of its rising channel, which is a bearish development. The Relative Strength Index (RSI) momentum indicator has tracked price lower and is actually diverging when compared to where XAU/USD was when it last dipped. Nor are there any signs on the 4-hour chart of a bullish reversal forming, so in the very short-term the trend looks a little bearish.

More losses could result in a further decline to $1,930 first, and the level of the 50-4hr Simple Moving Average (SMA), and then, if really volatile, to the March 15 low at $1,885, which is just above support from the 50-day SMA.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.