- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD approaches $1,970 as USD Index’s pullback seems less confident, US CPI eyed

Gold Price Forecast: XAU/USD approaches $1,970 as USD Index’s pullback seems less confident, US CPI eyed

- Gold price is marching towards the $1,970.00 resistance as the recovery move in the USD Index could conclude sooner.

- Easing US labor market conditions have improved the odds of a neutral policy stance by the Fed.

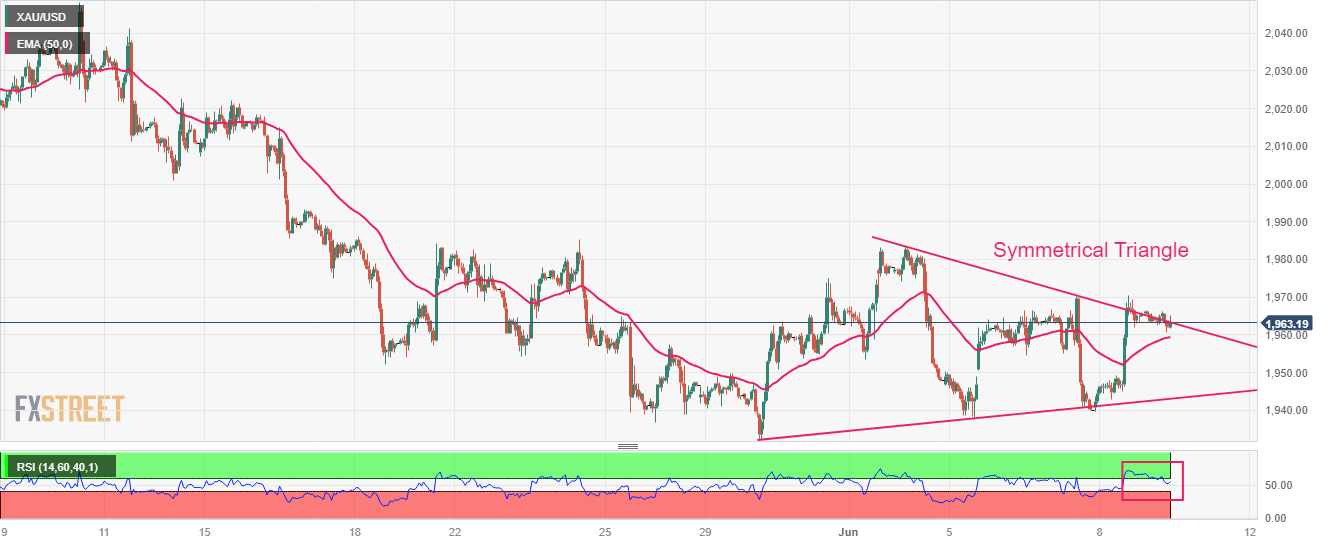

- Gold price is gathering strength for a breakout of the Symmetrical Triangle chart pattern.

Gold price (XAU/USD) has resumed its upside journey towards the $1,970.00 resistance in the European session. The precious metal is repossessing the spotlight as the recovery move in the US Dollar Index (DXY) seems less confident due to the absence of fundamental support.

S&P500 futures have surrendered half of the gains posted on Thursday as investors are shifting their focus toward the release of the United States Consumer Price Index (CPI) data. Market sentiment has turned cautious as the US inflation release could bring variation in expectations for the Federal Reserve (Fed) policy for June.

As per the preliminary report, headline inflation is seen softening to 4.2% vs. the prior release of 4.9%. Core CPI that strips off oil and food prices is expected to accelerate marginal to 5.6% vs. the former release of 5.5%. If core inflation continues to remain persistent, Fed chair Jerome Powell could be more favorable for the continuation of the policy-tightening spell.

Earlier, the street was divided about Fed’s policy stance but now easing labor market conditions have improved the odds of a neutral policy stance by the Fed. The USD Index has extended its recovery to near 103.60. Also, the yields offered on 10-year US Treasury bonds have climbed to 3.74%.

Gold technical analysis

Gold price is gathering strength for a breakout of the Symmetrical Triangle chart pattern formed on an hourly scale. A breakout of the neutral triangle results in wider ticks and heavy volume. The precious metal is hovering near the downward-sloping trendline of the aforementioned pattern plotted from June 02 high at $1,983.50.

The yellow metal is trading above the 50-period Exponential Moving Average (EMA) at $1,959.70, which adds to the upside filters.

A confident break into the bullish range of 60.00-80.00 by the Relative Strength Index (RSI) (14) will trigger the upside momentum.

Gold hourly chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.