- Analytics

- News and Tools

- Market News

- NZD/USD bulls under pressure below 0.6250

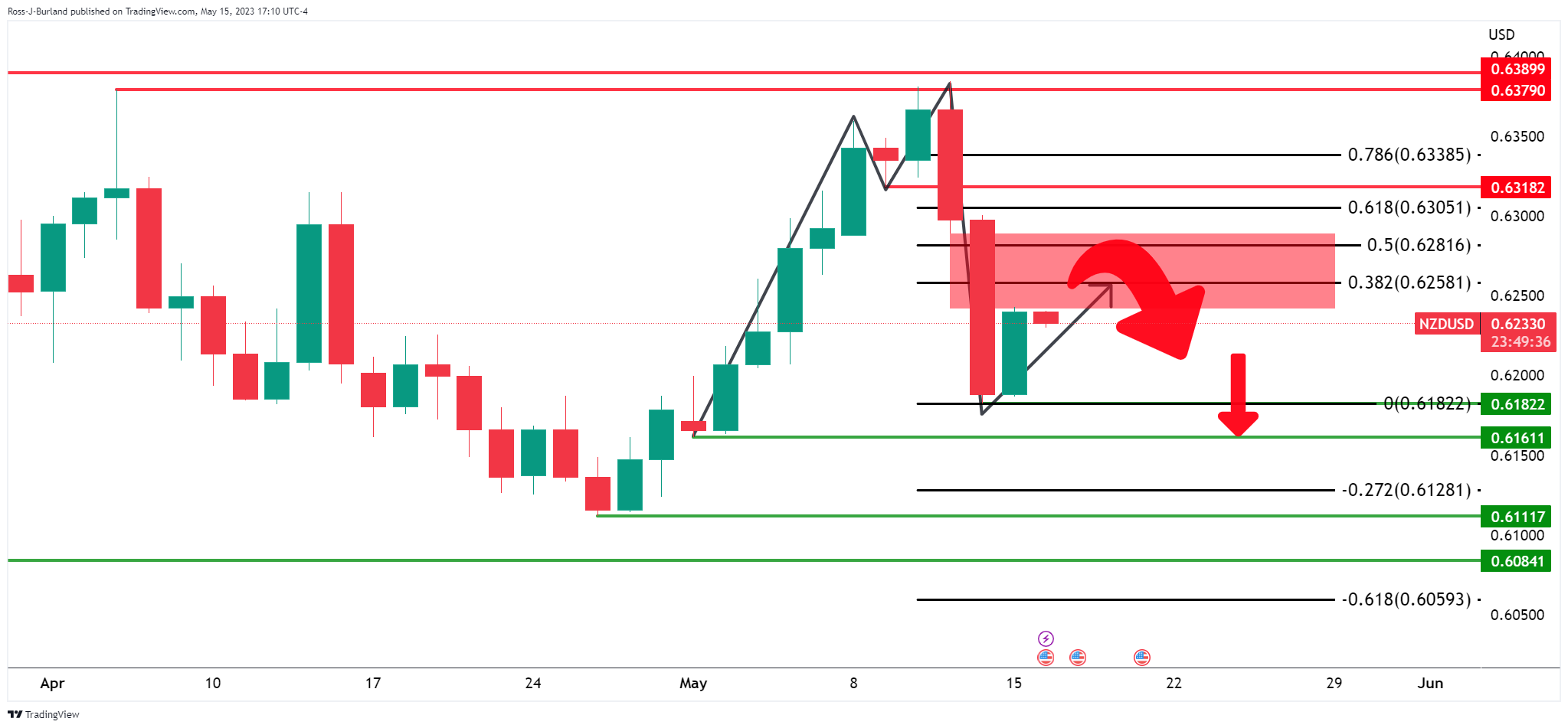

NZD/USD bulls under pressure below 0.6250

- NZD/USD bulls were pressured following a fresh high in the daily chart´s correction.

- Uncertainty over the US debt ceiling and hawkish Fedspeak may fuel USD safe-haven demand.

NZD/USD is down by some 0.16% as the forex markets head towards a close on Tuesday. The pair traveled from a high of 0.6259 and made a low of 0.6223.

´´The Kiwi lost a little of yesterday’s shine and is down a touch as we get underway today, but moves have been orderly and contained, mostly reflecting a slight uptick in the USD DXY as bond yields rose, data and Fedspeak surprised to the up/hawkish side,´´ analysts at ANZ Bank explained.

The analysts also explained that 1) ´´local participants are starting to size up the Budget, with the bond markets nervous about bond supply and FX markets worried about how credit rating agencies will perceive the Budget, hoping for a tick, but fearing the opposite,´´and 2) ´´More bonds pose an upside risk to bond yields, but not in a “good” way, as it’s supply, not demand driven. But going the other way, uncertainty over the US debt ceiling and hawkish Fedspeak may fuel USD safe-haven demand and it seems reasonable to expect more volatility.´´

NZD/USD technical analysis

As per the prior day´s analysis, NZD/USD bulls in the market and eye a firm correction, the pair moved up into the 38.2% Fibonacci resistance:

Prior analysis:

Update:

There are prospects of a move lower although the 4-hour and 1-hour charts can be used to gauge as to whether there is going to be a deceleration in the bullish correction and so far, it is early days still.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.