- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 22-01-2018.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2261 +0,33%

GBP/USD $1,3887 +0,19%

USD/CHF Chf0,9619 -0,10%

USD/JPY Y110,93 +0,17%

EUR/JPY Y136,02 +0,49%

GBP/JPY Y155,157 -0,23%

AUD/USD $0,8017 +0,29%

NZD/USD $0,7326 +0,73%

USD/CAD C$1,24427 -0,50%

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan BOJ Outlook Report

04:30 Japan All Industry Activity Index, m/m November 0.3% 0.9%

06:30 Japan BOJ Press Conference

09:30 United Kingdom PSNB, bln December -8.12

10:00 Eurozone ZEW Economic Sentiment January 29 30

10:00 Germany ZEW Survey - Economic Sentiment January 17.4 17.9

11:00 United Kingdom CBI industrial order books balance January 17 12

15:00 Eurozone Consumer Confidence (Preliminary) January 0.5 0.6

15:00 U.S. Richmond Fed Manufacturing Index January 20 18

23:30 Australia Leading Index December 0.1%

23:50 Japan Trade Balance Total, bln December 113 530

-

Says China needs to take further steps to open its economy to imports

-

More can be done on EU's banking union project, notably on common deposit insurance

-

Without policy action next economic downturn will come sooner and be harder to fight

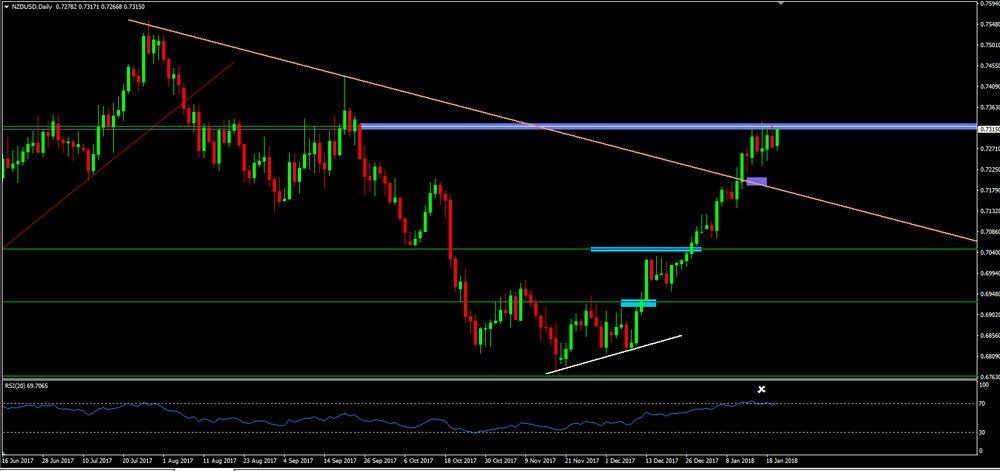

On daily time frame chart, we can see that NZD/USD has been follwing a strong bullish trend on the last few weeks.

However, now the price is showing some difficults in break through the purple box (resistance level) and the indicator - RSI - is showing a "overbought" which it may give some indications of a reversal trend.

Therefore, we can expect a further bearish movement soon.

-

Revises up growth forecasts for euro area, including Germany, Italy, cuts forecast for Spain

-

Maintains growth forecast for emerging markets and developing countries

-

Sees U.S. growth slowing from 2022 as impact from tax package starts to wane

-

Revision to its outlook reflects global growth momentum, expected impact of U.S. tax cuts

Sales were up in six of seven subsectors, representing 99% of wholesale sales. The food, beverage and tobacco subsector and the motor vehicle and parts subsector led the gains.

In volume terms, wholesale sales increased 0.5%.

The food, beverage and tobacco subsector posted the largest increase in dollar terms in November, rising 1.9% to $12.2 billion. Higher sales in the food industry, up 2.2% to $11.1 billion, contributed the most to the gain. This was the highest level on record for both the subsector and the industry.

-

Says we will discuss all issues again in german coalition negotiations

-

SPD will consider this week how to position itself for coalition negotiations

-

Sight deposits of domestic banks at 468.854 bln chf in week ending january 19 versus 473.922 bln chf a week earlier

-

Senate majority leader Mitch Mcconnell says if DACA isn't resolved by feb. 8th and government is open, he would allow a vote

EUR/USD

Resistance levels (open interest**, contracts)

$1.2338 (4134)

$1.2321 (3106)

$1.2297 (2863)

Price at time of writing this review: $1.2225

Support levels (open interest**, contracts):

$1.2166 (1723)

$1.2137 (1651)

$1.2104 (2330)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 115033 contracts (according to data from January, 19) with the maximum number of contracts with strike price $1,1850 (7013);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3970 (2014)

$1.3953 (2994)

$1.3930 (2366)

Price at time of writing this review: $1.3864

Support levels (open interest**, contracts):

$1.3786 (244)

$1.3760 (328)

$1.3730 (309)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 36758 contracts, with the maximum number of contracts with strike price $1,3600 (3482);

- Overall open interest on the PUT options with the expiration date February, 9 is 29760 contracts, with the maximum number of contracts with strike price $1,3500 (3054);

- The ratio of PUT/CALL was 0.81 versus 0.80 from the previous trading day according to data from January, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.