- Analytics

- News and Tools

- Market News

- NZD/USD bulls enaged and eye 0.6300 ahead of RBNZ

NZD/USD bulls enaged and eye 0.6300 ahead of RBNZ

- NZD/USD bulls have been in charge and eye 0.6300.

- The RBNZ is going to be one of the key events for the pair this week.

NZD/USD is up by some 0.2% and has risen from a low of 0.6261 to reach a high of 0.6292 so far. However, we have the Reserve Bank of New Zealand tomorrow which is likely to see the Kiwi tread water ahead of the event.

Markets are split on whether we’ll see a 25 or 50bp hike. ´´After the surprise 50bps hike in Apr, we don't expect another 50bps shocker after the softer Q1 CPI print,´´ analysts at TD Securities said.

´´However, we do acknowledge the risk of one as the budget update shows more fiscal impulse working through the economy from the cyclone rebuild. Focus turns to the new OCR track and an increase in the terminal rate will lead markets to price in further hikes,´´ the analysts added.

Meanwhile, there has been no progress seen in US debt ceiling negotiations and Fedspeak overnight was mixed and did little to shift the USD, as analysts at ANZ Bank noted,.

´´But let’s see what the Fed minutes and US core PCE deflator look like.´´

´´For the Kiwi per se, as we noted yesterday, it seems to be mostly about carry now that some short-end rates are around 6%, which is world-beating. With genuinely expansionary forces (migration/fiscal) behind the reasons most are calling for a higher OCR, higher rates should be NZD-beneficial, twin deficits (fiscal/trade) cast a dark shadow over the background,´´ the analysts added.

NZD/USD technical analysis

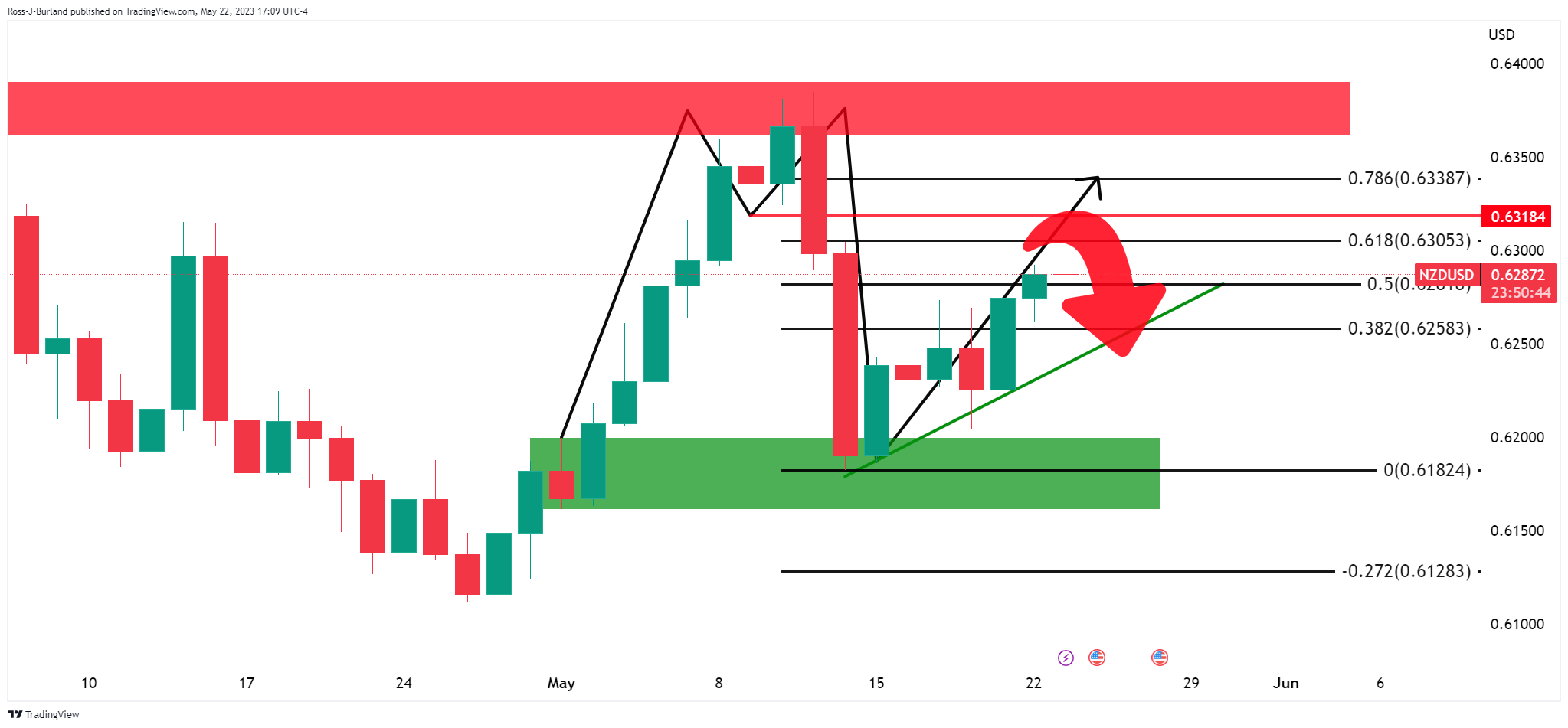

NZD/USD is completing the M-formation pattern with a move toward the neckline.

The price has already moved in on the 61.8% Fibonacci retracement level as illustrated above. This pattern´s neckline area could well hold and see a rejection to the downside in the coming days.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.