- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls need to step in or face a sell-off to daily support

Gold Price Forecast: XAU/USD bulls need to step in or face a sell-off to daily support

- Gold price bears are in the market but bulls are lurking.

- Fed speakers and the debt ceiling are on focus.

As per the prior analysis that was done in the pre-pen on Monday, Gold Price Forecast: XAU/USD bears are in the market but bulls step up, the bears have indeed moved in. Gold price is currently trading down some 0.13% and made a low of $1,968.90 in New York as Wall Street opened.

From a fundamental standpoint, it could be argued that due to a couple of US Federal Reserve officials, the non-yielding bullion was pressured by hawkish rhetoric. At the same time, markets are looking for more clarity around the US debt ceiling negotiations.

´´With the June 1 X-date rapidly approaching, markets will look for signs of progress on a debt ceiling deal,´´ the analysts at TD Securities explained:

´´While there have been positive overtures from both sides, the work is not yet complete. Markets appear to be assuming that negotiations are a done deal, suggesting that any souring in tone as negotiations play out could upset risk sentiment.´´

President Joe Biden and House Republican Speaker Kevin McCarthy are discussing the debt ceiling on Monday. as for Fed speak, Minneapolis Fed President Neel Kashkari told CNBC that "it may be that we have to go north of 6%" to get inflation back to the Fed's 2% target, while St. Louis Fed President James Bullard said there might be the need to go higher on policy rate.

Analysts at TD Securities explained that money managers liquidated some gold length and added shorts as debt ceiling optimism and resilient data aided the apparent formation of a triple top.

´´Still, our positioning analytics argue that selling exhaustion is imminent. After all, we estimate a high bar for subsequent CTA trend follower liquidations, whereas discretionary traders remain underinvested and Shanghai traders have begun adding to their positions once more,´´ the analysts added. ´´As expectations for a deeper Fed cutting cycle rise, discretionary traders should increasingly deploy their hoard of capital in the yellow metal, supporting new cycle highs before year-end.´´

Gold technical analysis

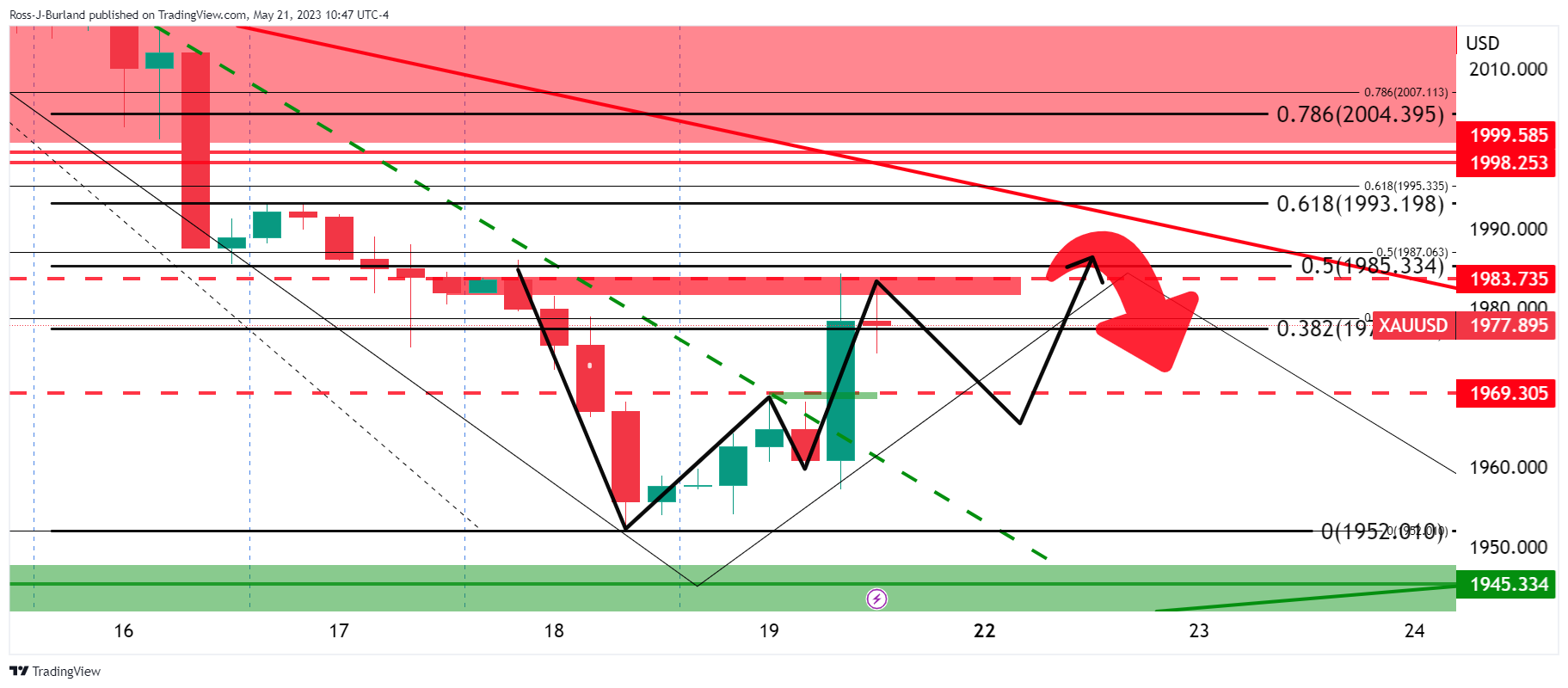

In the prior analysis, it was stated that the W-formation is a reversion pattern, so was something to take note of:

Gold price H4 chart, prior analysis

Gold price update, H4 chart

We have seen the pattern complete. Now the bulls need to step in and get on the back side of the trendline and into bullish territory. Failing that, then the broader bullish trendline could come under pressure:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.