- Analytics

- News and Tools

- Market News

- USD/CAD Price Analysis: Pierces 200-DMA, key resistance line as Canada Inflation, Fed Minutes loom

USD/CAD Price Analysis: Pierces 200-DMA, key resistance line as Canada Inflation, Fed Minutes loom

- USD/CAD takes the bids to refresh intraday high, jostles with crucial resistances.

- Bullish MACD signals, sustained upside break of four-month-old rising trend line favor Loonie pair buyers.

- Sellers need validation from April’s low to retake control.

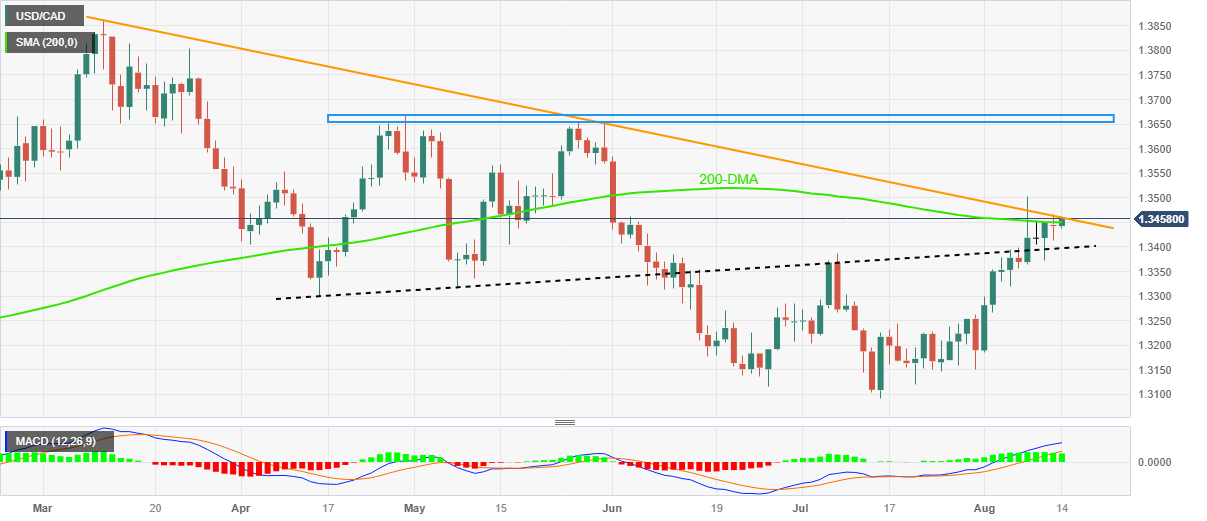

USD/CAD crosses the 200-DMA hurdle as bulls attack the five-month-old descending resistance line early Monday in Europe. In doing so, the Loonie pair justifies the retreat in the WTI crude oil prices, Canada’s key export item, while taking clues from the firmer US Treasury bond yields and the US Dollar amid sour sentiment. That said, the major currency pair rises 0.11% intraday to near 1.3460 by the press time.

Also read: USD/CAD holds ground near the 1.3440 mark, eyes on Canadian CPI, US Retail Sales

Apart from the aforementioned fundamentals, a successful break of the rising trend line from April 14, close to 1.3400, joins the bullish MACD signals to keep the USD/CAD buyers hopeful.

However, a daily closing beyond the stated resistance line, close to 1.3460 at the latest, becomes necessary for the Loonie pair buyers to keep the reins.

Also likely to challenge the USD/CAD buyers is the monthly high of near 1.3500, a break of which could propel the prices toward a horizontal area comprising multiple tops marked since late April, close to 1.3655–70.

On the flip side, USD/CAD sellers will seek a daily closing beneath the 200-DMA level of 1.3450 to rethink returning from the camp.

Even so, a four-month-long rising trend line near 1.3400 will test the Loonie pair’s downside before giving control to the bears.

USD/CAD: Daily chart

Trend: Further upside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.