- Analytics

- News and Tools

- Market News

- USD/JPY Price Analysis: Bears stay in control ahead of key NFP event

USD/JPY Price Analysis: Bears stay in control ahead of key NFP event

- The US Dollar bears are taking advantage of the less hawkish sentiment around the Fed.

- USD/JPY bulls are waiting in the flanks.

- The pair is meeting a key demand area on the charts.

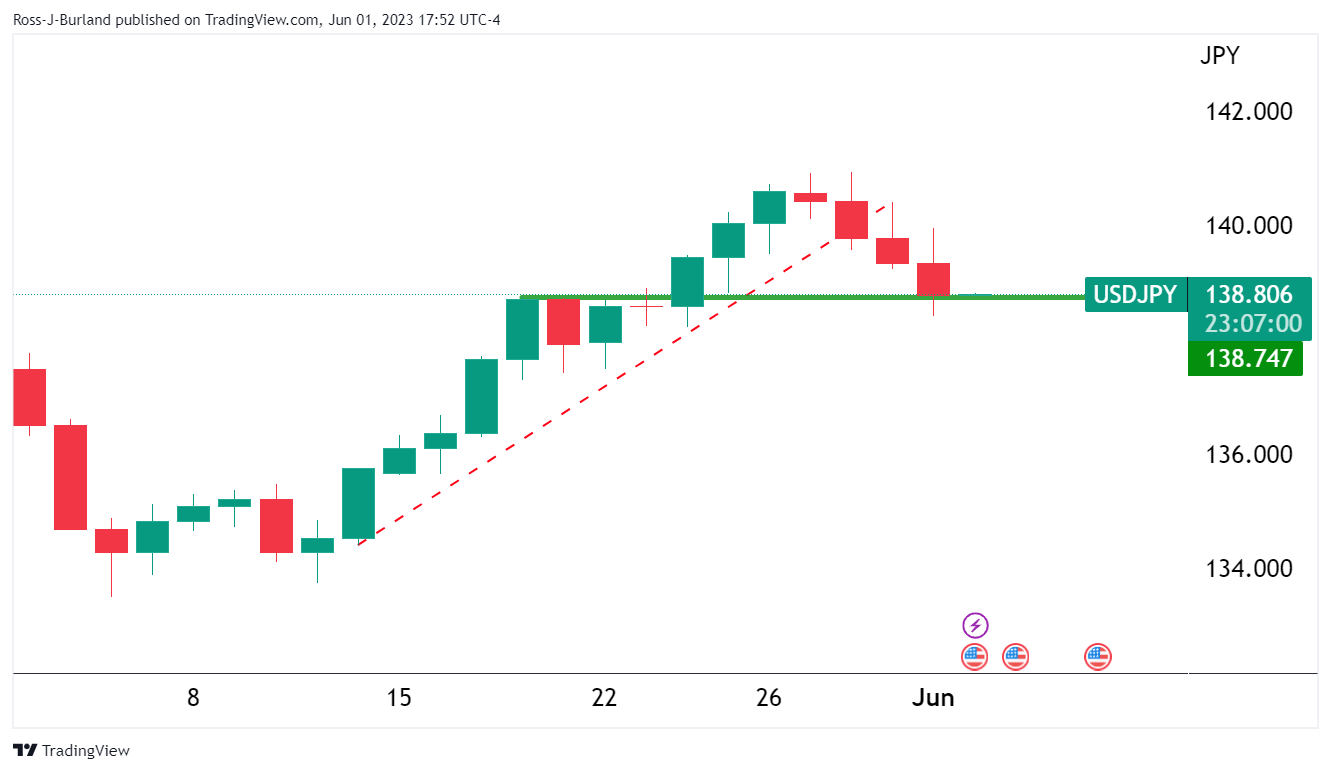

USD/JPY was on the offer on Thursday with the US Dollar on track for its worst daily loss in nearly a month. US manufacturing data and comments by Federal Reserve officials struck a chord with the bears surrounding the expectations that the Federal Reserve will likely skip an interest rate hike later this month.

Technically, the price is now entering a demand area while could see a reversal as we move into the Nonfarm Payrolls event on Friday.

USD/JPY daily chart

Bulls are lurking in the 138 area with eyes on a move up towards prior support in the 139.50s. However, while the price is on the front side of the trendline resistance, the focus remains a fade on rallies. With that being said, the NFP data will be key.

H1 chart:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.