- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 11-02-2019.

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Home Loans | December | -0.9% | -2% |

| 00:30 | Australia | National Australia Bank's Business Confidence | January | 3 | 3 |

| 04:30 | Japan | Tertiary Industry Index | December | -0.3% | 0.4% |

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | January | -18.3% | |

| 08:20 | Germany | German Buba President Weidmann Speaks | |||

| 13:00 | United Kingdom | BOE Gov Mark Carney Speaks | |||

| 15:00 | U.S. | JOLTs Job Openings | December | 6.888 | 6.96 |

| 17:45 | U.S. | Fed Chair Powell Speaks | |||

| 22:30 | U.S. | FOMC Member Esther George Speaks | |||

| 23:30 | Australia | Westpac Consumer Confidence | February | 99.6 | |

| 23:30 | Eurozone | ECB's Lautenschläger Speech | |||

| 23:30 | U.S. | FOMC Member Mester Speaks |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 00:30 | Australia | Home Loans | December | -0.9% | -2% |

| 00:30 | Australia | National Australia Bank's Business Confidence | January | 3 | 3 |

| 04:30 | Japan | Tertiary Industry Index | December | -0.3% | 0.4% |

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | January | -18.3% | |

| 08:20 | Germany | German Buba President Weidmann Speaks | |||

| 13:00 | United Kingdom | BOE Gov Mark Carney Speaks | |||

| 15:00 | U.S. | JOLTs Job Openings | December | 6.888 | 6.96 |

| 17:45 | U.S. | Fed Chair Powell Speaks | |||

| 22:30 | U.S. | FOMC Member Esther George Speaks | |||

| 23:30 | Australia | Westpac Consumer Confidence | February | 99.6 | |

| 23:30 | Eurozone | ECB's Lautenschläger Speech | |||

| 23:30 | U.S. | FOMC Member Mester Speaks |

The National Institute of Economic and Social Research (NIESR) estimated the UK's GDP growth is set to remain weak in the first quarter of this year.

The NIESR said the GDP Tracker suggests that the economy will expand by just 0.2 percent in the first quarter of this year.

Earlier on Monday, official data showed the UK's economy expanded 0.2 percent q-o-q in the fourth quarter of 2018, following a 0.6 percent q-o-q growth in the third quarter. Private and government consumption were the main drivers of growth. On the contrary, gross capital formation and net trade provided a negative contribution.

Garry Young, Head of macroeconomic forecasting and modelling, noted “The UK economy weakened sharply at the end of 2018, with falls in output in all of the major sectors in December. While single month figures can be volatile, the widespread weakness in official output data and many business surveys does not augur well for economic performance in the United Kingdom in 2019. Further downside economic news, including a costly exit from the EU, would strengthen the case for a more active policy response”.

The Democratic and Republican negotiators in the U.S. Congress on border security funding plan to meet on Monday, attempting to reach a deal to avert another partial government shutdown by a Friday deadline.

Negotiations broke down during the weekend over funding for immigrant detention beds and physical barriers that would be funded along the U.S.-Mexico border.

According to Reuters, the lawmakers hope to reach a deal today to allow time for the legislation to pass the House and Senate and get signed by Republican President Donald Trump by Friday when funding for the Department of Homeland Security and several other federal agencies expires.

Reuters reported that Germany’s trade surplus with the United States, a frequent source of tension with the U.S. President Donald Trump, decreased in 2018 but nonetheless remained at around 49 billion euros ($55.37 billion).

Preliminary estimates from the Federal Statistics Office showed that German exports to the U.S. increased by 1.5 percent to a record high of 113.5 billion euros in 2018. That implied the United States remained the biggest buyer of “Made in Germany” goods - ahead of France, which purchased 105 billion euros’ worth, and China, which bought 93 billion euros’ worth.

Meanwhile, German imports from the U.S. rose by nearly 4 percent to 64.6 billion euros.

That meant the surplus with the United States was around a billion euros smaller than in 2017. But it was still the largest surplus Germany has with any country and accounts for more than a fifth of Germany’s overall export surplus of around 228 billion euros in 2018.

China remained Germany’s most important trade partner in 2018, with the two countries exchanging goods worth around 200 billion euros. German exports to China surged by around 8 percent to 93 billion euros last year while imports from China climbed by almost 4 percent to 106 billion euros.

- possible Trump and Xi will meet very soon

UK government spokesman James Slack's remarks:

- Says May is to make a Brexit statement to parliament on Tuesday to give lawmakers an update on Brexit negotiations

- Government committed to bring vote on Brexit deal as soon as possible, but will not be this week

- Government will take whatever steps necessary for Britain to leave the EU on time

- Rules out Corbyn's proposal on Brexit customs union with the EU (UK must have an independent trade policy after Brexit)

- Says that UK economy continues to grow and remains fundamentally strong

The former foreign secretary Boris Johnson said in an interview to BBC Radio that there would be "challenges" to a no deal Brexit but did not think a no deal will happen.

He added he was positive that "the UK and EU will come to some kind of arrangement".

Such agreements can take years to negotiate, Sultan bin Saeed al-Mansouri said on a panel at the World Government Summit in Dubai.

In 2017, trade between the UAE and UK totalled 17.5 billion British pounds, up 12.3 percent from 2016, according to official figures.

By 2020, the UK government wants that number to increase to about 25 billion pounds.

China slowdown is also affecting global growth

China's foreign-exchange reserves increased for the third straight month in January, as continued dollar weakness boosted values in assets denominated in other currencies.

The foreign-exchange hoard rose by $15.21 billion in January from the previous month to $3.088 trillion, data from the central bank showed. Economists expected a gain of $12 billion. In December, China's forex reserves grew by $11 billion.

According to the report from Office for National Statistics, the total trade deficit (goods and services) widened £0.9 billion to £10.4 billion in the three months to December 2018, due mainly to a £1.5 billion rise in goods imports.

Rising imports of cars, material manufactures and chemicals were the main contributors to the rise in goods imports in the three months to December 2018; this was offset in part by falling imports of unspecified goods (including non-monetary gold) and fuels.

The trade in goods deficit widened £1.6 billion with EU countries and narrowed £0.2 billion with non-EU countries in the three months to December 2018.

Excluding erratic commodities, the total trade deficit widened £3.8 billion to £12.9 billion in the three months to December 2018.

Removing the effect of inflation, the total trade deficit widened £0.6 billion to £7.1 billion in the three months to December 2018.

Office for National Statistics said, production output fell by 0.5% between November 2018 and December 2018. Economists had expected a 0.2% increase. The manufacturing sector provided the largest downward contribution with a fall of 0.7%, its strongest monthly fall since January 2017 and marking the sixth consecutive monthly decrease. The monthly decrease in manufacturing was due to falls in 9 of the 13 sub-sectors; the largest downward contribution came from pharmaceuticals (4.2%) and other manufacturing and repair (2.8%).

According to the report. production output fell by 1.1% in Quarter 4 2018, compared with Quarter 3 2018, due mainly to a fall of 0.9% in manufacturing; this is the first time since Quarter 1 2009 that all four main sectors have fallen during a quarter. The decrease of 0.9% in manufacturing in Quarter 4 2018 is the strongest fall since Quarter 4 2012; there is broad-based weakness with the largest falls in transport equipment (2.7%) and basic metals (3.0%).

In Quarter 4 2018, production output decreased by 1.0% compared with Quarter 4 2017; the weakest growth since Quarter 2 2013, driven by a fall of 1.5% from manufacturing.

According to the preliminary data from Office for National Statistics, UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.2% between Quarter 3 (July to Sept) 2018 and Quarter 4 (Oct to Dec) 2018; the quarterly path of GDP through 2018 remains unrevised.

In the output approach to measuring GDP, growth in the latest quarter was driven by professional, scientific, administration and support services within the services sector, while production and construction both contributed negatively to GDP growth.

In the expenditure approach to measuring GDP, private consumption and government consumption contributed positively, while gross capital formation and net trade contributed negatively to GDP growth.

Business investment decreased by 1.4% in Quarter 4 2018, the fourth consecutive quarter in which there has been a decrease in growth.

GDP growth was estimated to have slowed to 1.4% between 2017 and 2018, the weakest it has been since 2009.

Former UK Foreign Secretary Boris Johnson said, the United Kingdom needs to secure changes to Brexit deal’s Irish border backstop such as a time limit and an exit mechanism.

“Some of the ideas that the prime minister has mentioned in the House do seem sensible,” Johnson told, one of Britain’s most prominent Brexit campaigners. “I think you would need a time limit.”

“I think I would want to look very carefully at what was being proposed and it would have to give the United Kingdom a UK-sized exit from the backstop,” he said.

expects eurozone inflation to continue to slow in the next few months

ECB will be prudent in setting monetary policy

Researchers from the London School of Economics' Centre for Economic Performance said, the 2016 Brexit vote spurred British companies into increasing investment in European Union countries sharply, likely at the expense of spending at home.

The referendum result led to a 12% increase in foreign direct investment transactions from Britain into the EU between mid-2016 and September 2018. That translated into an increase of around 8.3 billion pounds, concentrated entirely in the services industry.

Conversely, the research pointed to an 11% drop in investment transactions from the EU into Britain, worth around 3.5 billion pounds.

The business sentiment indicator in manufacturing industry stood at 99 in January, after 102 in December, the Bank of France said in its monthly business survey

The business sentiment indicator in services stood at 100 in January after 101 in December.

The business sentiment indicator in construction* stood at 105 in January as in December.

According to the monthly index of business activity (MIBA), GDP is expected to increase by 0.4% in the first quarter of 2019 (first estimate). It would represent a slight improvement from the fourth quarter of 2018, when the French economy grew by 0.3%.

British trade department said, Britain and Switzerland will sign an agreement on Monday to continue trading on preferential terms after Brexit, protecting a trade relationship worth 32 billion pounds.

The formal signing of the deal, on which agreement had previously been announced, is one of only handful of concrete steps Britain has made towards ensuring that all the trade deals it currently benefits from as an EU member will continue after it leaves the bloc next month.

"Not only will this help to support jobs throughout the UK but it will also be a solid foundation for us to build an even stronger trading relationship with Switzerland as we leave the EU,” International Trade minister Liam Fox said.

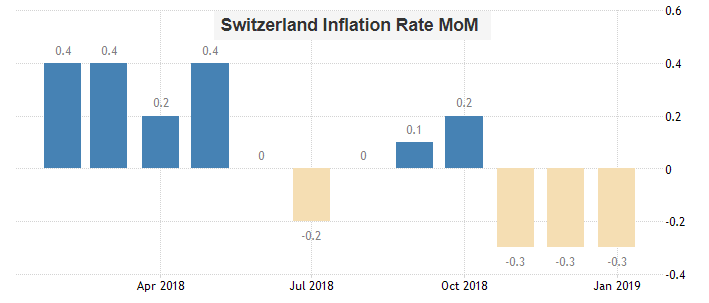

According to the report from Federal Statistical Office (FSO), the consumer price index (CPI) fell by 0.3% in January 2019 compared with the previous month, reaching 101.3 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year.

The decrease of 0.3% compared with the previous month can be explained by several factors including falling prices for clothing and footwear due to seasonal sales. The prices of heating oil also declined, along with prices for medicines. In contrast, prices for hotel accommodation and for electricity increased.

In January 2019, the Swiss Harmonised Index of Consumer Prices (HICP) stood at 100.63 points (base 2015=100). This corresponds to a rate of change of ?0.6% compared with the previous month and of +0.7% compared with the same month the previous year.

China's retailer and catering enterprises earned over 1 trillion yuan during the Lunar New Year holiday, defying an economic slump to rise 8.5% from last year, the country's commerce ministry said.

The increase was down to the rapid growth in sales of new-year gifts, traditional foods, electronic products and local speciality products over a six-day holiday period ending on Saturday.

Domestic tourism during the new year break generated total revenues of 513.9 billion yuan, up 8.2% on the year, with the number of trips rising 7.6% to 415 million.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1455 (3566)

$1.1429 (509)

$1.1408 (199)

Price at time of writing this review: $1.1324

Support levels (open interest**, contracts):

$1.1278 (3782)

$1.1248 (4466)

$1.1214 (3870)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 8 is 89925 contracts (according to data from February, 8) with the maximum number of contracts with strike price $1,1700 (6193);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3093 (970)

$1.3053 (165)

$1.3023 (398)

Price at time of writing this review: $1.2930

Support levels (open interest**, contracts):

$1.2880 (753)

$1.2861 (1080)

$1.2839 (756)

Comments:

- Overall open interest on the CALL options with the expiration date March, 8 is 42006 contracts, with the maximum number of contracts with strike price $1,3000 (3877);

- Overall open interest on the PUT options with the expiration date March, 8 is 28177 contracts, with the maximum number of contracts with strike price $1,2300 (1790);

- The ratio of PUT/CALL was 0.67 versus 1.06 from the previous trading day according to data from February, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.70847 | -0.25 |

| EURJPY | 124.301 | -0.17 |

| EURUSD | 1.13211 | -0.15 |

| GBPJPY | 141.987 | -0.16 |

| GBPUSD | 1.29335 | -0.13 |

| NZDUSD | 0.67482 | 0 |

| USDCAD | 1.32649 | -0.3 |

| USDCHF | 1 | -0.22 |

| USDJPY | 109.78 | -0.03 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.