- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 05-02-2019.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | RBA's Governor Philip Lowe Speaks | |||

| 02:00 | U.S. | President Trump Speaks | |||

| 07:00 | Germany | Factory Orders s.a. (MoM) | December | -1.0% | 0.3% |

| 13:15 | Canada | Housing Starts | January | 213.4 | 202 |

| 13:30 | Canada | Building Permits (MoM) | December | 2.6% | -1.0% |

| 13:30 | U.S. | Unit Labor Costs, q/q | Quarter IV | 0.9% | 1.7% |

| 13:30 | U.S. | Nonfarm Productivity, q/q | Quarter IV | 2.3% | 1.7% |

| 13:30 | U.S. | International Trade, bln | November | -55.5 | -54 |

| 13:35 | Canada | Gov Council Member Lane Speaks | |||

| 15:00 | Canada | Ivey Purchasing Managers Index | January | 59.7 | 56 |

| 15:30 | U.S. | Crude Oil Inventories | February | 0.919 | 1.601 |

| 21:45 | New Zealand | Unemployment Rate | Quarter IV | 3.9% | 4.1% |

| 21:45 | New Zealand | Employment Change, q/q | Quarter IV | 1.1% | 0.3% |

| 22:30 | Australia | AiG Performance of Construction Index | January | 42.6 | |

| 23:05 | U.S. | FOMC Member Quarles Speaks |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | RBA's Governor Philip Lowe Speaks | |||

| 02:00 | U.S. | President Trump Speaks | |||

| 07:00 | Germany | Factory Orders s.a. (MoM) | December | -1.0% | 0.3% |

| 13:15 | Canada | Housing Starts | January | 213.4 | 202 |

| 13:30 | Canada | Building Permits (MoM) | December | 2.6% | -1.0% |

| 13:30 | U.S. | Unit Labor Costs, q/q | Quarter IV | 0.9% | 1.7% |

| 13:30 | U.S. | Nonfarm Productivity, q/q | Quarter IV | 2.3% | 1.7% |

| 13:30 | U.S. | International Trade, bln | November | -55.5 | -54 |

| 13:35 | Canada | Gov Council Member Lane Speaks | |||

| 15:00 | Canada | Ivey Purchasing Managers Index | January | 59.7 | 56 |

| 15:30 | U.S. | Crude Oil Inventories | February | 0.919 | 1.601 |

| 21:45 | New Zealand | Unemployment Rate | Quarter IV | 3.9% | 4.1% |

| 21:45 | New Zealand | Employment Change, q/q | Quarter IV | 1.1% | 0.3% |

| 22:30 | Australia | AiG Performance of Construction Index | January | 42.6 | |

| 23:05 | U.S. | FOMC Member Quarles Speaks |

The

Institute for Supply Management (ISM) reported its non-manufacturing index

(NMI) came in at 56.7 in January, which was 1.3 percentage points lower than

the December 2018 reading of 58.0 percent. This pointed to continued growth in

the non-manufacturing sector at a slower rate.

Economists

forecast the index to decrease to 57.2 last month. A reading above 50 signals

expansion, while a reading below 50 indicates contraction.

Of the 18

manufacturing industries, 11 reported growth last month, the ISM said.

According

to the report, the ISM’s non-manufacturing business activity measure dropped to

59.7 percent, 1.5 percentage points lower than the December reading of 61.2

percent. That reflected growth for the 114th consecutive month, at a slower

pace in January. The new orders gauge decreased to 57.7 percent, 5 percentage

points lower than the reading of 62.7 percent in December. Meanwhile, the

employment indicator rose 1.2 percentage points in January to 57.8 percent from

the December reading of 56.6 percent. The Prices Index increased 1.4 percentage

points from the December reading of 58 percent to 59.4 percent, indicating that

prices increased in January for the 20th consecutive month.

Commenting

on the data, the Chair of the ISM Non-Manufacturing Business Survey Committee,

Anthony Nieves, noted, "The past relationship between the NMI and the

overall economy indicates that the NMI for January (56.7 percent) corresponds

to a 2.8-percent increase in real gross domestic product (GDP) on an annualized

basis.”

Final data

released by IHS Markit showed activity growth in the U.S. services sector improved

at the slowest rate for four months.

The

seasonally adjusted IHS Markit final U.S. Services Purchasing Managers’ Index

(PMI) posted 54.2 in January, down slightly from 54.4 in December 2018. The

rate of expansion was the softest for four months and weaker than both the

series trend and the average seen in 2018.

Economists

had expected the reading to come in at 54.2.

A reading

above 50 signals an expansion in activity, while a reading below this level

signals a contraction.

According

to the report, the rise in output was also the slowest for four months, amid

one of the softest increases in new business since October 2017. In line

with a slower increase in new business, employment growth eased to the

second-weakest since June 2017. However, firms registered a stronger degree of

confidence towards business activity levels over the coming 12 months. On the

price front, price pressures eased in January, with the rate of input price

inflation weakening to a 22-month low. The increase in cost burdens was also

slower than the series trend but solid overall.

A report released by the UN Conference on Trade and Development (UNCTAD) on Monday outlined the potential impact of increased tariffs between the U.S. and China.

According to the UN report, continuing or hiking tariffs between the U.S. and China would have an unavoidable impact on the "still fragile" global economy, including disturbances in commodities, financial markets and currencies.

"One major concern is the risk that trade tensions could spiral into currency wars, making dollar-denominated debt more difficult to service," the report said. "Another worry is that more countries may join the fray and that protectionist policies could escalate to a global level."

It was also noted that protectionist policies generally hurt weaker economies the most, while tit-for-tat steps of the trade giants would have a domino effect beyond their domestic markets.

"Tariff increases penalize not only the assembler of a product but also suppliers along the chain," the report said.

According to the latest headlines floating on the wires, European Commission President Jean-Claude Juncker will meet with British Prime Minister Theresa May later this week.

The spokesman for the bloc’s executive, Margaritis Schinas, said the meeting will be held in Brussels on Thursday, adding that the EU wants to hear what May plans to do on Brexit.

“The European Union’s position is clear,” Margaritis Schinase said. “We are expecting, waiting once again to hear what the prime minister has to tell us.”

Germany could take stakes in companies to prevent foreign takeovers in some key technology areas, Economy Minister Peter Altmaier said on Tuesday.

"It can go as far as the state taking temporary stakes in companies - not to nationalise them and run them in the long run but to prevent key technologies being sold off and leaving the country", Altmaier said.

In a speech to industrialists, Juncker said the Commission had only ever blocked 30 mergers and approved more than 6,000.

“This is a message for those who are saying that the Commission is composed (of) stubborn technocrats. This shows that we believe in competition as long as it is fair for all. We will never play politics or play favorites when it comes to ensuring a level playing field.” he said.

Сomment seemingly aimed at complaints in France and Germany over its expected rejection of a merger between Siemens’ and Alstom’s rail businesses.

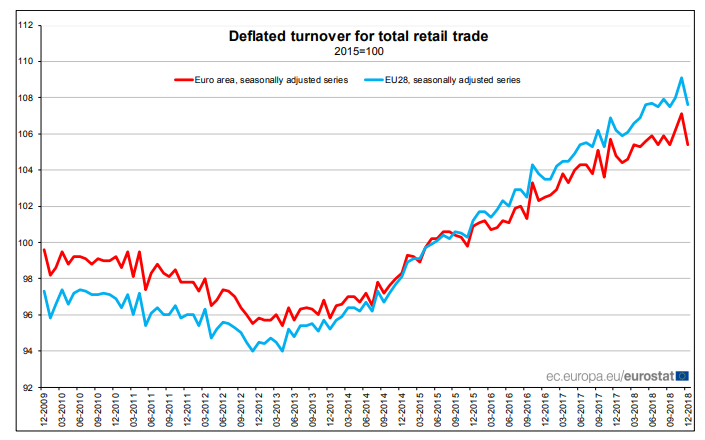

According to estimates from Eurostat, in December 2018 compared with November 2018, the seasonally adjusted volume of retail trade decreased by 1.6% in the euro area (EA19) and by 1.4% in the EU28. In November, the retail trade volume increased by 0.8% in the euro area and by 1.0% in the EU28.

In December 2018 compared with December 2017 the calendar adjusted retail sales index increased by 0.8% in the euro area and by 1.2% in the EU28.

The average retail trade for the year 2018, compared with 2017, rose by 1.4% in the euro area and by 2.0% in EU28.

In the euro area in December 2018, compared with November 2018, the volume of retail trade fell by 2.7% for nonfood products and by 0.3% for food, drinks and tobacco, while it increased by 0.5% for automotive fuel. In the EU28, the retail trade volume fell by 2.6% non-food products and by 0.4% for foods, drinks and tobacco, while it increased by 0.7% for automotive fuel.

In the euro area in December 2018, compared with December 2017, the volume of retail trade increased by 2.5% for automotive fuels, by 0.7% for food, drinks and tobacco and by 0.5% for non-food products. In the EU28, the retail trade volume increased by 3.3% for automotive fuel, by 1.2% for non-food products, and by 0.6% for food, drinks and tobacco.

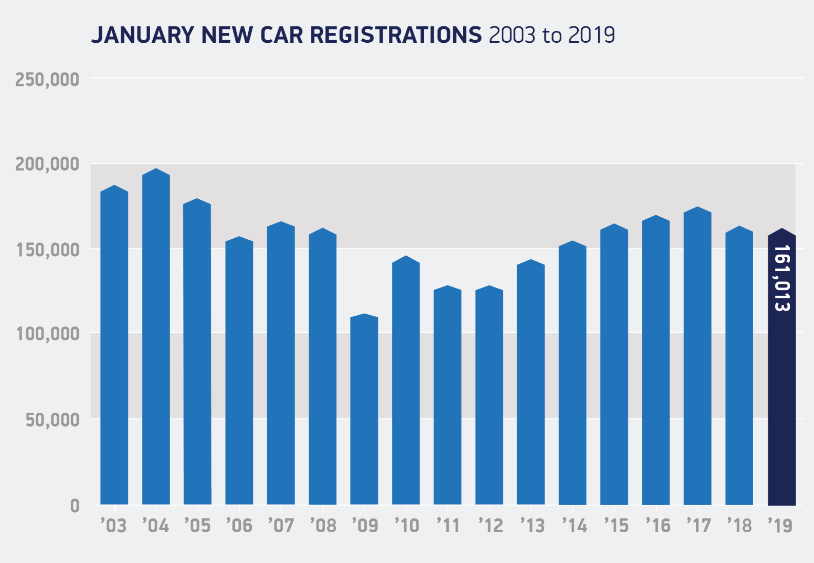

According to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT), the UK’s new car market dipped 1.6% in January. 161,013 new cars were registered for use on UK roads, with trends in fuel choice seen last year continuing in the first month of 2019.

Following a decline in December, private buyers returned to showrooms – up 2.9% – registering 71,378 models in the month. Conversely, demand from business and fleet buyers fell by -33.5% and -3.4% respectively.

Meanwhile, appetite for alternatively fuelled vehicles grew 26.3%, resulting in a total 6.8% market share. The performance supports the latest forecast for this sector, currently expected to rise more than a quarter by the end of 2019 to around 177,000 units.

Petrol demand also grew in January, up 7.3%, but this was not enough to offset another month of decline for diesel, as registrations fell 20.3%.

January data indicated a renewed loss of momentum for the UK service sector, with a decline in incoming new work reported for the first time since July 2016.

At 50.1 in January, the headline seasonally adjusted IHS Markit/CIPS UK Services PMI Business Activity Index was down from 51.2 in December. The latest reading was the lowest for two-and-a-half years and the second-weakest since December 2012.

Survey respondents overwhelmingly linked the slowdown in business activity growth to heightened political uncertainty at the start of 2019. New business volumes declined for the first time in two and-a-half years during January, although the rate of contraction was only modest. Political uncertainty was the most commonly cited reason for lower new orders. Backlogs of work decreased for the fourth month running in January, which pointed to reduced pressure on business capacity and a lack of new orders to replace completed projects. Meanwhile, service providers reported more cautious staff hiring strategies in response to subdued demand and heightened uncertainty about the economic outlook.

Despite softer demand for staff, service sector firms continued to cite higher salary payments as a key factor driving up input costs during January. The overall rate of input cost inflation edged up to a three-month high.

Optimism towards the year ahead outlook for business activity rebounded slightly from December's 29-month low. That said, the latest reading was still one of the lowest seen since early 2009.

After the release of the data, the pound fell against major currencies, while the GBP / USD reached January 24 low.

The IHS Markit Eurozone PMI Composite Output Index edged lower in January, falling for a fifth successive month to register its lowest level for five-and-a-half years.

After accounting for seasonal factors, the index recorded 51.0 in January, a little better than the earlier flash estimate of 50.7 but still down from 51.1 in December and signalling only weak growth in business activity.

Activity weakness was principally centered on France and Italy. Output in France was down for a second successive month, and at the fastest rate in over four years. Meanwhile, Italian private sector output deteriorated for the third time in four months and to the greatest degree in over five years.

The IHS Markit Eurozone PMI Services Business Activity Index was unmoved on December’s 49-month low of 51.2 at the start of the year.

France and Italy remained the primary sources of weakness, with both countries registering declines in activity during January. This was in stark contrast to Germany and Spain, where growth of activity improved in each case.

The headline seasonally adjusted IHS Markit Germany Services PMI Business Activity Index ticked up in January for the first time in four months, signalling a more solid rate of growth than at the end of 2018. However, at 53.0, from 51.8 in December, the latest reading was still the second-lowest in the past eight months and below the average recorded since the current upturn began in mid-2013 (54.2).

Inflows of new business at service providers eased closer to stagnation in January, rising only marginally and at the slowest rate for over three-and-a-half years. With business activity growing more quickly than incoming new work in January, service providers recorded a further decrease in backlogs during the month. It marked the first back-to-back falls since the spring of 2017.Furthermore, the rate at which outstanding business decreased was the most marked since May 2016. January saw the rate of employment growth across Germany's service sector ease for the fourth straight month to the slowest since last May.

On the price front, January's survey indicated a steep rise in service sector output charges that was the strongest in three months. Wage pressures were also widely mentioned, with services firms' overall operating expenses rising to the greatest extent since March 2011.

Looking ahead, service providers reported slightly stronger optimism towards the outlook for activity over the next 12 months.

The current backstop is 'toxic'

Backstop would divide UK on trade

Backstop must be replaced

Have raised opposition to backstop repeatedly with Theresa May

Will support May if the backstop is replaced/removed

Says that DUP wants a Brexit deal but with no backstop

According to the report from IHS Markit, the headline Business Activity Index rose to 54.7 in January from 54.0 in December. The latest reading signalled a marked monthly rise in activity that was the greatest since June last year. Services activity has now increased in each of the past 63 months, with panellists linking the latest rise to higher new orders.

The Transport & Storage sector again posted the sharpest increase in activity of the broad sectors covered by the survey, with only Hotels & Restaurants signalling a reduction. Although new business continued to expand in January, the rate of expansion eased to a 25-month low. New export orders decreased for the sixth successive month, albeit marginally. Outstanding business rose only fractionally at the start of 2019, with the latest accumulation the weakest in the current nine-month sequence of increasing backlogs. Service providers increased their staffing levels at a sharp and accelerated pace amid rising demand and the securing of new clients. The rate of job creation was the fastest since July last year. Companies took on extra staff amid improving sentiment regarding the 12-month outlook for activity.

Input costs continued to rise at a sharp pace in January, and one that was above the series average. This was despite the rate of inflation softening to a four-month low. Where input prices increased, panellists often linked this to higher staff costs. Service providers responded to increases in input costs by raising their output prices accordingly. Charges were up for the ninth month running, and to the greatest extent since March 2018.

Accounting firm Deloitte said, construction activity in four regional cities in Britain is at a record high, including a flurry of building projects in Manchester, despite uncertainty about Brexit/

Deloitte said its Real Estate Crane Survey, covering Leeds, Birmingham, Manchester and Belfast, showed sustained or increased activity across sectors including offices, hotels, retail, education and student housing.

"To have construction figures this healthy is somewhat of a surprise given a myriad of market uncertainties," Deloitte Real Estate partner and regional head Simon Bedford said.

The White House is expected to begin releasing the president's fiscal year 2020 budget proposal on March 11, about a month later than usual due to the partial government shutdown.

Administration officials have told lawmakers the proposal will be unveiled in two parts. The president's budget message, top priorities, and summary tables will come March 11. The remaining materials, including proposed spending cuts, detailed budgets for each agency. and the analytic perspectives document, including the economic assumptions underlying the plan, will be released the following week.

It is important to know what British side wants exactly

Finding a solution on backstop will depend on the type of trade agreement forged

Low rates supporting economy

Progress on unemployment, inflation expected to be gradual

Central scenario for gdp growth to average around 3 pct this year

Central scenario for gdp growth to slow in 2020 due to weaker resource exports

Inflation remains low and stable

Central scenario for inflation 2 percent in 2019, and 2.25 pct in 2020

Household consumption remains a source of uncertainty

Main domestic uncertainty remains around household spending, effect of falling house prices

Consumption data have been volatile

Growth in household income expected to pick up and support spending

Labour market remains strong

Wage growth to pick up gradually over time

Further fall in unemployment rate to 4.75 pct expected

Gdp growth in september quarter was weaker than expected

Credit conditions for some borrowers are tighter than they have been

Global economy slowed in second half of 2018, downside risks have increased

Seeing some signs of slowdown in global trade, partly stemming from trade tensions

Australian dollar has remained within the narrow range of recent times

Australia's terms of trade have increased, expected to decline over time

According to the Australian Bureau of Statistics (ABS), Australia posted a seasonally adjusted merchandise trade surplus of A$3.681 billion in December. That exceeded expectations for a surplus of A$2.225 billion and was up sharply from the A$2.256 billion surplus in November.

In trend terms, the balance on goods and services was a surplus of $2,796m in December 2018, an increase of $131m on the surplus in November 2018.

In seasonally adjusted terms, goods and services credits fell $634m (2%) to $37,924m. Non-monetary gold fell $1,034m (57%) and net exports of goods under merchanting fell $1m (3%). Rural goods rose $353m (10%) and non-rural goods rose $33m. Services credits rose $16m.

In seasonally adjusted terms, goods and services debits fell $2,058m (6%) to $34,244m. Capital goods fell $1,070m (15%), intermediate and other merchandise goods fell $717m (6%) and consumption goods fell $653m (7%). Non-monetary gold rose $161m (45%). Services debits rose $222m (3%).

In original terms, the balance on goods and services for 2018 was a surplus of A$22.2b, an increase of A$12.7b on the surplus of A$9.5b recorded in 2017, resulting from a A$51.1b (13%) increase in goods and services credits and a $38.4b (10%) increase in goods and services debits.

The Australian Bureau of Statistics said, the total value of retail sales in Australia was down a seasonally adjusted 0.4% on month in December. This follows a rise of 0.5% in November 2018. Sales were expected to decline 0.1%.

The trend estimate rose 0.2% in December 2018. This follows a rise of 0.2% in November 2018 and a rise of 0.2% in October 2018.

In trend terms, Australian turnover rose 3.2% in December 2018 compared with December 2017.

The following industries rose in trend terms in December 2018: Food retailing (0.2%), Clothing, footwear and personal accessory retailing (0.3%), Other retailing (0.1%), Cafes restaurants and takeaway food services (0.1%), and Department stores (0.1%). Household goods retailing was relatively unchanged (0.0%).

In volume terms, the trend estimate for Australian turnover rose 0.3% in the December quarter 2018.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1556 (3439 )

$1.1518 (3383)

$1.1493 (3491)

Price at time of writing this review: $1.1431

Support levels (open interest**, contracts):

$1.1392 (3854)

$1.1347 (3998)

$1.1299 (2765)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 8 is 70597 contracts (according to data from February, 4) with the maximum number of contracts with strike price $1,1500 (4693);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3137 (1767)

$1.3096 (1930)

$1.3075 (1206)

Price at time of writing this review: $1.3040

Support levels (open interest**, contracts):

$1.2976 (670)

$1.2936 (266)

$1.2892 (457)

Comments:

- Overall open interest on the CALL options with the expiration date February, 8 is 24136 contracts, with the maximum number of contracts with strike price $1,3000 (1930);

- Overall open interest on the PUT options with the expiration date February, 8 is 24807 contracts, with the maximum number of contracts with strike price $1,2550 (1900);

- The ratio of PUT/CALL was 1.03 versus 1.02 from the previous trading day according to data from February, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.72245 | -0.34 |

| EURJPY | 125.674 | 0.16 |

| EURUSD | 1.14348 | -0.2 |

| GBPJPY | 143.275 | 0.04 |

| GBPUSD | 1.3037 | -0.31 |

| NZDUSD | 0.68834 | -0.21 |

| USDCAD | 1.31103 | 0.18 |

| USDCHF | 0.99783 | 0.26 |

| USDJPY | 109.897 | 0.36 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.