- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 22-02-2018.

(pare/closed(GMT +2)/change, %)

EUR/USD $1,2331 +0,39%

GBP/USD $1,3954 +0,27%

USD/CHF Chf0,93273 -0,67%

USD/JPY Y106,74 -0,96%

EUR/JPY Y131,63 -0,56%

GBP/JPY Y148,95 -0,69%

AUD/USD $0,7845 +0,54%

NZD/USD $0,7337 +0,29%

USD/CAD C$1,27039 +0,02%

07:00 Germany GDP (YoY) (Finally) Quarter IV 2.8% 2.9%

07:00 Germany GDP (QoQ) (Finally) Quarter IV 0.7% 0.6%

10:00 Eurozone Harmonized CPI January 0.4% -0.9%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) January 0.9% 1%

10:00 Eurozone Harmonized CPI, Y/Y (Finally) January 1.4% 1.3%

13:30 Canada Consumer Price Index m / m January -0.4% 0.4%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.2%

13:30 Canada Consumer price index, y/y January 1.9% 1.4%

15:15 U.S. FOMC Member Dudley Speak

18:00 U.S. Baker Hughes Oil Rig Count February 798

18:30 U.S. FOMC Member Mester Speaks

20:40 U.S. FOMC Member Williams Speaks

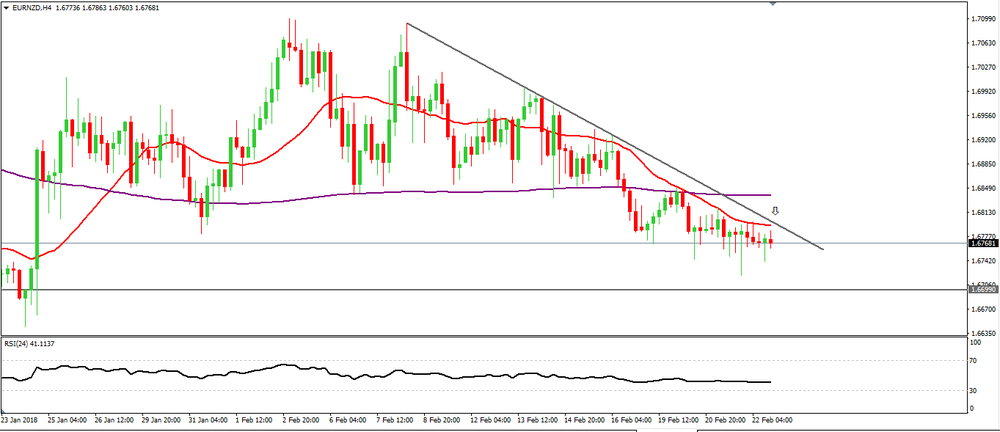

EUR/NZD has been forming a downside trend line for a while on 4 hour time frame chart.

We can see that the price is showing some difficulty in breakthrough the zone where it is at this moment.

However, it might be interesting go short in this pair once it breaks below that zone.

Despite this decline, retail sales were up 1.5% in the fourth quarter and up 6.7% for the year. Sales fell in 6 of 11 subsectors, representing 42% of retail trade.

Lower sales at general merchandise; health and personal care; and electronics and appliance stores more than offset gains at motor vehicle and parts dealers and food and beverage stores. Excluding motor vehicle and parts dealers, retail sales decreased 1.8%.

Retail sales in volume terms were also down 0.8% in December.

In the week ending February 17, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 7,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 230,000 to 229,000. The 4-week moving average was 226,000, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised down by 250 from 228,500 to 228,250.

-

Policymakers were in broad agreement over the concerns about the euro's volatility

-

Communication stance could be revisited at upcoming meetings in early part of 2018

-

Some expressed preference for dropping easing bias

-

Policy will evolve to avoid abrupt, disorderly adjustments later

-

Pace of economic expansion could strengthen, growth robust

-

Increasingly confident about inflation but patience required

-

German economy slightly less euphoric, export euphoria has dampened somewhat

-

German coalition deal is not cause for jubilation, rather sobriety

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.4% between Quarter 3 (July to Sept) and Quarter 4 (Oct to Dec) 2017; this is a 0.1 percentage point revision down from the preliminary estimate of GDP, in part reflecting a small downward revision to the estimated output of the production industries.

Growth in the latest quarter was driven by business services and finance within the services sector, there was, though, a small downward revision to services since the preliminary estimate of GDP, but this does not impact on services quarterly growth to one decimal place.

Business investment growth was flat between Quarter 3 (July to Sept) and Quarter 4 (Oct to Dec) 2017, but when compared with the same quarter a year ago business investment grew by 2.1%.

GDP was estimated to have increased by 1.7% between 2016 and 2017, a downward revision of 0.1 percentage points from the preliminary estimate and slightly lower than the 1.9% growth seen between 2015 and 2016.

Household spending grew by 1.8% between 2016 and 2017, its slowest rate of annual growth since 2012, in part reflecting the increased prices faced by consumers.

In January 2018, the Consumer Prices Index (CPI) edged down by 0.1%, following a +0.3% rebound in December. This decline is largely the result of a seasonal downturn in manufactured product prices due to winter sales, and a drop in transport prices. Tobacco prices fell also. The monthly downturn was mitigated by a sharp acceleration in energy prices and a rise in food prices.

Seasonally adjusted, consumer prices accelerated (+0.7%) after +0.1% in December.

Year on year, consumer prices rose by 1.3% in January after +1.2% in November and December. The acceleration in energy and services prices was partly offset by slower prices of tobacco and food products. Prices of manufactured products were stable.

EUR/USD

Resistance levels (open interest**, contracts)

$1.2393 (2528)

$1.2365 (1181)

$1.2341 (1406)

Price at time of writing this review: $1.2266

Support levels (open interest**, contracts):

$1.2209 (5470)

$1.2178 (3036)

$1.2144 (4640)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date March, 9 is 128200 contracts (according to data from February, 21) with the maximum number of contracts with strike price $1,2400 (6413);

GBP/USD

Resistance levels (open interest**, contracts)

$1.4025 (1812)

$1.3995 (1164)

$1.3970 (677)

Price at time of writing this review: $1.3882

Support levels (open interest**, contracts):

$1.3804 (2337)

$1.3773 (2123)

$1.3739 (2045)

Comments:

- Overall open interest on the CALL options with the expiration date March, 9 is 48779 contracts, with the maximum number of contracts with strike price $1,3900 (3712);

- Overall open interest on the PUT options with the expiration date March, 9 is 46301 contracts, with the maximum number of contracts with strike price $1,3900 (2337);

- The ratio of PUT/CALL was 0.95 versus 0.95 from the previous trading day according to data from February, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Recent volatility in equity markets shows asset prices can move rapidly, unexpectedly

-

Recent U.S. tax, fiscal policy could help sustain economy's momentum

-

Investment drought that has afflicted U.S. economy may be breaking

-

Soft inflation likely transitory, 'does not cause me great concern'

-

Don't really know if U.S. is at full employment

-

We are not sure about neutral rate, or output gap either

-

Fed should be patient, let inflation build

-

Is very focused on wage growth, labor market slack and inflation

-

Hitting 2-pct inflation target would give Fed more flexibility in fighting future downturns

-

Most voting policymakers said recent data suggested modestly stronger near-term economic outlook than was anticipated in december

-

Several policymakers cautioned imbalances in financial markets may emerge as the economy operates above potential; a few said important to monitor slope of yield curve

-

A number of Fed policymakers raised near-term economic growth forecasts based on recent strong data, information suggesting tax overhaul might have larger effects than previously thought

-

Voting policymakers generally judged risks as roughly balanced but several saw increased upside risks to near-term economic outlook

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.