- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 17-10-2018.

| Pare | Closed | % change |

| EUR/USD | $1,1499 | -0,63% |

| GBP/USD | $1,3102 | -0,62% |

| USD/CHF | Chf0,99448 | +0,42% |

| USD/JPY | Y112,68 | +0,35% |

| EUR/JPY | Y129,57 | -0,28% |

| GBP/JPY | Y147,643 | -0,26% |

| AUD/USD | $0,7108 | -0,47% |

| NZD/USD | $0,6546 | -0,57% |

| USD/CAD | C$1,30211 | +0,67% |

Manufacturing sales fell 0.4% to $58.6 billion in August, following three consecutive monthly increases.

The decline was mainly due to lower motor vehicle sales. Excluding this industry, manufacturing sales rose 0.4% in August.

Sales were down in 7 of 21 industries, representing 50.9% of the Canadian manufacturing sector.

After taking price changes into account, the volume of sales in the manufacturing sector edged down 0.3% in Augu

Privately‐owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,241,000. This is 0.6 percent below the revised August rate of 1,249,000 and is 1.0 percent below the September 2017 rate of 1,254,000. Single‐family authorizations in September were at a rate of 851,000; this is 2.9 percent above the revised August figure of 827,000. Authorizations of units in buildings with five units or more were at a rate of 351,000 in September.

Privately‐owned housing starts in September were at a seasonally adjusted annual rate of 1,201,000. This is 5.3 percent below the revised August estimate of 1,268,000, but is 3.7 percent above the September 2017 rate of 1,158,000. Single‐family housing starts in September were at a rate of 871,000; this is 0.9 percent below the revised August figure of 879,000. The September rate for units in buildings with five units or more was 324,000.

A year earlier, the rate was 1.5%. European Union annual inflation was 2.2% in September 2018, stable compared to August. A year earlier, the rate was 1.8%. These figures are published by Eurostat, the statistical office of the European Union. The lowest annual rates were registered in Denmark (0.5%), Greece (1.1%) and Ireland (1.2%). The highest annual rates were recorded in Romania (4.7%), Hungary (3.7%) and Bulgaria (3.6%). Compared with August 2018, annual inflation fell in nine Member States, remained stable in four and rose in fourteen. In September 2018, the highest contribution to the annual euro area inflation rate came from energy (+0.90 percentage points, pp), followed by services (+0.57 pp), food, alcohol & tobacco (+0.51 pp) and non-energy industrial goods (+0.08 pp).

UK house prices rose by 3.2% in the year to August 2018, down from 3.4% in the year to July 2018. Annual growth in house prices has remained broadly stable at a national level since April 2018.

House prices grew fastest in the East Midlands region increasing by 6.5% in the year to August 2018, followed by the West Midlands region which increased by 5.1% over the year. House prices in London fell by 0.2% in the year to August 2018. Annual growth in London house prices has been around zero for the last 6 months.

The headline rate of output inflation for goods leaving the factory gate was 3.1% on the year to September 2018, up from 2.9% in August 2018.

The growth rate of prices for materials and fuels used in the manufacturing process rose to 10.3% on the year to September 2018, up from 9.4% in August 2018.

All product groups provided upward contributions to output and input annual inflation.

Annual inflation remained positive for both input and output indices for the 27th consecutive month; this is the longest period where both indices have displayed positive growth since May 2012.

The Consumer Prices Index including owner occupiers' housing costs (CPIH) 12-month inflation rate was 2.2% in September 2018, down from 2.4% in August 2018.

The largest downward contribution came from food and non-alcoholic beverages where prices fell between August and September 2018 but rose between the same two months a year ago.

Other large downward contributions came from transport, recreation and culture, and clothing.

Partially offsetting upward contributions came from increases to electricity and gas prices.

The Consumer Prices Index (CPI) 12-month rate was 2.4% in September 2018, down from 2.7% in August 2018.

-

EU's Barnier Has Indicated Clearly That EU Side Is Willing To Allow More Time To Find Solution To Backstop

EUR/USD

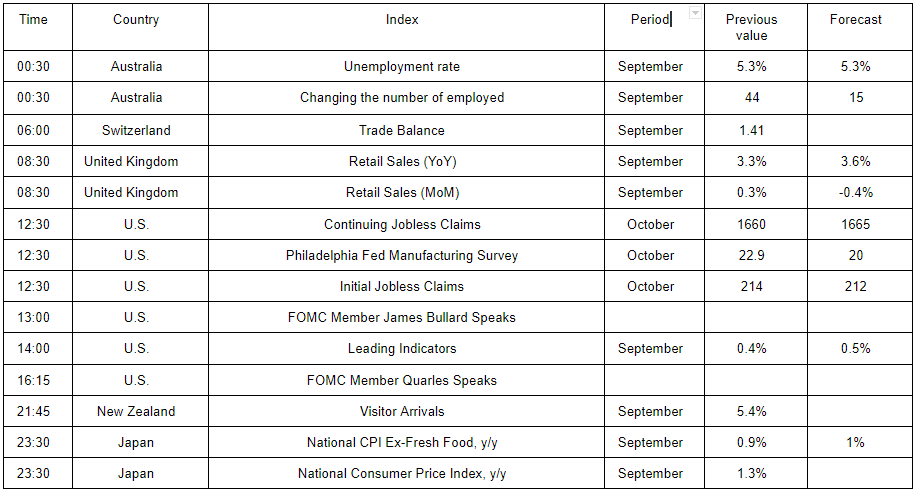

Resistance levels (open interest**, contracts)

$1.1726 (1930)

$1.1703 (2074)

$1.1670 (457)

Price at time of writing this review: $1.1566

Support levels (open interest**, contracts):

$1.1531 (4424)

$1.1499 (3378)

$1.1464 (2867)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 19 is 79789 contracts (according to data from October, 16) with the maximum number of contracts with strike price $1,1600 (4442);

GBP/USD

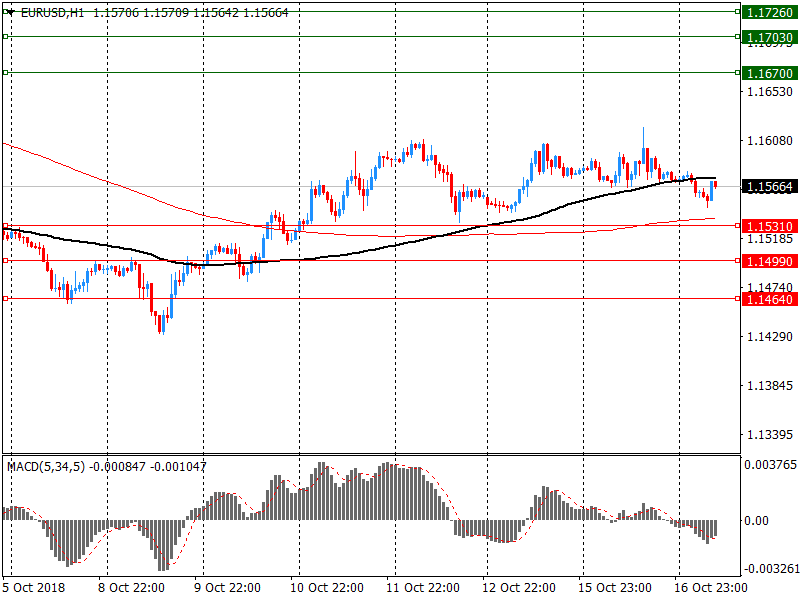

Resistance levels (open interest**, contracts)

$1.3309 (1012)

$1.3282 (802)

$1.3264 (388)

Price at time of writing this review: $1.3184

Support levels (open interest**, contracts):

$1.3133 (457)

$1.3082 (684)

$1.3018 (1997)

Comments:

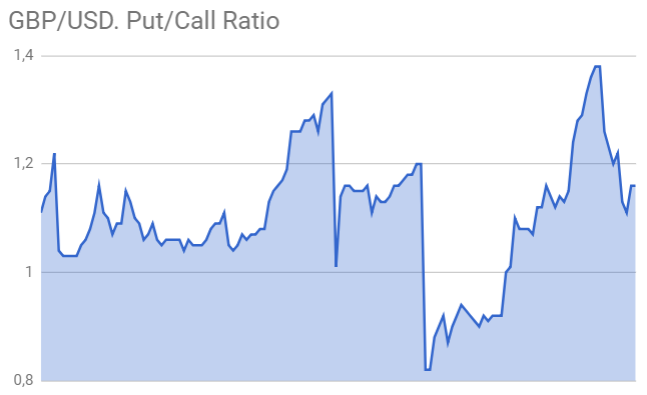

- Overall open interest on the CALL options with the expiration date November, 19 is 23330 contracts, with the maximum number of contracts with strike price $1,3500 (3428);

- Overall open interest on the PUT options with the expiration date November, 19 is 27166 contracts, with the maximum number of contracts with strike price $1,3000 (3005);

- The ratio of PUT/CALL was 1.16 versus 1.16 from the previous trading day according to data from October, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

On Wednesday, the dollar is little changed so far against most major currencies, but rose against the yen, as optimistic earnings on Wall Street improved investor sentiment.

The three major Wall Street indices rose by more than 2%, because blue chips provided high incomes, which indicates that the recovery of the US economy is in full swing, despite the impact of rising interest rates and tensions in world trade.

The data on Tuesday showed that industrial production in the United States increased in September for the fourth month in a row, helped by growth in manufacturing and mining, but growth rates declined sharply in the third quarter.

The dollar index, an indicator of its value against six major currencies, is trading at 95.08 on Wednesday.

The dollar rose 0.13% against the Japanese yen , which was trading at Y112.40 against the dollar. The yen rose seven of eight sessions until Tuesday and reached a monthly high of Y111.61 on Monday.

Buyers expect further signals for the dollar from the minutes of the September meeting of the Federal Reserve System, which will be published later today. Investors are looking for clues about how the interest rate will increase this year.

Interest rate futures indicate a 77% chance that the Federal Reserve will raise interest rates again at the December meeting, according to the CME Group FedWatch Tool analytic report.

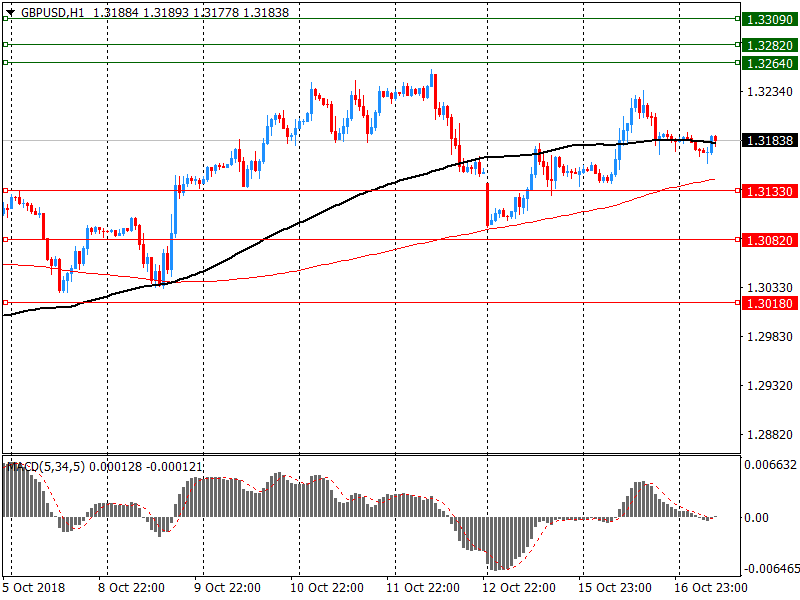

The British pound is trading at $ 1.3187 on Wednesday after it rose 0.25% on Tuesday. While growth was supported by stronger than expected data from the UK labor market, investors still doubt that a European Union summit on Wednesday will provide significant progress on the issue of NI border.

"The way I'm approaching it...is very consistent with the way the [rate-setting Federal Open Market Committee] has been approaching it while I haven't been a member or participant, and that is you make a gradual pace of normalization" to help keep the economy moving forward, Ms. Daly said. - via DJ

"It's independent so I don't speak to him, but I'm not happy with what he's doing, because it's going too fast," Mr. Trump said in an interview with the Fox Business Network, referring to Fed Chairman Jerome Powell, whom he nominated last year. "You looked at the last inflation numbers, they're very low."

-

'We Just Went Through That with Justice Kavanaugh and He Was Innocent All the Way'

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.