- Analytics

- News and Tools

- Market News

- Gold consolidates further with another new all-time high on the cards

Gold consolidates further with another new all-time high on the cards

- Gold orbits around $2,900 as tariff tensions start to ease a bit.

- The delay of automaker US tariffs on Mexico and Canada has led to a shift in Treasury yields.

- Traders are betting on multiple Fed rate cuts while US economic data is deteriorating.

Gold’s price (XAU/USD) is consolidating for a second day in a row around $2,900 on Thursday while keeping an eye on the all-time high at $2,956. Although there might be some easing for Canada and Mexico with a delay on car import tariffs into the United States (US), the reciprocal tariffs are still due to kick in as of April. This still supports safe haven inflow which is beneficial for the precious metal.

Meanwhile, the focus shifts this Thursday to Europe, where the European Central Bank (ECB) will deliver its interest rate decision, with market expectations for a 25 basis points (bps) rate cut. A high-stakes European meeting is set to take place as well, where EU leaders will decide on the defense spending package and the possibility of providing more aid to Ukraine.

Another seismic shift can be seen this week in bonds, where traders are now pricing in multiple interest rate cuts by the Federal Reserve (Fed) for 2025. The reason is the deteriorating US economic data, which looks to confirm the idea that exceptionalism has come to an end and sparks recession fears.

Daily digest market movers: A delay is not indefinite

- The delay of automaker US tariffs on Mexico and Canada has led to a shift in Treasury yields, with investors expecting the Fed to cut interest rates multiple times this year, which could benefit Gold, Bloomberg reports.

- Another precious metal, Copper, jumped by more than 5% in Wednesday’s New York session. Prices are leaping further above other global benchmarks, as US President Donald Trump suggested imports of this commodity could be subject to a 25% tariff, Reuters reports.

- Mali has stopped issuing permits for small-scale Gold mining to foreign nationals after several deadly incidents. Interim President Assimi Goita has “instructed the government to strengthen measures to avoid human and environmental tragedies,” Minister of Security and Civil Protection General Daoud Aly Mohamedinne said on Wednesday, Bloomberg reports.

Technical Analysis: Tailwind to be priced in

More bets on interest rate cuts by the Federal Reserve are another tailwind for Gold while markets undergo seismic shifts. When all analysts and economists were predicting just one or no rate cut from the Fed, in just three trading days that narrative has now shifted to possibly more than at least two rate cuts this year.

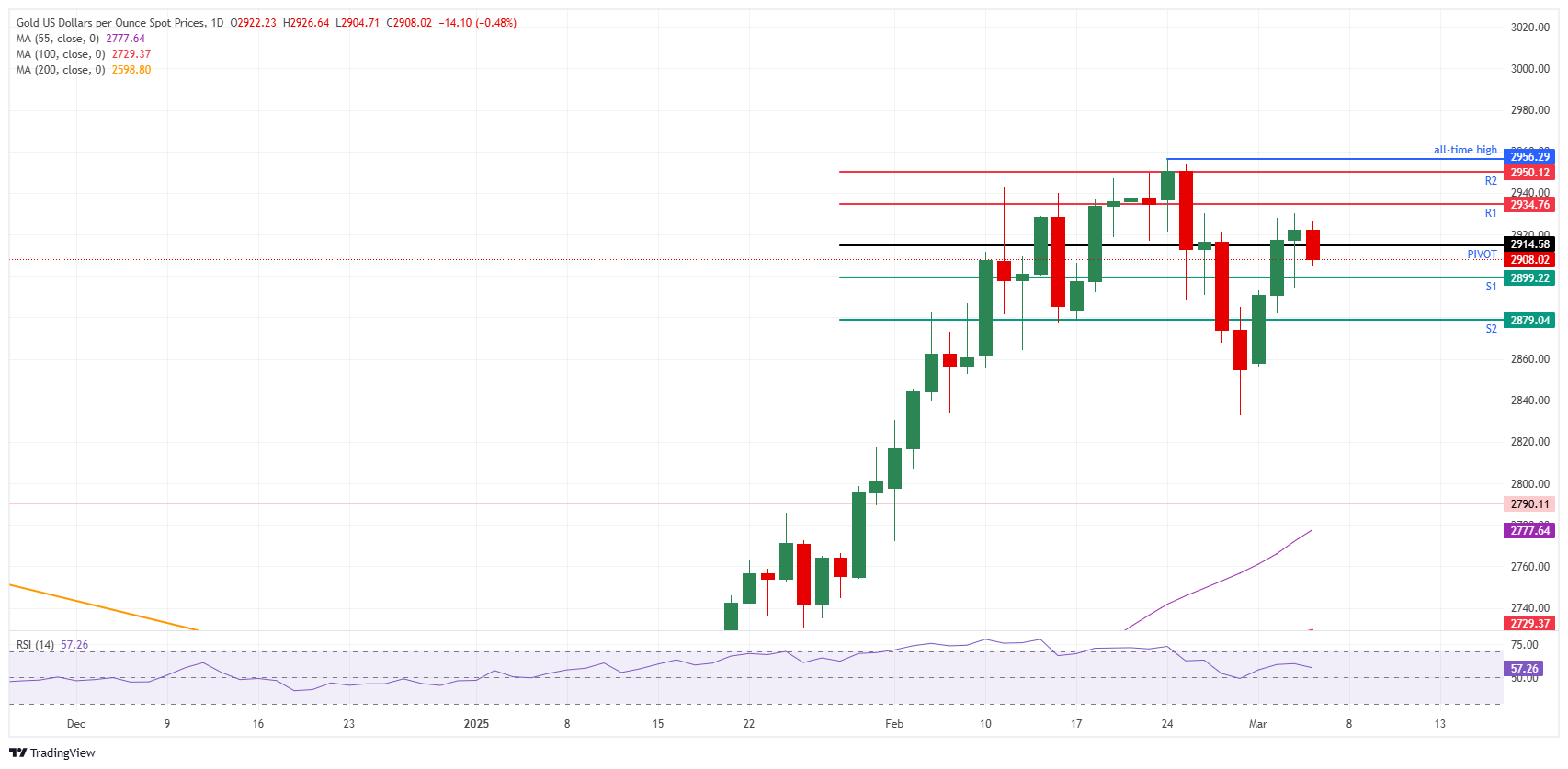

While Gold trades near $2,905 at the time of writing, the daily Pivot Point at $2,914 and the daily R1 resistance at $2,934 are the key levels to watch for on Thursday. In case Gold sees more inflows, the daily R2 resistance at $2,950 will possibly be the final cap ahead of the all-time high of $2,956 reached on February 24.

On the downside, the S1 support at $2,899 acts as a double support with the $2,900 psychological big figure. That will be the vital support for this Thursday. If Bullion bulls want to avoid another leg lower, that level must hold. Further down, the daily S2 support at $2,879 should be able to catch any additional downside pressure.

XAU/USD: Daily Chart

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.