- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 04-02-2019.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Retail Sales, M/M | December | 0.4% | -0.1% |

| 00:30 | Australia | Trade Balance | December | 1.925 | 2.25 |

| 00:30 | Japan | Nikkei Services PMI | January | 51.0 | |

| 00:30 | U.S. | FOMC Member Mester Speaks | |||

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 1.5% | 1.5% | |

| 03:30 | Australia | RBA Rate Statement | |||

| 08:50 | France | Services PMI | January | 49 | 47.5 |

| 08:55 | Germany | Services PMI | January | 51.8 | 53.1 |

| 09:00 | Eurozone | Services PMI | January | 51.2 | 50.8 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | January | 51.1 | 51 |

| 10:00 | Eurozone | Retail Sales (MoM) | December | 51.1 | -1.6% |

| 10:00 | Eurozone | Retail Sales (YoY) | December | 1.1% | 0.5% |

| 13:30 | Canada | Trade balance, billions | December | -2.06 | |

| 14:45 | U.S. | Services PMI | January | 54.4 | 54.2 |

| 15:00 | U.S. | ISM Non-Manufacturing | January | 58 | 57 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Retail Sales, M/M | December | 0.4% | -0.1% |

| 00:30 | Australia | Trade Balance | December | 1.925 | 2.25 |

| 00:30 | Japan | Nikkei Services PMI | January | 51.0 | |

| 00:30 | U.S. | FOMC Member Mester Speaks | |||

| 03:30 | Australia | Announcement of the RBA decision on the discount rate | 1.5% | 1.5% | |

| 03:30 | Australia | RBA Rate Statement | |||

| 08:50 | France | Services PMI | January | 49 | 47.5 |

| 08:55 | Germany | Services PMI | January | 51.8 | 53.1 |

| 09:00 | Eurozone | Services PMI | January | 51.2 | 50.8 |

| 09:30 | United Kingdom | Purchasing Manager Index Services | January | 51.1 | 51 |

| 10:00 | Eurozone | Retail Sales (MoM) | December | 51.1 | -1.6% |

| 10:00 | Eurozone | Retail Sales (YoY) | December | 1.1% | 0.5% |

| 13:30 | Canada | Trade balance, billions | December | -2.06 | |

| 14:45 | U.S. | Services PMI | January | 54.4 | 54.2 |

| 15:00 | U.S. | ISM Non-Manufacturing | January | 58 | 57 |

The U.S.

Commerce Department reported that the value of new factory orders decreased 0.6

percent m-o-m in November, following an unrevised 2.1 percent m-o-m drop in

October.

Economists

had forecast a 0.2 percent m-o-m advance.

The release

of the report was delayed by 28 days due to the U.S. government shutdown.

According

to the report, orders for durable goods rose by 0.7 percent m-o-m in November,

driven by a gain in orders for transportation equipment (+3.0 percent m-o-m).

Meanwhile, orders for non-durable goods decreased by 1.9 percent m-o-m.

Total factory orders excluding transportation, a volatile part of the overall reading, fell 1.3 percent m-o-m in November (compared to a downwardly revised 0.2 percent m-o-m gain in October), while orders for nondefense capital goods excluding aircraft, a measure of business spending plans, fell 0.6 percent m-o-m (compared to a 0.5 percent m-o-m raise in October).

The report also showed that shipments of core capital goods decreased 0.2 percent m-o-m in November, after increasing 0.8 percent m-o-m in October.

In y-o-y

terms, factory orders grew 7.9 percent in November.

Janus Henderson Investors said Bill Gross, 74, will retire from the investment firm, departing on March 1.

In 1971, the storied investor helped found PIMCO, the largest bond fund manager in the world.

In 2014, he moved on to Janus to manage its Unconstrained Bond Fund. But in the past few years, the fund has suffered a raft of outflows after his fund underperformed its 3-month LIBOR benchmark.

After the retirement, Bill Gross will focus on managing his personal assets and on his private charitable foundation.

Reuters reported the document of Germany’s Finance Ministry it obtained showed that the country is facing a budget shortfall of around 25 billion euros ($28.62 billion) by 2023 as an economic slowdown means tax revenues will come in below previous forecasts.

The German government last month lowered its growth estimate for this year to 1.0 percent from 1.8 percent previously.

The governmental document pointed to further risks for the budget, including costs related to exiting coal power.

According

to Theresa May's official spokesperson James Slack:

- May will

speak about the UK’s commitments on Northern Irish border on Tuesday;

- The UK

government wants to conclude work on backstop urgently;

- Insists

that PM has been clear she will not revoke Article 50;

- Aims to

bring back a Brexit deal to the UK parliament as soon as possible;

- Rules out

calling for a general election.

Newspaper Bild said on Sunday that Germany could face a 25 billion euro budget shortfall by 2023 due to expected fall in tax revenues and increase in public sector wages, citing an internal government document.

When asked about the report that Germany could face a budget shortfall in the coming years, a spokeswoman for the Germany’s Finance Ministry said on Monday that economic slowdown is having an impact on tax revenues in the country.

Britain’s Financial Conduct Authority said, managers of four trillion pounds in assets must clearly spell out their investment objectives to customers and explain why they use a benchmark to measure performance.

The FCA published a set of new rules for asset managers, saying its review of the market found “weak price competition” leading to lower returns for savers.

It was the second batch of remedies or rule changes following publication of its market study into asset management in November 2015 to improve “value for money” for investors in funds that have been accused of being opaque regarding fees and charges.

The latest batch require fund managers to clarify how performance of the fund is measured, and show that where a performance fee is specified, it must be calculated based on the scheme’s performance after the deduction of all other fees.

Japanese Prime Minister Shinzo Abe said that Japan wants a stable, democratic and prompt solution to the Venezuela situation shortly after France said it recognised national assembly president Juan Guaido as the country's interim leader.

We Need To Know From Britain What It Envisages

We Do Not Want To Reopen The Withdrawal Agreement On Brexit

Wants To Do All We Can To Ensure There Is Not A No Deal Brexit

According to preliminary estimates from Istat, in January 2019 the Italian consumer price index for the whole nation (NIC) increased by 0.1% on monthly basis and by 0.9% with respect to January 2018, down from +1.1% in the previous month.

Core inflation excluding energy and unprocessed food was +0.5% (in deceleration from +0.6%) and inflation excluding energy was +0.6% (stable compared to the previous month).

The increase on monthly basis of All items index was especially due to prices of Unprocessed food (+1.3%), only partially offset by the decrease of Non-regulated energy products (-1.2%) and of Services related to transport (-1.4%), the latter mainly due to seasonal factors.

In January 2019, according to preliminary estimates, the Italian harmonized index of consumer prices (HICP) decreased by 1.7% compared with the previous month, mainly due to the winter sales of Clothing and footwear (-21.2% compared with December 2018), which are not taken into account in the national index NIC. The HICP increased by +0.9% with respect to January 2018 (it was +1.2% in December 2018).

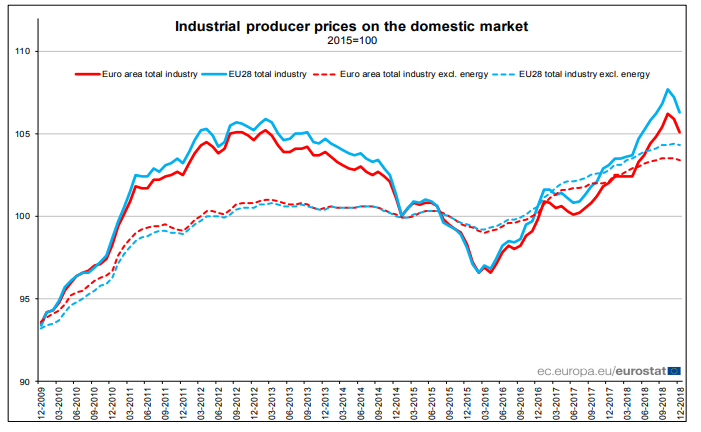

According to estimates from Eurostat, in December 2018, compared with November 2018, industrial producer prices fell by 0.8% in both the euro area (EA19) and the EU28. In November 2018, prices decreased by 0.3% in the euro area and by 0.5% in the EU28. In December 2018, compared with December 2017, industrial producer prices rose by 3.0% in the euro area and by 3.1% in the EU28.

Average industrial producer prices for the year 2018, compared with 2017, increased by 3.2% in the euro area and by 3.6% in the EU28.

Industrial producer prices in the euro area in December 2018, compared with November 2018, fell by 2.6% in the energy sector and by 0.4% for intermediate goods, while prices remained stable for non-durable consumer goods and increased by 0.1% for capital goods and by 0.2% for durable consumer goods. Prices in total industry excluding energy fell by 0.1%.

In the EU28, industrial producer prices fell by 3.3% in the energy sector and by 0.3% for intermediate goods, while prices remained stable for capital goods and rose by 0.1% for both durable and non-durable consumer goods. Prices in total industry excluding energy fell by 0.1%.

The sentix economic index drops to only +3.1 points for the sixth time in a row. This is the lowest level since November 2014. It was expected that the index will rise to -1.1 compared with -1.5 in January. The sentix indices are performing similarly to the recent ifo index: with slightly improved expectations, the situation values continue to collapse. Things are looking a little better internationally. The overall indices may improve slightly here. But this is not enough to proclaim a turnaround.

The report also reflected a renewed decline of the sentix overall economic index for the Euro zone by 3 points to +3.1. The situation values, with their sixth decline as well, are primarily responsible for this.

The situation in Germany is no different: the overall index and the current situation are declining for the fourth time. The loss of momentum remains remarkable.

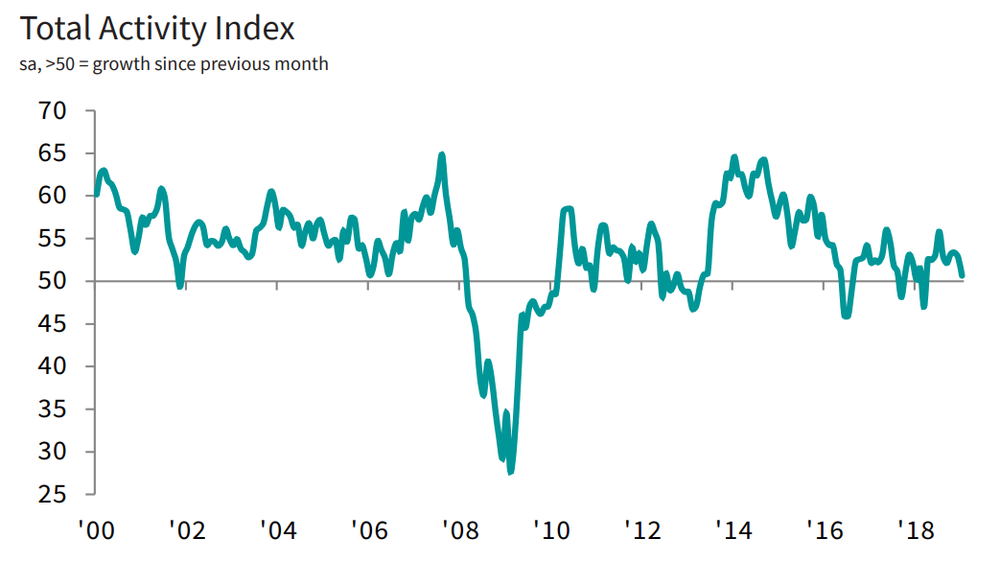

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index dropped to 50.6 in January, from 52.8 in December. The index has posted above the 50.0 no-change mark in each month since the snow related decline seen in March 2018, but the latest expansion was the weakest seen over this ten month period of growth.

According to the report, all three categories of construction output - residential work, civil engineering activity, сommercial work - recorded weaker trends than those reported in December.New business growth eased to an eight-month low in January. Construction firms widely commented on softer demand conditions and longer sales conversion times, reflecting a wait-and-see approach to spending by clients.

Meanwhile, slower growth of input buying helped to reduce pressure on construction supply chains in January. The latest deterioration in vendor performance was the joint-weakest since September 2016. Input price inflation continued to moderate in January, with average cost burdens rising at the slowest pace since June 2016. Where an increase in purchasing costs was reported, this was generally linked to rising prices for imported construction products and materials.

Construction firms remain positive about the outlook for business activity in 2019. Around 41% of the survey panel anticipate a rise in output, while only 16% forecast a fall. However, the resulting index signalled a moderation in optimism since December.

We will see an increase in core CPI

ECB is data-driven

The European Central Bank should have a bigger say in how the euro zone fights financial bubbles, ECB director Yves Mersch said on Monday.

"The best solution is to integrate financial stability concerns into monetary policy at the European level – including possible corrections with instruments at national levels", told Mersch.

French Foreign Minister Jean-Yves Le Drian said that Italy - which has been engaged in diplomatic clashes with France of late - could be accommodating when faced with important matters such as its economy and immigration.

“When we arrive at a moment when action is needed, Italy can bend,” told Le Drian.

In January 2019 registered unemployment in the offices of the Public Employment Services has been reduced by 190,767 people with respect to the same month of the previous year, with a year-on-year reduction rate of 5.49%. The number of unemployed registered in the month of January 2019 has risen by 83,464 in relation to the previous month. In relative values, the increase in unemployment is 2.61%. Thus, the total number of unemployed stands at 3,285,761. In January 2018 unemployment rose by 63,747 unemployed in relation to the previous month.

In seasonally adjusted terms, unemployment rises by 3,292 people.

Male unemployment stood at 1,360,448 people, increasing by 23,204 (1.74%) and female unemployment by 1,925,313, increasing by 60,260 (3.23%) in relation to the month of December. If we compare it with January 2018, male unemployment falls by 115,031 (-7.8%) people, and female unemployment drops by 75,736 (-3.78%).

China's central bank has set up an institution to improve financial regulation and risk prevention, the office of public sectors reform commission said in a statement Saturday.

According to the statement, The People's Bank of China (PBOC) has established a macro-prudential management bureau to replace the previous foreign exchange department.

The bureau will be responsible to formulate macro-prudential policies, assess financial agencies, draft rules and regulations, and monitor financial risks.

It will also shoulder foreign exchange department duties, such as assessing foreign exchange policies and promoting the yuan's cross-border transactions.

Establishing the bureau is a crucial measure in the country's strategy of building a two-pillar framework consisting of monetary policy and macro-prudential assessment, said Yin Zhentao, a researcher with the Chinese Academy of Social Sciences.

China's economic slowdown is weighing on corporate earnings across Asia and around the world as businesses and consumers tighten their purse strings in a vital market.

Nikkei tallied earnings and analyst forecasts for the October-December quarter for leading companies in the U.S., Europe, China, Japan and the rest of Asia. China suffered a particularly sharp slowdown, with sales slumping roughly 30% on the year. Net profit sank 9%, marking the first decline on a quarterly basis in two years and the largest drop since April-June 2016.

China's troubles have rippled out to hit surrounding Asian markets. Net profit slumped 9% at Japanese companies and 18% at businesses in Asia excluding China and Japan.

Statistics New Zealand said, the total number of building permits issued in New Zealand advanced a seasonally adjusted 5.1 percent on month in December, standing at 2,382. That following the upwardly revised 1.9 percent decline in November (originally -2.0 percent).

In the year ended December 2018, the actual number of new dwellings consented was 32,996, up 6.1 percent from the December 2017 year.

The annual value of non-residential building work consented was NZ$7.1 billion, up 9.0 percent from the December 2017 year.

New dwelling consents

In December 2018, 2,382 new dwellings were consented:

1,492 stand-alone houses

451 townhouses, flats, and units

273 apartments.

166 retirement village units.

For stand-alone houses only, the seasonally adjusted number fell 3.2 percent, after rising 1.4 percent in November and 6.0 percent in October.

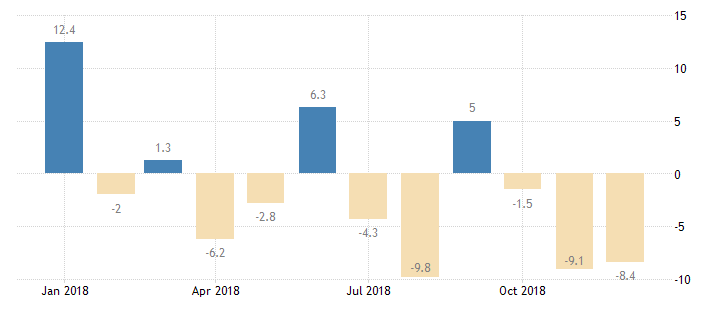

The Australian Bureau of Statistics said, the total number of building approvals issued in Australia was down a seasonally adjusted 8.4% on month in December, coming in at 13,995. That missed forecast for an decrease of 0.5% following the 9.8% decline in November.

On a yearly basis, building approvals tumbled 22.5% - again missing expectations for a fall of 10.9% following the 32.8% plummet in the previous month.

TOTAL DWELLING UNITS

The trend estimate for total dwellings approved fell 4.1% in December.

The seasonally adjusted estimate for total dwellings approved fell 8.4% in December.

PRIVATE SECTOR HOUSES

The trend estimate for private sector houses approved fell 1.1% in December.

The seasonally adjusted estimate for private sector houses fell 2.2% in December.

PRIVATE SECTOR DWELLINGS EXCLUDING HOUSES

The trend estimate for private sector dwellings excluding houses fell 8.5% in December.

The seasonally adjusted estimate for private sector dwellings excluding houses fell 18.8% in December.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1565 (3484 )

$1.1535 (3321)

$1.1507 (582)

Price at time of writing this review: $1.1443

Support levels (open interest**, contracts):

$1.1435 (3229)

$1.1394 (3694)

$1.1348 (4003)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 8 is 70814 contracts (according to data from February, 1) with the maximum number of contracts with strike price $1,1500 (4707);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3188 (1372)

$1.3162 (1767)

$1.3131 (1929)

Price at time of writing this review: $1.3075

Support levels (open interest**, contracts):

$1.3019 (312)

$1.2981 (654)

$1.2939 (265)

Comments:

- Overall open interest on the CALL options with the expiration date February, 8 is 24305 contracts, with the maximum number of contracts with strike price $1,3000 (1929);

- Overall open interest on the PUT options with the expiration date February, 8 is 24749 contracts, with the maximum number of contracts with strike price $1,2550 (1900);

- The ratio of PUT/CALL was 1.02 versus 1.21 from the previous trading day according to data from February, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.725 | -0.33 |

| EURJPY | 125.481 | 0.7 |

| EURUSD | 1.14585 | 0.1 |

| GBPJPY | 143.238 | 0.38 |

| GBPUSD | 1.30801 | -0.22 |

| NZDUSD | 0.68989 | -0.27 |

| USDCAD | 1.30854 | -0.28 |

| USDCHF | 0.99529 | 0.11 |

| USDJPY | 109.504 | 0.6 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.