- Analytics

- News and Tools

- Market News

- EUR/USD bulls have moved in on the critical resistance

EUR/USD bulls have moved in on the critical resistance

- EUR/USD bulls are back in the market and sitting pretty above 1.000.

- The bears need to get involved or face further pressure on Monday.

EUR/USD is holding up at around 0.1% higher and has rallied back into resistance after traveling between 1.0966 and 1.1047 on the day so far. The US Dollar rallied early doors on Friday after the Nonfarm Payrolls data showed that US employers added more jobs than expected in April. Most importantly, wages also grew more than the expectations as well.

NFP showed that there were 253,000 added jobs, well above economists' forecasts for a gain of 180,000. US average hourly earnings climbed at an annual rate of 4.4%, above expectations for a 4.2% increase. However, data for March was revised lower to show 165,000 jobs added instead of 236,000 as previously reported. This diluted the punchy headline although markets were already wrongly footed and needed to scramble back US Dollar shorts, exacerbating the move in EUR/USD lower.

However, the turnaround came on Wall Street when stocks rallied and the bulls moved back in. EUR/USD popped above 1.1000 again and has managed to hold above the psychological number for the rest of the day. Traders still expect that the Federal Reserve is at or near the end of its tightening cycle which is keeping a lid on the Greenback.

´´WIRP now suggests around 50% odds of a 50 bp hike at the March 21-22 FOMC meeting, down from over 70% pre-SVB,´´ analysts at Brown Brothers Harriman explained in respect to the banking crisis. ´´Looking ahead, 25 bp hikes in May and June are priced in that would take Fed Funds to 5.50-5.75%.´´

The analysts said that the ´´odds of a last 25 bp hike in Q3 have evaporated vs. over 30% odds pre-SVB. A strong jobs report today should bring the market focus back to the US economy rather than the US banking system. For now, we believe the uptrends in US yields and the US Dollar remains intact.´´

Meanwhile, analysts at Rabobank explained that ´´given that further European Central Bank rate hikes are already priced in, reasons to buy the EUR may be running dry.´´

´´In our view, EUR/USD may be in the process of peaking. We see scope for a move lower in the months ahead potentially towards the EUR/USD1.06 area,´´ the analysts said.

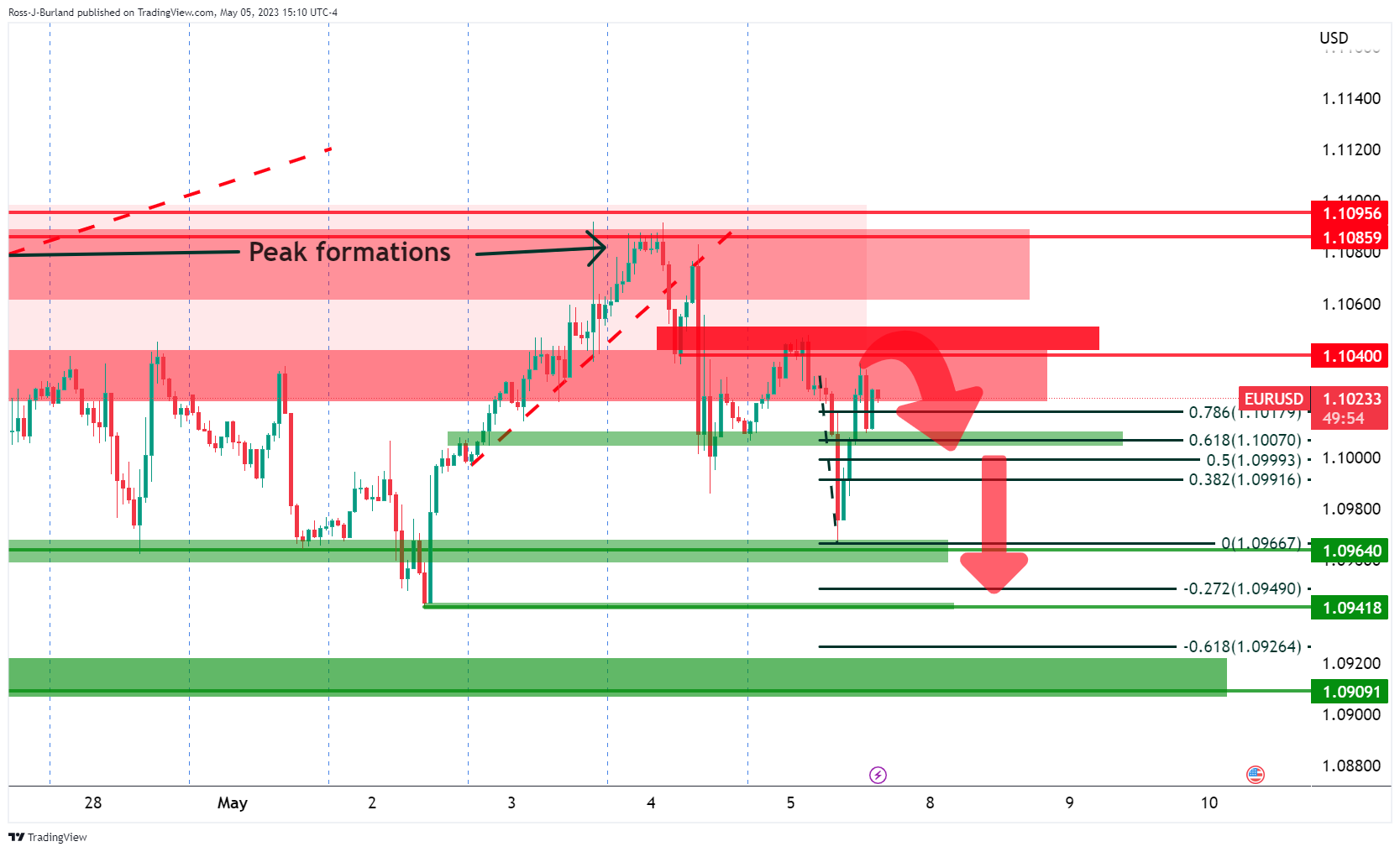

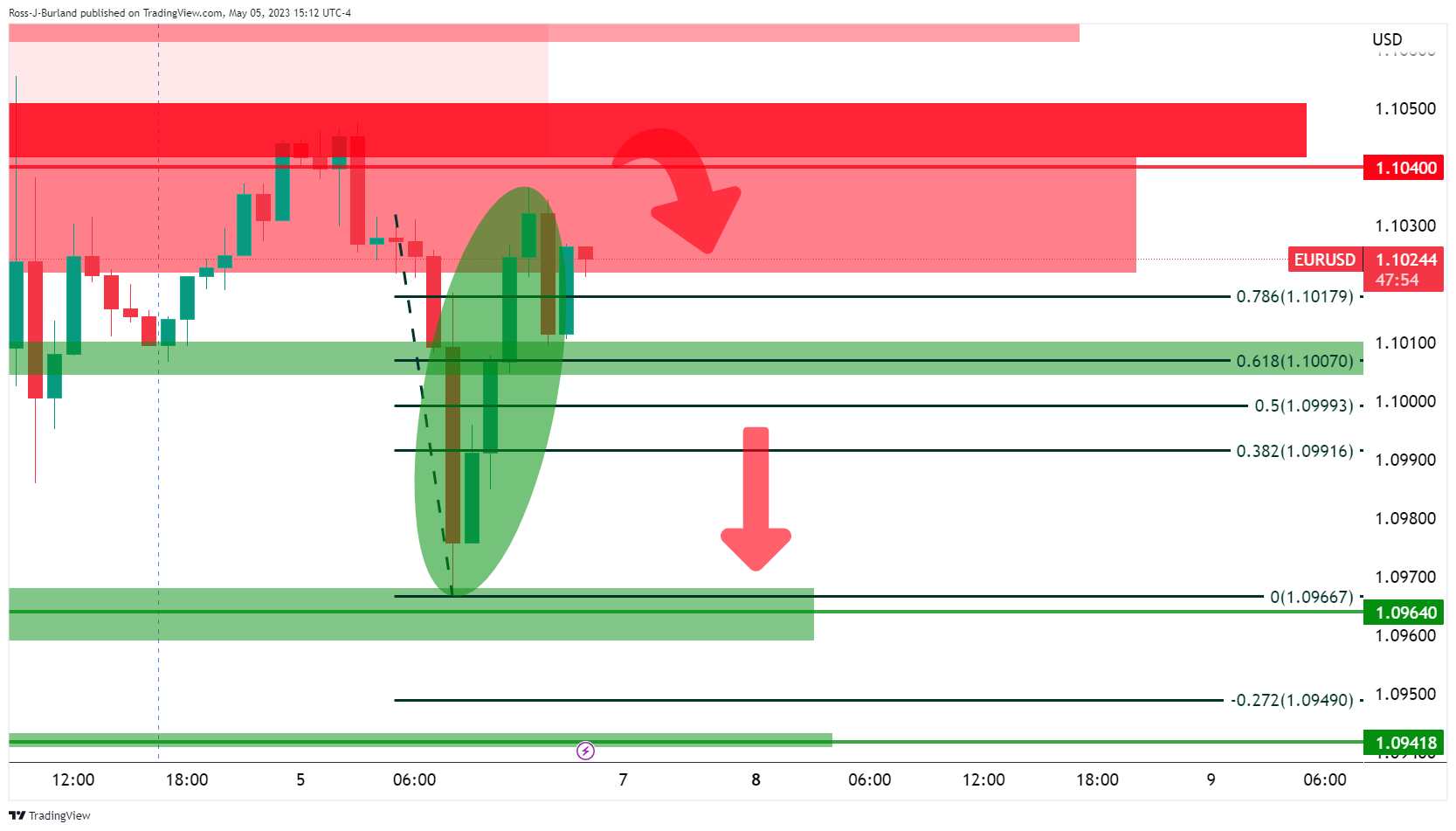

EUR/USD technical analysis

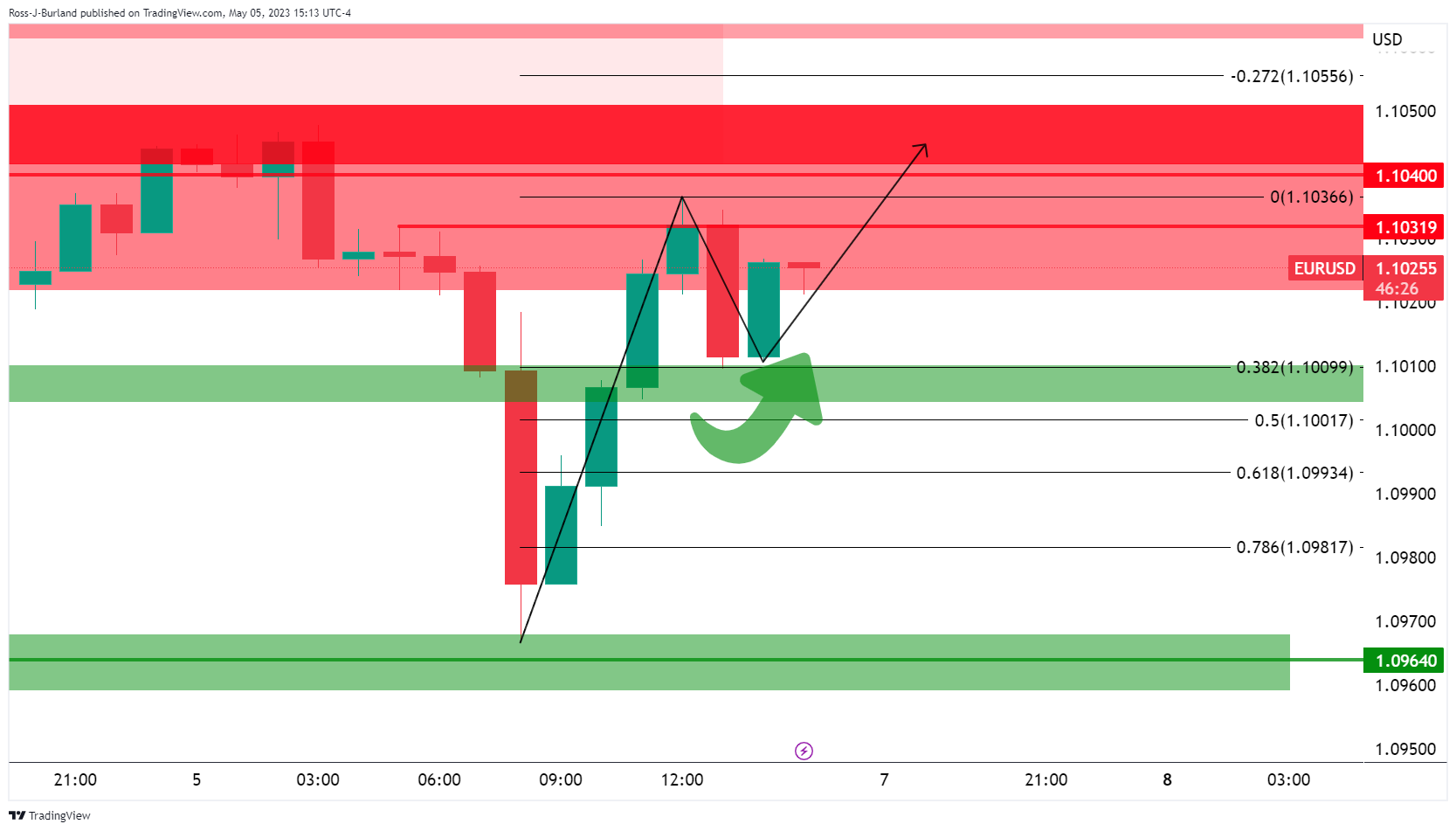

The price is now meeting resistance in this bearish schematic with a focus on a move towards 1.0900. the bears need to show up at this juncture, however, considering the bulls managed to clear the 78.6% Fibonacci ratio on the rally on Wall Street:

This makes for a bullish bias, at least for the time being:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.