- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 11-01-2012.

The euro weakened to a 16-month low versus the dollar and dropped for the first time in three days against the yen amid speculation France’s credit rating may be downgraded and Europe’s sovereign debt crisis will worsen. The shared currency declined against 14 of its 16 most- traded peers even after French Finance Minister Francois Baroin denied having been notified by a ratings company that the nation’s top rating will be cut. The euro extended losses as leading members of the European Parliament objected to a planned German-led euro fiscal treaty.

Sterling was the worst performer against the dollar after data showed the U.K. trade deficit increased more than forecast. British retail-store inflation also slowed to the least in 16 months, fueling bets the Bank of England will need to add stimulus to aid the economy.

The pound dropped 1 percent to $1.5329 and fell 0.3 percent to 82.76 pence per euro.

The U.S. currency rose against most of its major peers as investors sought the safety of Treasuries. Yields on 10-year notes dropped to the lowest level in two days, 1.92 percent.

The Dollar Index (DXY), which IntercontinentalExchange Inc. uses to track the greenback against the currencies of six major U.S. trading partners, gained as much as 0.7 percent to 81.493, approaching Jan. 9’s 81.503, the highest since September 2010.

EUR/USD $1.2500, $1.2825, $1.2850, $1.2875, $1.2920

USD/JPY Y76.00

AUD/USD $1.0400, $1.0175, $1.0150

GBP/USD $1.5620

09:30 United Kingdom Trade in goods November -7.6 -8.2 -8.6

The euro weakened as Fitch Ratings added to concern the region’s debt crisis will spread, reducing demand for the 17-nation currency.

The euro declined against after Fitch’s head of sovereign ratings David Riley said the European Central Bank should boost bond purchases to combat the debt crisis and prevent a collapse of the shared currency. The euro also depreciated after a German report showed the region’s largest economy may be on the brink of recession.

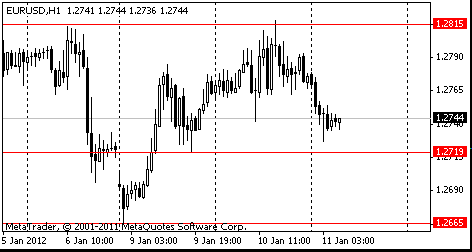

EUR/USD: the pair decreased, showed low below $1,2700.

At 1340GMT, Chicago Fed President Charles Evans speaks to the Rotary Club of Lake Forest and Lake Bluff, while at 1400GMT, Atlanta Fed President Dennis Lockhart delivers a speech on the economic outlook to the Georgia Center for Nonprofits in Atlanta.

EUR/USD

Offers $1.2800, $1.2750, $1.2720/25

Bids $1.2675/65, $1.2650, $1.2640, $1.2625/20, $1.2600, $1.2580

Resistance 3: Y77.60 (61,8 % FIBO Y78,20-Y76,60)

Resistance 2: Y77.35/40 (Jan 6 high, 50,0 % FIBO Y78,20-Y76,60)

Resistance 1: Y77.05 (session high)

Current price: Y76.93

Support 1:Y76.80 (support line from Jan 4)

Support 2:Y76.55 (lows of November and January)

Support 3:Y76.10 (Sep 22 low)

Resistance 3: Chf0.9780 (high of 2011)

Resistance 2: Chf0.9600 (area of Jan 9 high)

Resistance 1: Chf0.9560 (session high)

Current price: Chf0.9537

Support 1: Chf0.9520 (area of asian session high)

Support 2: Chf0.9480 (session low)

Support 3: Chf0.9465/50 (area of Dec 29, Jan 4 highs, МА (200) for Н1 and Jan 10 low)

- Hungary's deficit cutting measures are insufficient;

- to recommend new deficit cutting moves for Hungary;

- will pronounce on hungary's central bank law Jan 17;

- hope Hungary will reconsider central bank law;

- expect Spain to tackle labour market problems.

Resistance 2 : $1.5445 (low of asian session)

Resistance 1 : $1.5420 (earlier resistance, area of Jan 9 american session low)

Current price: $1.5390

Support 1 : $1.5375/60 (area of December and Jan 6 lows and session low)

Support 2 : $1.5300 (psychological level)

Support 3 : $1.5270 (low of 2011)

Resistance 3: $ 1.2810/20 (38,2 % $1,3080-$ 1,2660, Jan 6 and 10 highs)

Resistance 2: $ 1.2790 (session high)

Resistance 1: $ 1.2730 (low of asian session)

Current price: $1.2705

Support 1 : $1.2700/690 (area of session low)

Support 2 : $1.2660 (Jan 9 low)

Support 3 : $1.2590 (low of Aug'2010)

EUR/USD $1.2500, $1.2825, $1.2850, $1.2875, $1.2920

USD/JPY Y76.00

AUD/USD $1.0400, $1.0175, $1.0150

GBP/USD $1.5620

- Jan 11 German Merkel & Italy Monti to meet in Berlin at 1200GMT

- Jan 11 EU report on 'Excessive Deficit' for Belgium, Cyprus, Malta, Poland and Hungary

- Jan 12 Italy PM Monti addresses lower house on economy, EU

- Jan 12 Spain sells new 2015, 3.25% 2016 & 4.25% 2016 Bono upto E5bln

- Jan 12 ECB Governing Council meeting, press conference with Draghi

- Jan 12 Italy sells new 12-month-/3-month T-bills for up to E12.0bln

- Jan 13 Greek T-bill redemption for E2.0bln

- Jan 13 Italy sells medium-long bonds

- Jan 16 Italy T-bill redemption for E7.7bln

- Jan 17 Spain to sell 12-/18-month T-bills

05:00 Japan Leading Economic Index November 92.0 92.9 92.9

05:00 Japan Coincident Index November 91.4 90.3 90.3

The euro dropped versus the dollar before a report that may signal Europe’s sovereign-debt crisis is hurting the region’s prospects for economic growth.

The 17-nation currency slid against most of its major peers before Spain and Italy sell securities this week amid concern the nations will struggle to meet funding needs. Industrial production in the euro region is forecast to have shrunk for a third month in November, according to a Bloomberg News survey of economists before the European Union’s statistics office in Luxembourg releases the data tomorrow. The median estimate is for a 0.3 percent contraction.

The European Central Bank will keep its key interest rate at 1 percent at a policy meeting tomorrow, the median estimate in a separate Bloomberg poll showed. That would follow quarter- point rate reductions at each of the bank’s last two meetings.

Gains in the dollar were limited before a report tomorrow forecast to show inflation is slowing in China, spurring speculation the Asian nation’s central bank will have more scope to support growth in the world’s second-biggest economy.

China’s consumer prices probably rose 4 percent in December from a year earlier, according to median estimate of economists surveyed by Bloomberg News before the statistics bureau releases its figures tomorrow. That would be the lowest inflation rate since September 2010.

The world’s second-largest economy is experiencing a slowdown in trade, with import growth falling to a two-year low in December, according to a Chinese government report published yesterday. The data also showed a deceleration in export growth.

EUR/USD: on Asian session the pair fell.

GBP/USD: on Asian session the pair dropped.

USD/JPY: on Asian session the pair gain.

European events for Wednesday start at 0700GMT with German GDP for 2011, while UK data at 0930GMT sees trade data as well as BoE quoted rates data. US data starts at 1200GMT with the weekly MBA Mortgage Applications Index. At 1340GMT, Chicago Fed President Charles Evans speaks to the Rotary Club of Lake Forest and Lake Bluff, while at 1400GMT, Atlanta Fed President Dennis Lockhart

delivers a speech on the economic outlook to the Georgia Center for Nonprofits in Atlanta. European events continue at 1500GMT, when the Eurozone Insee, IFO, ISAE institutes give their Q1 economic outlook.

Yesterday the dollar declined as US stocks advanced, damping demand for safer investments.

The euro’s gains were tempered before Spain and Italy sell debt this week amid concern the nations will struggle to meet funding needs. Spain will auction as much as 5 billion euros of bonds due in 2015 and 2016 on Jan. 12, and Italy will sell 12 billion euros of bills the same day.

The dollar and yen weakened against higher-yielding currencies before Germany’s chancellor meets with the International Monetary Fund’s managing director amid signs European leaders are taking steps to end the debt crisis.

EUR/USD: yesterday the pair has slightly grown.

GBP/USD: yesterday the pair has slightly grown.

USD/JPY: yesterday the pair traded in range Y76.77-Y76.90.

European events for Wednesday start at 0700GMT with German GDP for 2011, while UK data at 0930GMT sees trade data as well as BoE quoted rates data. US data starts at 1200GMT with the weekly MBA Mortgage Applications Index. At 1340GMT, Chicago Fed President Charles Evans speaks to the Rotary Club of Lake Forest and Lake Bluff, while at 1400GMT, Atlanta Fed President Dennis Lockhart

delivers a speech on the economic outlook to the Georgia Center for Nonprofits in Atlanta. European events continue at 1500GMT, when the Eurozone Insee, IFO, ISAE institutes give their Q1 economic outlook.

Resistance 3: Y77.60 (61.8% FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 1: Y77.00 (Jan 9 high)

The current price: Y76.91

Support 1:Y76.75 (Jan 9 low)

Support 2:Y76.55 (Nov 18 low)

Support 3:Y76.10 (Sep 22 low)

Resistance 3: Chf0.9650 (Feb 9 high)

Resistance 2: Chf0.9595 (Jan 9 high)

Resistance 1: Chf0.9540 (high of the American session on Jan 9)

The current price: Chf0.9514

Support 1: Chf0.9465 (Jan 10 low)

Support 2: Chf0.9415 (61.8% FIBO Chf0.9595-Chf0.9305)

Support 3: Chf0.9395 (Dec 29 low)

Resistance 3: $1.2920 (61.8% FIBO $1.2665-$1.3075)

Resistance 2: $1.2870 (50.0% FIBO $1.2665-$1.3075, MA (233) H1)

Resistance 1: $1.2815 (Jan 6-10 high)

The current price: $1.2737

Support 1 : $1.2720 (low of the American session on Jan 9)

Support 2 : $1.2665 (Jan 9 low)

Support 3 : $1.2625 (Aug 31 low)

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2776 +0,10%

GBP/USD $1,5482 +0,17%

USD/CHF Chf0,9490 -0,04%

USD/JPY Y76,84 +0,01%

EUR/JPY Y98,19 +0,12%

GBP/JPY Y118,96 +0,19%

AUD/USD $1,0312 +0,72%

NZD/USD $0,7942 +0,91%

USD/CAD C$1,0154 -0,78%

Change % Change Last

Oil $102.20 +0.90 +0.89%

Gold $1,632.00 +24.00 +1.49%

Change % Change Last

Nikkei 8,422 +31.91 +0.38%

Hang Seng 19,004 +138.56 +0.73%

Shanghai Composite 2,286 +59.85 +2.69%

FTSE 5,697 +84.44 +1.50%CAC 3,211 +83.10 +2.66%

DAX 6,163 +145.75 +2.42%

Dow 12,460.13 +67.44 +0.54%

Nasdaq 2,702.50 +25.94 +0.97%

S&P 500 1,292.08 +11.38 +0.89%

05:00 Japan Leading Economic Index November 92.0 92.9

05:00 Japan Coincident Index November 91.4 90.3

09:30 United Kingdom Trade in goods November -7.6 -8.2

13:40 U.S. FOMC Member Charles Evans Speaks 0

14:00 U.S. FOMC Member Dennis Lockhart Speaks 0

15:30 U.S. EIA Crude Oil Stocks change 06.01.2012 +2.2

17:30 U.S. FOMC Member Charles Plosser Speaks 0

19:00 U.S. Fed's Beige Book January

23:50 Japan Current Account Total, bln November 562.4 246.8

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.