- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears step in and eye a break of support structure

Gold Price Forecast: XAU/USD bears step in and eye a break of support structure

- Gold price is under pressure following the knee-jerk rally.

- Fed´s dovish 25bp rate hike leaves the sentiment mixed and Gold price in limbo.

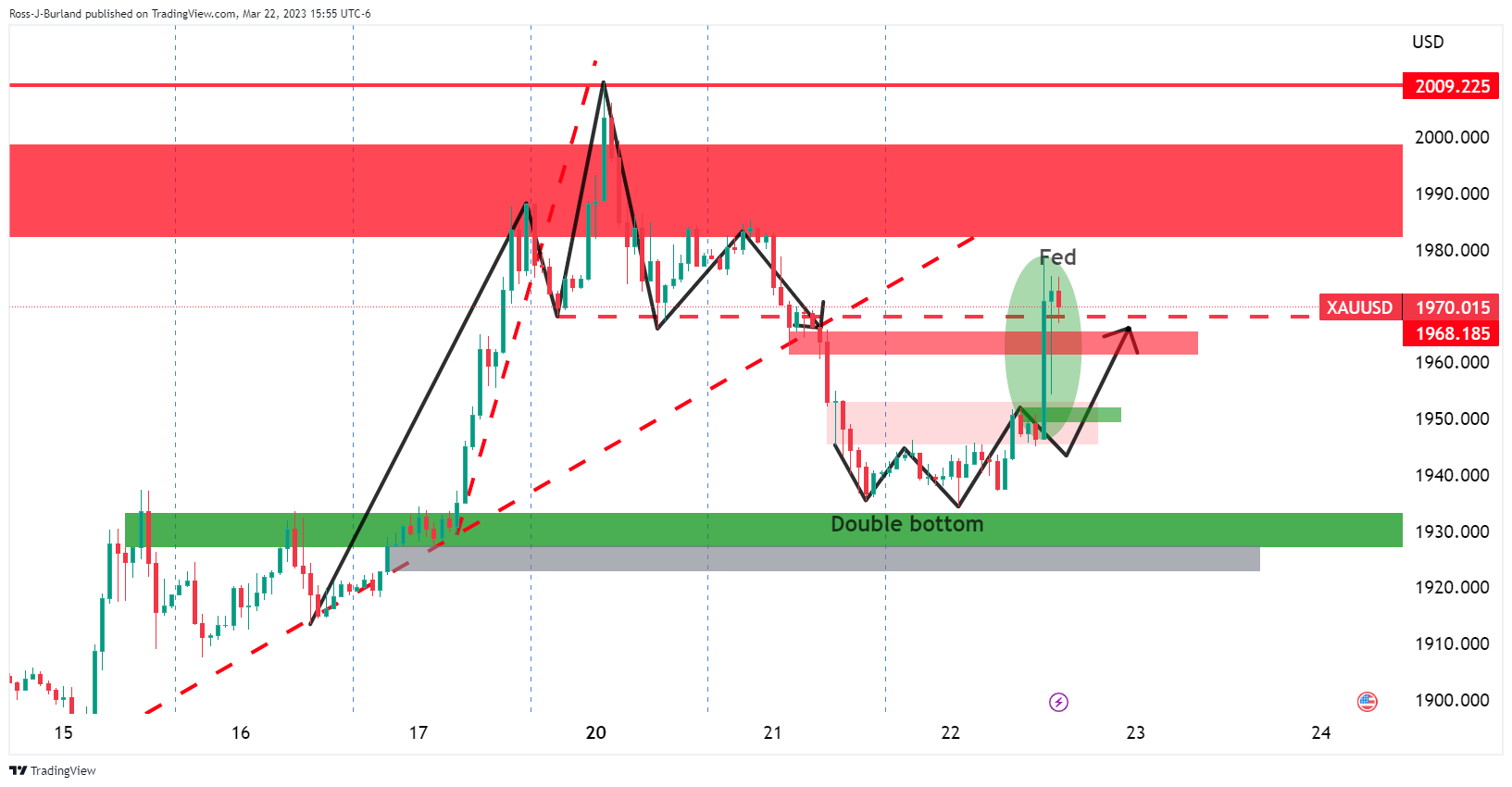

As per the start of the week´s analysis, Gold, Chart of the Week: XAU/USD is front side of the trend ahead of the Fed, where a correction was expected ahead of the Federal Reserve, we have seen two 'way business into and around the event.

The Federal Reserve´s dovish interest rate decision when the central bank announced its 25 bp rate hike flagged “some additional policy firming” with the dot plot median pointing to one more hike. Before today´s Federal Reserve event, markets were pricing in a year-end target rate of 4.36%. This has dropped in volatile reactions to the statement to 4.26%. At the time of writing, US 2-year Treasury yields are down to 4.77%, dropping from 4.259% on the day to print a low of 3.958%. Consequently, the US Dollar index, DXY, fell to a low of 102.065 from a high of 103.265 and Gold price ook off.

Gold prior analysis

Gold update

Ahead of the event, the Gold price was poised for a move up:

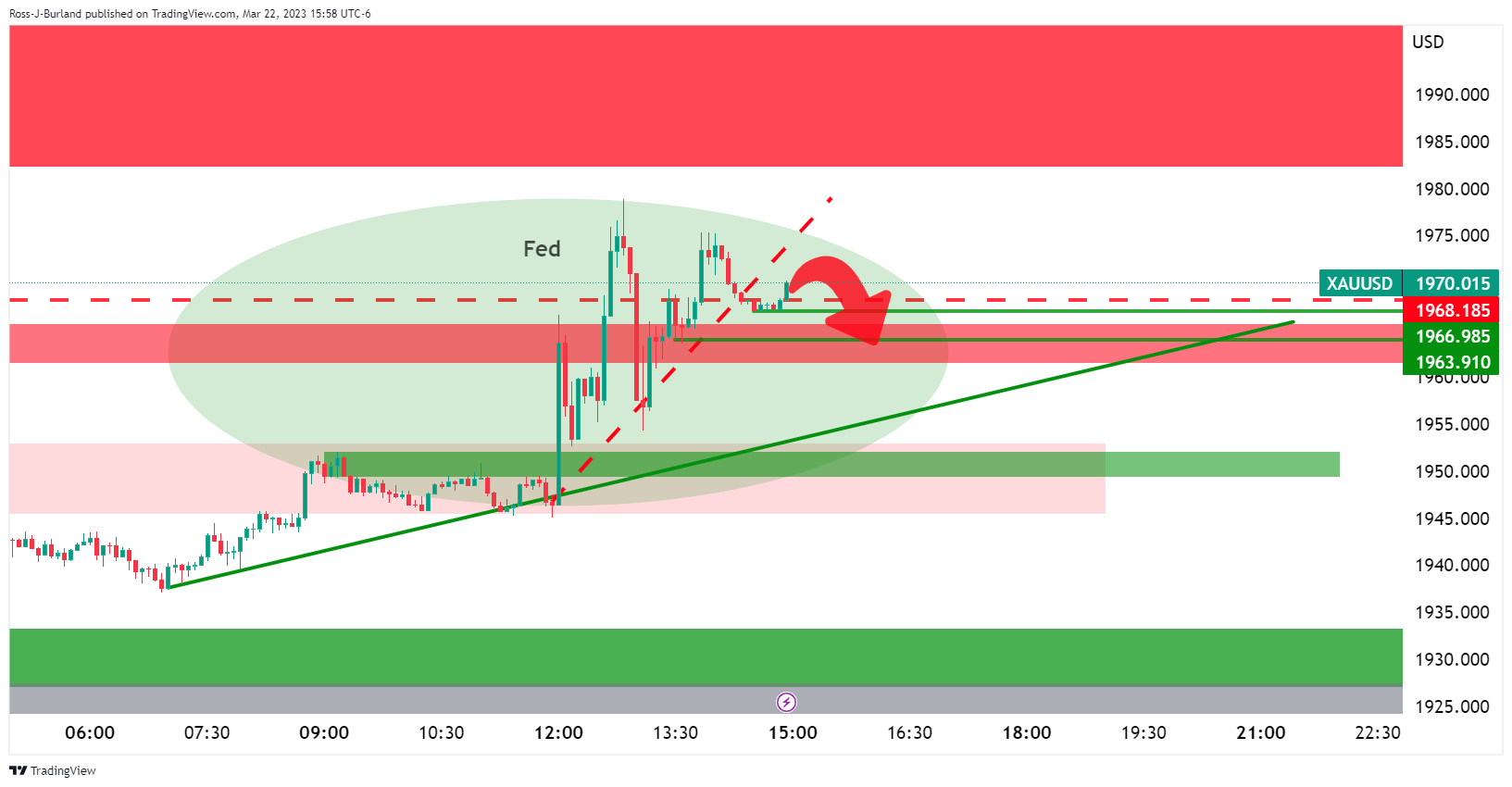

After the Fed:

Gold price 5-min chart

The bears have moved in but they need to get below the $1,960s for a look-in at the $1,950s support area. If the $1,950s were to give then the H&S on the daily chart´s target will be eyed below the prior double bottom.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.