- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 13-01-2012.

Downgrades Portugal to BB from BBB-, outlook negative.

Affirms Ireland at BBB+, outlook revised to negative.

Downgrades Spain to A from AA-, outlook negative.

Downgrades Italy to BBB+ from A, outlook negative.

Affirms Germany rating at AAA, outlook revised to stable.

Downgrades France to AA+ from AAA, outlook negative.

The euro dropped amid speculation Standard & Poor’s may downgrade the credit ratings of several countries in the 17-nation currency region today.

The shared currency amid reports talks between Greece and its creditor banks were put on hold. The Dollar Index climbed as U.S. stocks fell after JPMorgan Chase & Co. said profit declined.

The dollar climbed as risk appetite faded and investors sought refuge.

Germany, Europe’s biggest economy, will retain its AAA rating in a review of euro-area countries’ credit grades by S&P, a European government official said.

France is among several euro-area countries facing downgrades by S&P in the review, which is due 20:0 GMT, the official said on condition of anonymity because the announcement has yet to be made. Austria will probably lose its AAA rating on concern about bad debts at the country’s banks, according to a person familiar with the matter.

“There is mounting evidence that China will avoid a hard landing, and US data have similarly taken a more upbeat tone. European data continue to point to falling activity."

EUR/USD $1.2700, $1.2720, $1.2750, $1.2800, $1.2850, $1.2900, $1.2970, $1.3000

USD/JPY Y76.00, Y76.50, Y77.00, Y77.20, Y77.35, Y77.75

AUD/USD $1.0255, $1.0275, $1.0300, $1.0310, $1.0320, $1.0405, $1.0500

GBP/USD $1.5200

EUR/JPY Y101.00

EUR/GBP stg0.8350, stg0.8330

USD/CHF Chf0.9400, Chf0.9510

EUR/CHF Chf1.2100

AUD/NZD NZ$1.3105

AUD/CHF Chf0.9800

Italy sold 3 billion euros of notes due in November 2014 today at an average yield of 4.83 percent, down from 5.62 percent at a previous auction on Dec. 29. It also sold debt due in July 2014 and August 2018. Yesterday, the nation sold one- year bills at 2.735 percent, more than half of the 5.952 percent yield at the prior sale on Dec. 12. “Expectations were built up quite significantly following yesterday’s auction,” said Ian Stannard, head of European currency strategy at Morgan Stanley in London. “Any rebound we see in euro-dollar is going to remain limited, and we remain bearish over the medium term.”

The 17-nation currency dropped against all but two of its 16 major counterparts as concern recent measures by European leaders may still fail to resolve the region’s debt crisis.

The Dollar Index headed for a weekly decline before a U.S. report that economists said will show consumer confidence improved this month, reducing demand for the U.S. currency as a haven.

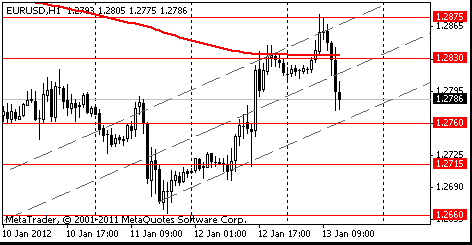

EUR/USD: during european session the pair fell to $1.2765.

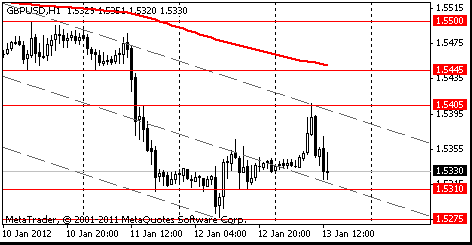

GBP/USD: during european session the pair updated session low.

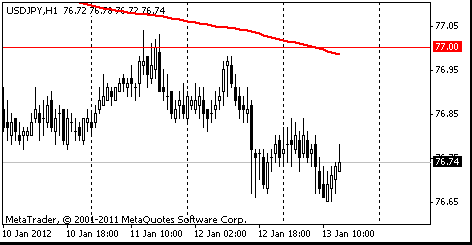

USD/JPY: the pair has traded nearby Y76.75.

Resistance 3: Y77.60 (61.8% FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 1: Y77.00 (MA (233) H1)

The current price: Y76.75

Support 1:Y76.55 (Nov 18 low)

Support 2:Y76.10 (Sep 22 low)

Support 3:Y75.60 (Oct 31 low)

Resistance 3: Chf0.9595 (high on Jan 9)

Resistance 2: Chf0.9565 (Jan 11 high)

Resistance 1: Chf0.9525 (high of the American session on Jan 12)

The current price: Chf0.9469

Support 1: Chf0.9450 (middle line from Jan 11)

Support 2: Chf0.9405 (session low)

Support 3: Chf0.9340 (Dec 30 low)

Resistance 3 : $1.5500 (Jan 10 high)

Resistance 2 : $1.5445 (MA (233) H1)

Resistance 1 : $1.5405 (session high)

The current price: $1.5330

Support 1 : $1.5310 (low of the American session on Jan 12)

Support 2 : $1.5275 (Jan 12 low)

Support 3 : $1.5200 (a psychological level)

Resistance 3 : $1.2920 (61.8% FIBO $1.2665-$1.3075)

Resistance 2 : $1.2875 (session high)

Resistance 1 : $1.2830 (MA (233) H1)

The current price: $1.2786

Support 1 : $1.2760 (support line from Jan 11)

Support 2 : $1.2715 (low of the American session on Jan 12)

Support 3 : $1.2660 (Jan 11 low)

Italy sold E4.75bln vs target E4.75bln

E3.0bln of 6% 2014 BTP, avg yield 4.83% (5.62%), cover 1.2 (1.364)

E779mln of 4.25% July 2014 BTP, avg yield 4.29%, cover 1.2

E971mln of 4.50% Aug 2018 BTP, avg yield 5.75%, cover 1.6

EUR/USD $1.2700, $1.2720, $1.2750, $1.2800, $1.2850, $1.2900, $1.2970, $1.3000

USD/JPY Y76.00, Y76.50, Y77.00, Y77.20, Y77.35, Y77.75

AUD/USD $1.0255, $1.0275, $1.0300, $1.0310, $1.0320, $1.0405, $1.0500

GBP/USD $1.5200

EUR/JPY Y101.00

EUR/GBP stg0.8350, stg0.8330

USD/CHF Chf0.9400, Chf0.9510

EUR/CHF Chf1.2100

AUD/NZD NZ$1.3105

AUD/CHF Chf0.9800

The euro was set to halt a five-week drop against the dollar as Italy prepared to sell bonds and after European Central Bank President Mario Draghi said policy makers have averted a credit shortage.

The 17-nation euro rose yesterday after Spain sold twice the maximum target at a note auction.

Italy will sell bonds due in 2014 and 2018 today. The nation’s Treasury raised 12 billion euros ($15.4 billion) from a bill auction yesterday. Italy’s 10-year yield fell 35 basis points, 0.35 percentage point, to 6.63 percent.

Spain raised 9.98 billion euros from yesterday’s note auction. The rate on the country’s 10-year debt dropped 19 basis points to 5.13 percent.

The greenback slid versus 15 of 16 major peers this week before a report that may show confidence among U.S. consumers gained, damping demand for the currency as a haven.

The Australian and New Zealand dollars fell against most of their 16 major peers amid concern U.S. economic growth may be weaker than forecast, sapping demand for riskier assets.

EUR/USD: on Asian session the pair gain.

GBP/USD: on Asian session the pair gain.

USD/JPY: on Asian session the pair fell.

Core-European data is limited to the 1000GMT release of the EMU trade balance. UK data comes at 0930GMT with PPI and also construction output. Producer prices have ended their long ascent and are coming back down.

Yesterday the euro rose to a one-week high versus the dollar after European Central Bank President Mario Draghi said he saw signs of stabilization in the economy and Spain sold almost twice its maximum target at a note auction.

The shared currency appreciated versus 14 of its 16 most- traded peers as Italian borrowing costs dropped at a bill auction. The ECB left its benchmark interest rate unchanged.

The dollar fell the yen after data showed U.S. retail sales increased less than economists forecast.

The dollar fell bafter the Commerce Department said U.S. retail sales gained 0.1 percent last month, following a revised 0.4 percent increase in November. Economists in a Bloomberg survey forecast a 0.3 percent advance in December.

The Australian dollar erased gains versus its U.S. counterpart as stocks declined after the sales report and after more Americans than forecast filed claims for jobless benefits last week.

EUR/USD: yesterday the pair has grown on a figure.

GBP/USD: yesterday the pair traded about a level $1.5330.

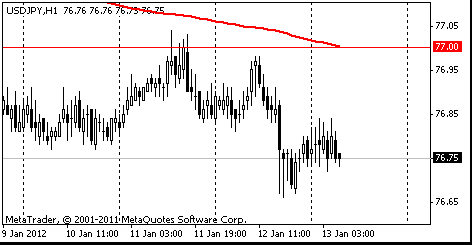

USD/JPY: yesterday the pair has fallen.

Core-European data is limited to the 1000GMT release of the EMU trade balance. UK data comes at 0930GMT with PPI and also construction output. Producer prices have ended their long ascent and are coming back down.

Resistance 3: Y77.60 (61.8% FIBO Y78.20-Y76.60)

Resistance 2: Y77.35/40 (Jan 6 high, 50.0% FIBO Y78.20-Y76.60)

Resistance 1: Y77.00 (MA (233) H1)

The current price: Y76.75

Support 1:Y76.55 (Nov 18 low)

Support 2:Y76.10 (Sep 22 low)

Support 3:Y75.60 (Oct 31 low)

Resistance 3: Chf0.9565 (Jan 11 low)

Resistance 2: Chf0.9525 (high of the American session on Jan 12)

Resistance 1: Chf0.9465 (MA (233) H1)

The current price: Chf0.9435

Support 1: Chf0.9410 (Jan 12 low)

Support 2: Chf0.9395 (Dec 29 low)

Support 3: Chf0.9340 (Dec 30 low)

Resistance 3 : $1.2920 (61.8% FIBO $1.2665-$1.3075)

Resistance 2 : $1.2870 (50.0% FIBO $1.2660-$1.3075)

Resistance 1 : $1.2845 (Jan 12 high)

The current price: $1.2828

Support 1 : $1.2790 (Jan 11 low)

Support 2 : $1.2715 (low of the American session on Jan 12)

Support 3 : $1.2660 (Jan 11 low)

Change % Change Last

Oil $98.92 -0.18 -0.18%

Gold $1,650.50 +2.80 +0.17%

Change % Change Last

Nikkei 8,386 -62.29 -0.74%

Hang Seng 19,095 -56.56 -0.30%

Shanghai Composite 2,275 -1.04 -0.05%

FTSE 5,662 -8.40 -0.15%

CAC 3,200 -4.85 -0.15%

DAX 6,179 +26.87 +0.44%

Dow 12,471.02 +21.57 +0.17%

Nasdaq 2,724.70 +13.94 +0.51%

S&P 500 1,295.50 +3.02 +0.23%

(pare/closed(00:00 GMT +02:00)/change, %)

EUR/USD $1,2815 +0,86%

GBP/USD $1,5303 -0,15%

USD/CHF Chf0,9444 -1,01%

USD/JPY Y76,75 -0,13%

EUR/JPY Y98,37 +0,74%

GBP/JPY Y117,65 -0,11%

AUD/USD $1,0332 +0,23%

NZD/USD $0,7936 -0,40%

USD/CAD C$1,0190 -0,05%

09:30 United Kingdom Producer Price Index - Input (MoM) December +0.1% +0.1%

09:30 United Kingdom Producer Price Index - Input (YoY) December +13.4% +9.1%

09:30 United Kingdom Producer Price Index - Output (MoM) December 0.0% 0.0%

09:30 United Kingdom Producer Price Index - Output (YoY) December +5.4% +5.0%

10:00 Eurozone Trade Balance s.a. November 0.3 0.7

13:30 Canada Trade balance, billions November -0.9 -0.4

13:30 U.S. International trade, bln November -43.5 -44.6

13:30 U.S. Import Price Index December +0.7% 0.0%

14:45 U.S. Reuters/Michigan Consumer Sentiment Index (Prelim) January 69.9 70.8

16:10 U.S. FOMC Member Elizabeth Duke Speaks

17:45 U.S. FOMC Member Laker Speaks

18:00 U.S. FOMC Member Charles Evans Speaks

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.