- Analytics

- News and Tools

- Market News

- EUR/JPY Price Analysis: Rallies sharply, invalidating a head-and-shoulders pattern

EUR/JPY Price Analysis: Rallies sharply, invalidating a head-and-shoulders pattern

- EUR/JPY breaks head-and-shoulders neckline, bolstered by high EU inflation and hawkish ECB comments.

- The uptrend remains intact as the pair holds above the 20-day EMA, but further gains require a break above the month-to-date high.

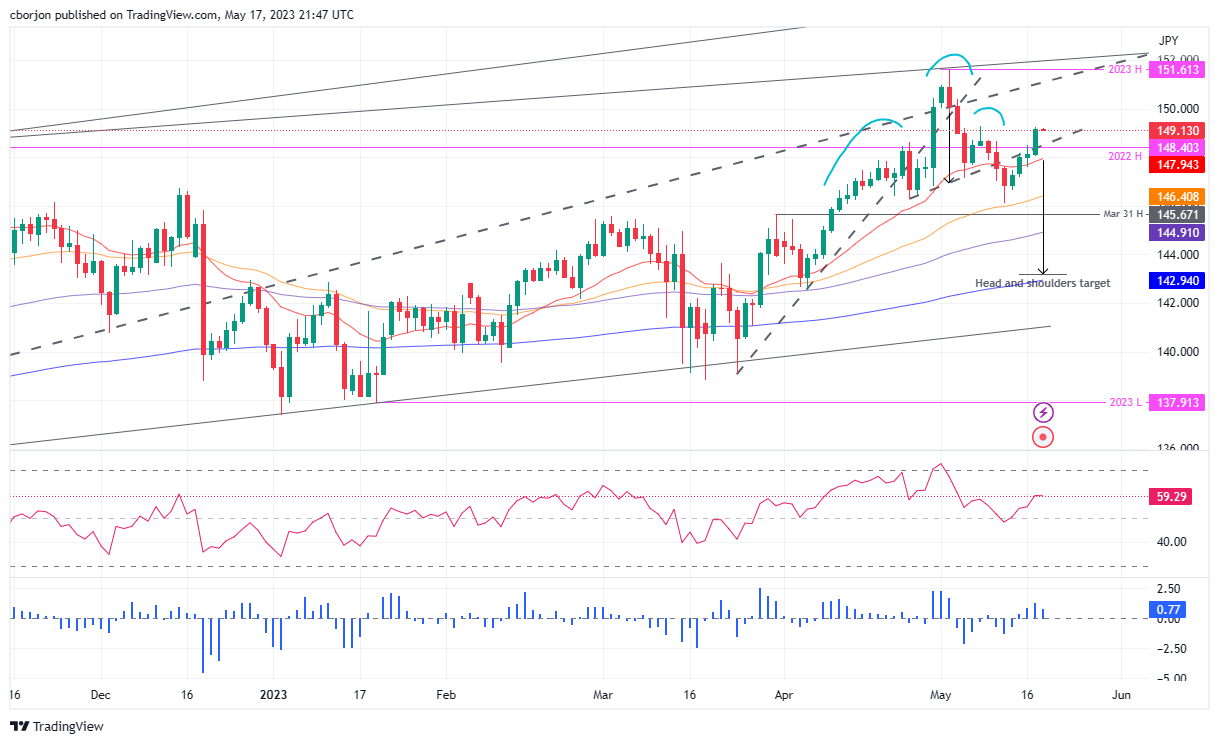

EUR/JPY rallied sharply on Wednesday, breaking above a head-and-shoulders chart pattern neckline, invalidating the pattern, as buyers emerged on a high inflation report in the Eurozone (EU). That, alongside European Central Bank’s (ECB) hawkish commentary, opened the door for further gains. As the Asian session begins, the EUR/JPY trades at 149.17, registering a minuscule gain of 0.01%.

EUR/JPY Price Analysis: Technical outlook

After the EUR/JPY struggled to crack the 2022 high of 148.40, the cross-currency pair extended its gains and cleared the neckline of a head-and-shoulders chart pattern. Therefore, the EUR/JPY’s uptrend remains intact in play, as also the pair jumped off the 20-day Exponential Moving Average (EMA) at 147.94. Nevertheless, to further cement its bias, a break above the month-to-date (MTD) high of 149.26 is needed, so the EUR/JPY could threaten to crack the 150.00 figure.

The Relative Strength Index (RSI) indicator shows buyers entered the market but has turned flat as the Asian session begins. The 3-day Rate of Change (RoC) portrays that buying pressure is fading; hence, mixed signals around the pair could prevent traders from opening fresh long positions.

On the upside, if EUR/JPY buyers reclaim 49.26, the psychological 150.00 figure is up for grabs. A breach of the latter will expose the year-to-date (YTD) high of 151.61.

Conversely, the EUR/JPY first support would be the 149.00 mark. Downside risks will emerge below the latter, like the 2022 high turned support at 148.40, ahead of the 20-day EMA at 147.94.

EUR/JPY Price Action – Daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.