- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 02-04-2018.

| Pare | Closed | % change |

| EUR/USD | $1,2301 | -0,21% |

| GBP/USD | $1,4049 | +0,15% |

| USD/CHF | Chf0,95474 | +0,14% |

| USD/JPY | Y105,84 | -0,39% |

| EUR/JPY | Y130,20 | -0,59% |

| GBP/JPY | Y148,697 | -0,22% |

| AUD/USD | $0,7661 | -0,25% |

| NZD/USD | $0,7212 | -0,27% |

| USD/CAD | C$1,291 | +0,14% |

| Time | Region | Event | Period | Previous | Forecast |

| 00:00 | USA | FOMC Member Kashkari Speaks | | | |

| 01:30 | Australia | AIG Manufacturing Index | March | 57.5 | |

| 02:00 | Australia | MI Inflation Gauge, m/m | March | -0.1% | |

| 02:30 | Australia | ANZ Job Advertisements (MoM) | March | -0.3% | |

| 06:30 | Australia | Announcement of the RBA decision on the discount rate | | 1.5% | 1.5% |

| 06:30 | Australia | RBA Rate Statement | | | |

| 08:00 | Germany | Retail sales, real unadjusted, y/y | February | 2.3% | 2.2% |

| 08:00 | Germany | Retail sales, real adjusted | February | -0.7% | 0.7% |

| 09:15 | Switzerland | Retail Sales (MoM) | February | -0.6% | |

| 09:15 | Switzerland | Retail Sales Y/Y | February | -1.4% | -0.7% |

| 09:30 | Switzerland | Manufacturing PMI | March | 65.5 | 64.3 |

| 09:50 | France | Manufacturing PMI | March | 55.9 | 53.6 |

| 09:55 | Germany | Manufacturing PMI | March | 60.6 | 58.4 |

| 10:00 | Eurozone | Manufacturing PMI | March | 58.6 | 56.6 |

| 10:30 | United Kingdom | Purchasing Manager Index Manufacturing | March | 55.2 | 54.8 |

| 15:30 | USA | FOMC Member Kashkari Speaks | | | |

| 21:00 | USA | Total Vehicle Sales, mln | March | 17.08 | 16.95 |

| 22:30 | USA | FOMC Member Brainard Speaks | | |

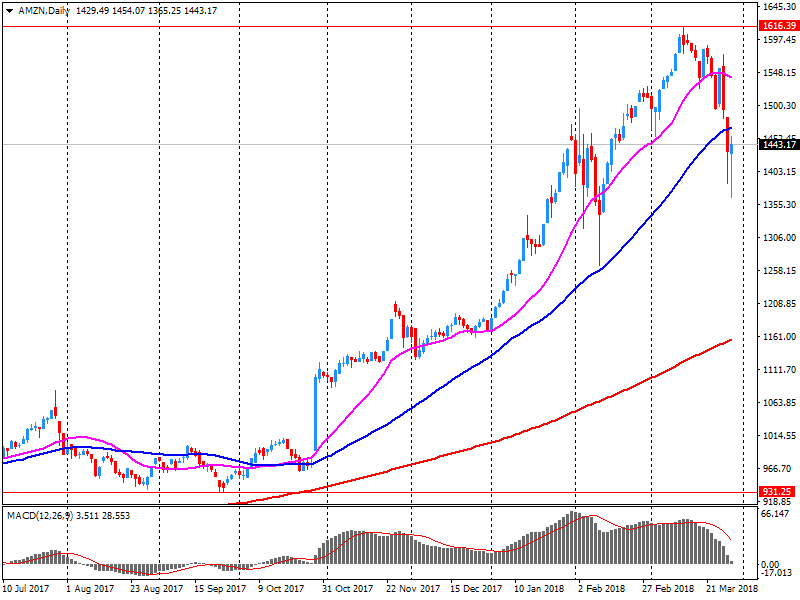

On Saturday, March 31, US President Donald Trump "attacked" Amazon.com Inc. (AMZN) on Twitter, stating that the online retailer "must pay at real rates (and taxes)!"

According to the president, the US postal service loses an average of $ 1.5 on each parcel carried out for Amazon. This together gives a loss of "billions of dollars."

Trump also adds that fraud with the postal service should stop, and Amazon should "pay at real rates (and taxes) now!"

In addition, Donald Trump criticized The Washington Post, which belongs to the founder of Amazon Jeff Bezos, for lobbying the interests of the retailer.

Shares of AMZN in premarket declined to $ 1,423.00 (-1.68%).

Production and total new orders both expanded at the weakest rates for four months, while export sales increased only marginally.

The headline Purchasing Managers' Index (PMI) - a composite indicator designed to provide a singlefigure snapshot of operating conditions in the manufacturing economy - posted 51.0 in March, down from 51.6 in February. Although the reading signalled a further improvement in the health of the sector, the latest upturn was only slight and the weakest recorded since last November.

-

Japan's real effective interest rate is falling as inflation picks up, heightens public inflation expectations

-

Says hands note of protest to British envoy over London's "provocative actions"

-

Has summoned representatives of embassies of Albania. Denmark, Ireland, Spain on friday

EUR/USD

Resistance levels (open interest**, contracts)

$1.2402 (1532)

$1.2383 (2782)

$1.2359 (850)

Price at time of writing this review: $1.2316

Support levels (open interest**, contracts):

$1.2276 (5527)

$1.2237 (3642)

$1.2193 (4445)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date April, 6 is 108872 contracts (according to data from March, 29) with the maximum number of contracts with strike price $1,2150 (6531);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4177 (2401)

$1.4143 (2204)

$1.4095 (2493)

Price at time of writing this review: $1.4039

Support levels (open interest**, contracts):

$1.3963 (1183)

$1.3927 (1153)

$1.3886 (3450)

Comments:

- Overall open interest on the CALL options with the expiration date April, 6 is 30835 contracts, with the maximum number of contracts with strike price $1,4200 (2808);

- Overall open interest on the PUT options with the expiration date April, 6 is 34003 contracts, with the maximum number of contracts with strike price $1,3800 (3570);

- The ratio of PUT/CALL was 1.10 versus 1.02 from the previous trading day according to data from March, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Pare | Closed | % change |

| EUR/USD | $1,2326 | +0,20% |

| GBP/USD | $1,4028 | -0,02% |

| USD/CHF | Chf0,95344 | -0,30% |

| USD/JPY | Y106,26 | -0,20% |

| EUR/JPY | Y130,97 | -0,77% |

| GBP/JPY | Y149,026 | -0,30% |

| AUD/USD | $0,7680 | +0,05% |

| NZD/USD | $0,7232 | +0,01% |

| USD/CAD | C$1,28919 | +0,07% |

| Time | Region | Event | Period | Previous | Forecast |

| 01:50 | Japan | BoJ Tankan. Non-Manufacturing Index | I quarter | 23 | 24 |

| 01:50 | Japan | BoJ Tankan. Manufacturing Index | I quarter | 25 | 25 |

| 02:30 | Japan | Manufacturing PMI | March | 54.1 | 53.2 |

| 03:45 | China | Markit/Caixin Manufacturing PMI | March | 51.6 | 51.7 |

| 15:45 | USA | Manufacturing PMI | March | 55.3 | |

| 16:00 | USA | Construction Spending, m/m | February | 0% | 0.6% |

| 16:00 | USA | ISM Manufacturing | March | 60.8 | 60.0 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.