- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 19-01-2018.

While the preliminary January reading for the Sentiment Index was largely unchanged from last month (-1.5%), consumers evaluated current economic conditions less favorably (-4.6%). This small decrease in current conditions produced a small overall decline. Importantly, the survey recorded persistent strength in personal finances and buying plans, while favorable levels of buying conditions for household durables have receded to preholiday levels in early January, largely due to less attractive pricing.

The Expectations Index remained virtually unchanged at 84.8. Tax reform was spontaneously mentioned by 34% of all respondents; 70% of those who mentioned tax reform thought the impact would be positive, and 18% said it would be negative. The disconnect between the future outlook assessment and the largely positive view of the tax reform is due to uncertainties about the delayed impact of the tax reforms on the consumers.

Manufacturing sales rose 3.4% to a record high $55.5 billion in November, mainly due to higher sales in the transportation equipment, petroleum and coal product and chemical industries.

Higher petroleum prices contributed to the overall increase in manufacturing sales. Once the effects of these and other price changes are removed, manufacturing sales volumes rose 2.5% in November.

Sales of transportation equipment increased 9.1% to $10.6 billion in November, following two consecutive monthly decreases. Most of the increase in November was attributable to higher sales in the motor vehicle assembly (+14.2%) and motor vehicle parts (+11.3%) industries, reflecting increased production after motor vehicle assembly plant shutdowns in October. In constant dollars, sales volumes rose 14.7% in the motor vehicle assembly industry and 10.9% in the motor vehicle parts industry in November.

Foreign investment in Canadian securities amounted to $19.6 billion in November, mainly purchases of Canadian bonds. Meanwhile, Canadian investors reduced their holdings of foreign securities by $4.6 billion, following strong acquisitions in October.

Non-resident acquisitions of Canadian bonds stood at $17.8 billion in November. Foreign investors acquired $8.8 billion of federal government bonds, the fifth consecutive month of strong investment. From July to November, foreign acquisitions of federal government bonds have totalled $36.6 billion, compared with a divestment of $7.9 billion in the first half of the year (January to June). Non-resident investors also added $6.6 billion of private corporate bonds to their holdings in November. Canadian long-term interest rates were down by 16 basis points in the month.

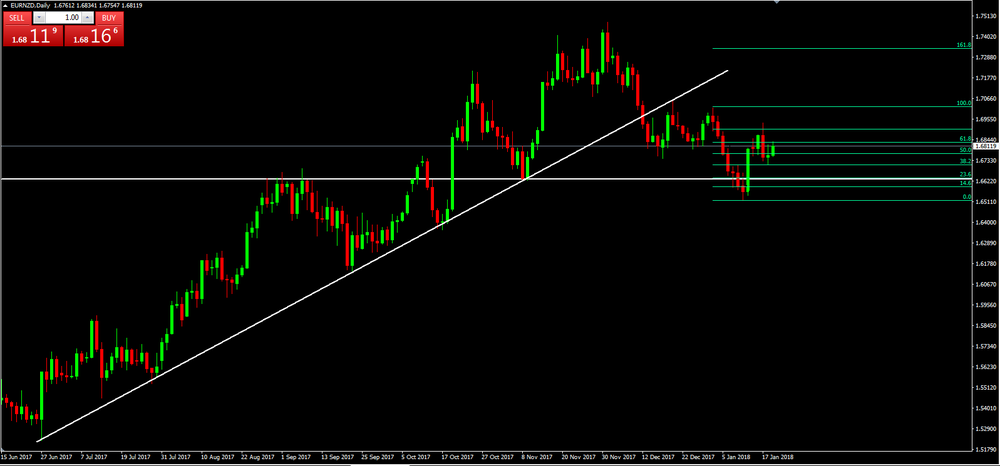

On daily time frame chart, we can see that EUR/NZD has broken an important upside trend line and since the breakout it starts a new bearish movement.

At this moment, we can see that the price is correcting its last movement.

However, it can be interesting to short entries once the price starts to reject the fibonacci levels.

In the latest three months the quantity bought in retail sales increased by 0.4% compared with the previous three months; while the underlying pattern remains one of growth, this is the weakest quarterly growth since the decline of 1.2% in Quarter 1 (Jan to Mar) 2017.

On the month, the quantity bought decreased by 1.5% when compared with strong sales in November 2017.

In December 2017, the quantity bought increased by 1.4% when compared with December 2016, with positive contributions from all stores except food stores.

For the whole of 2017, the quantity bought in retail sales increased by 1.9%; the lowest annual growth since 2013.

Internet sales continued to increase when compared with previous years, with physical stores dominating online sales growth in December.

This reflected surpluses for goods (€31.1 billion), primary income (€10.5 billion) and services (€4.5 billion), which were partly offset by a deficit for secondary income (€13.6 billion).

The 12-month cumulated current account for the period ending in November 2017 recorded a surplus of €386.1 billion (3.5% of euro area GDP), compared with one of €375.1 billion (3.5% of euro area GDP) for the 12 months to November 2016. This development was due to increases in the surpluses for services (from €43.4 billion to €73.7 billion) and primary income (from €98.7 billion to €112.6 billion). These were partly offset by a decrease in the surplus for goods (from €371.9 billion to €349.1 billion) and an increase in the deficit for secondary income (from €138.9 billion to €149.4 billion).

The overall index of producer and import prices rose by 0.2% in December 2017 compared to the previous month, reaching 101.9 points (base of December 2015 = 100). Compared to December 2016, the price level of the total supply of domestic and imported products increased by 1.8%. The average annual inflation in 2017 was 0.9%. This is evident from the figures of the Federal Statistical Office (FSO). The average annual tax rate 2017 corresponds to the rate of change between the average for 2017 and the average for 2016. The annual average is calculated as the arithmetic average of the 12 monthly indices of the calendar year.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2346 (4125)

$1.2316 (5511)

$1.2299 (3465)

Price at time of writing this review: $1.2264

Support levels (open interest**, contracts):

$1.2194 (1325)

$1.2169 (1410)

$1.2140 (1530)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date February, 9 is 110836 contracts (according to data from January, 18) with the maximum number of contracts with strike price $1,2100 (5511);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3986 (2030)

$1.3958 (3177)

$1.3941 (3482)

Price at time of writing this review: $1.3915

Support levels (open interest**, contracts):

$1.3837 (103)

$1.3793 (56)

$1.3766 (147)

Comments:

- Overall open interest on the CALL options with the expiration date February, 9 is 36477 contracts, with the maximum number of contracts with strike price $1,3600 (3482);

- Overall open interest on the PUT options with the expiration date February, 9 is 29027 contracts, with the maximum number of contracts with strike price $1,3500 (3054);

- The ratio of PUT/CALL was 0.80 versus 0.84 from the previous trading day according to data from January, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Primary dealers take 11.04 pct of U.S. indexed 10-yr note sale, direct 10.01 pct and indirect 78.95 pct

-

U.S. sells $13 bln indexed 10-year notes at high yield 0.548 pct, awards 91.10 pct of bids at high

In 2017 the index of producer prices for industrial products (domestic sales) for Germany increased by 2.6% on an annual average from the preceding year. As reported by the Federal Statistical Office (Destatis) this was the first increase on an annual average since 2012 (+ 1.6% compared with 2011). In 2016 the index had fallen by 1.7% compared with 2015.

In December 2017 the index of producer prices for industrial products rose by 2.3% compared with the corresponding month of the preceding year. In November 2017 the annual rate of change all over had been +2.5.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.