- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 28-11-2016.

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0612 +0,19%

GBP/USD $1,2415 -0,40%

USD/CHF Chf1,0129 -0,14%

USD/JPY Y111,93 -1,00%

EUR/JPY Y118,80 -0,80%

GBP/JPY Y138,98 -1,36%

AUD/USD $0,7480 +0,52%

NZD/USD $0,7072 +0,42%

USD/CAD C$1,341 -0,83%

01:00 Canada BOC Gov Stephen Poloz Speaks

09:30 United Kingdom Mortgage Approvals October 62.93 65

09:30 United Kingdom Consumer credit, mln October 1405 1550

09:30 United Kingdom Net Lending to Individuals, bln October 4.7

10:00 Eurozone Consumer Confidence (Finally) November -8 -6.1

10:00 Eurozone Business climate indicator November 0.55 0.57

10:00 Eurozone Industrial confidence November -0.6 -0.5

10:00 Eurozone Economic sentiment index November 106.3 107

13:00 Germany CPI, m/m (Preliminary) November 0.2% 0.1%

13:00 Germany CPI, y/y (Preliminary) November 0.8% 0.8%

13:30 Canada Current Account, bln Quarter III -19.9

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter III 1.8% 1.7%

13:30 U.S. GDP, q/q (Revised) Quarter III 1.4% 3%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September 5.1% 5.2%

14:15 U.S. FOMC Member Dudley Speak 15:00 U.S. Consumer confidence November 98.6 100

17:40 U.S. FOMC Member Jerome Powell Speaks

21:45 New Zealand Building Permits, m/m October 0.2%

23:50 Japan Industrial Production (MoM) (Preliminary) October 0.6% -0.1%

23:50 Japan Industrial Production (YoY) (Preliminary) October 1.5%

-

Italian Debt is Sustainable

-

But Greatest Risk Comes from Impaired Growth, Recovery Not Firming

-

Protracted Period of Time with Low Rates Are "Fertile Terrain" for Financial Stability Risks

-

'Not Obvious' That High Interest Rate Would Stimulate Reforms

-

Still Serious Concerns About Sustainability of Greek Public Debt

-

Geopolitical Uncertainty Has Become Major Source of Uncertainty

-

Eurozone Has Weathered Brexit Fallout with "Encouraging Resilience"

-

Monetary Policy Could be More Effective If Supported by "Decisive Action" from Other Policies

-

Economy Continues to Expand at Moderate, Steady Pace

EUR/USD 1.0500 (EUR 3,114 M) 1.0525 (EUR 554 M) 1.0550-1.0565 (EUR 390 M) 1.0585-1.0600 (EUR 784 M) 1.0625 (EUR 200 M) 1.0650 (EUR 1,435 M) 1.0665-1.0680 (EUR 541 M) 1.0700 (EUR 2,803 M) 1.0745-1.0760 (EUR 572 M) 1.0770-1.0785 (EUR 642 M) 1.0800 (EUR 707 M)

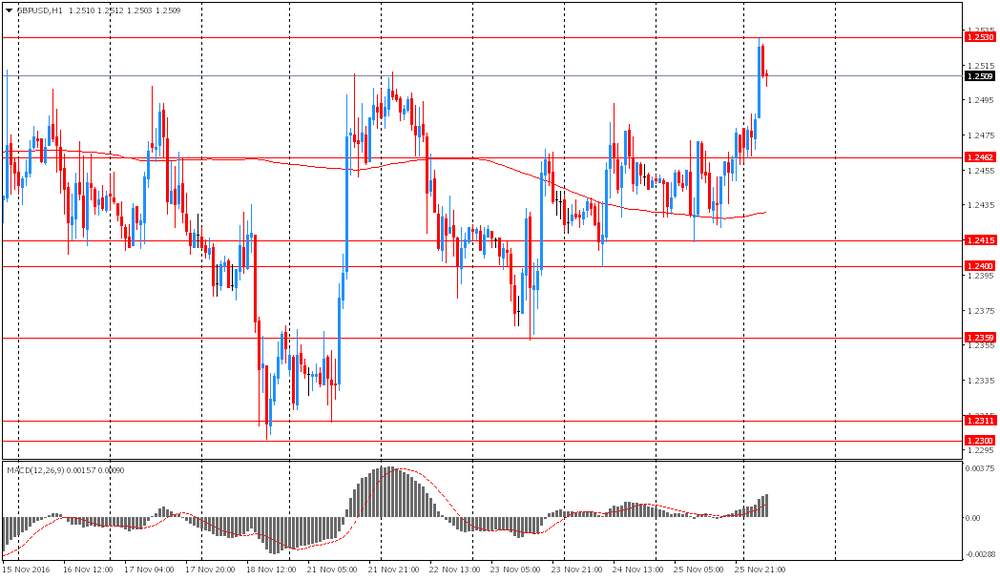

GBP/USD 1.2500 (GBP 291 M)

EUR/GBP 0.8600 (EUR 253 M)

USD/JPY 112.00 (USD 514 M)

AUD/USD 0.7347-0.7360 (AUD 198 M) 0.7500-0.7505 (AUD 341 M) 0.7615-0.7630 (AUD 243 M)

USD/CAD 1.3500-1.3505 (USD 231 M) 1.3600 (USD 302 M) 1.3695-1.3700 (USD 316 M)

NZD/USD 0.7000-0.7010 (NZD 256 M)

President Vladimir Putin of the Russian Federation not scheduled meetings with representatives of the oil companies in anticipation of, or at the end of the OPEC meeting to be held in Vienna

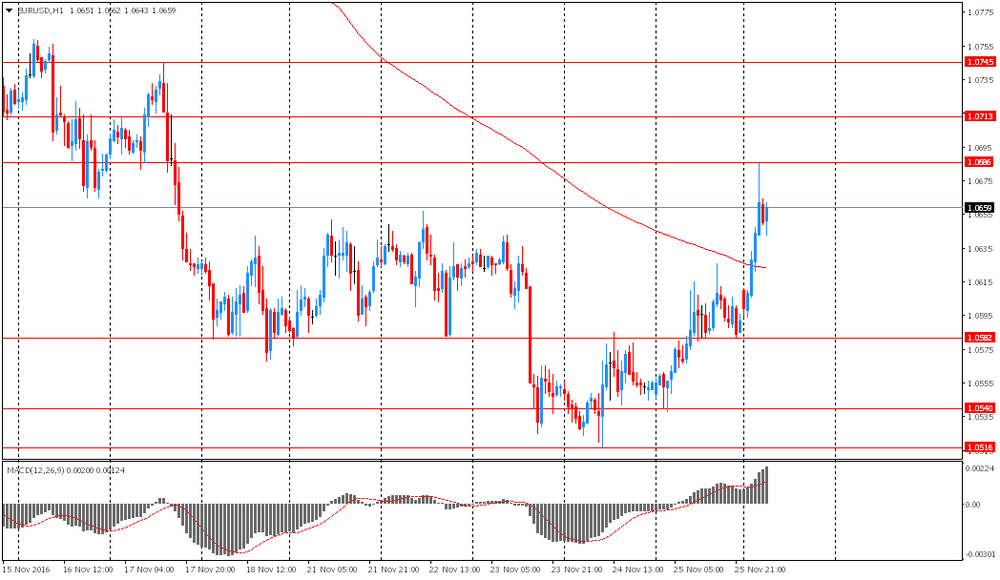

EUR/USD

Offers 1.0685 1.0700 1.0730 1.0750 1.0780 1.0800

Bids 1.0630 1.0600 1.0580-85 1.0560 1.0530 1.0515 1.0500

GBP/USD

Offers 1.2520 1.2530-35 1.2550-55 1.2570 1.2585 1.2600 1.2630 1.2650 1.2700

Bids 1.2480-85 1.2460 1.2430 1.2400 1.2380 1.2360 1 .2340 1.2315-20 1.2300

EUR/GBP

Offers 0.8545-50 0.8580-85 0.8600 0.8630-35 0.8650

Bids 0.8500-8495 0.8475-80 0.8450 0.8420 0.8400 0.8380-85 0.8350

EUR/JPY

Offers 119.50 119.80-85 120.00 120.45-50 121.00 121.50

Bids 119.00 118.80 118.50 118.00 117.80 117.60 117.30 117.00

USD/JPY

Offers 112.20 112.30-35 112.50 112.80 113.00 113.25-30 113.60 113.80 114.00

Bids 111.85 111.50 111.30-35 111.00 110.85 110.50 110.30 110.00

AUD/USD

Offers 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids 0.7460 0.7430 0.7400 0.7370 0.7355-60 0.7325-30 0.7300

-

OECD has improved the outlook for global GDP growth for 2017 from 3.2% to 3.3%

-

The forecast for global GDP growth for 2016 remained unchanged at 2.9%

-

The forecast for US GDP growth in 2016 increased to 1.5% from 1.4%, and in 2017 - to 2.3% from 2.1%

-

The forecast for GDP growth in the euro area improved to 1.7% in 2016 from 1.5% and in 2017 - to 1.6% from 1.4%

-

The forecast for GDP growth in Japan for 2016 increased to 0.8% from 0.6%, and in 2017 - to 1.0% from 0.7%

-

The forecast for GDP growth in the UK increased to 2.0% in 2016 to 1.8% and in 2017 - to 1.2% from 1.0%

-

The forecast for China's GDP growth improved to 6.7% in 2016 to 6.5% and in 2017 - to 6.4% from 6.2%

The Bank of Japan posted a net loss of 200.2 billon yen ($1.8 billion) in six months through September 30 due to the impact of the strong yen, the first time it posted a loss in four years.

The central bank cited by Dow Jones said losses related to foreign exchange fluctuations totaled ¥ 697.6 billion in the fiscal first half, compared with a profit of ¥ 27.2 billion in the same period a year earlier.

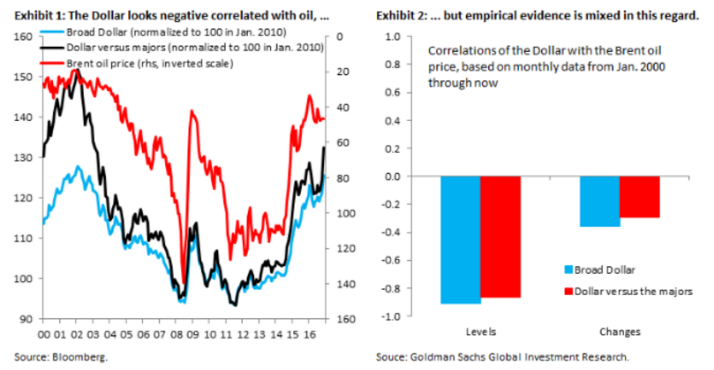

"Historically, the Dollar has been negatively correlated with oil prices, meaning low oil prices have coincided with a strong Dollar, while high oil prices have typically come when the Dollar has been weak.

We argue that the importance of this empirical relationship is overstated for two reasons.

First, many of the counterpart currencies in broad Dollar indices belong to commodity exporting countries, so that falling (rising) oil prices push down (up) their terms of trade, which weakens (strengthens) their currencies. The negative correlation thus exists almost by construction, i.e. is a bit like looking at the correlation of oil prices with their reciprocal (commodity exporters' terms of trade). In short, the correlation isn't really about the Dollar per se, but about commodity exporters.

Second, fluctuations in oil prices often coincide with other developments that have effects on the Dollar, including global demand shocks or monetary policy changes. Both of these are present in Exhibit 1, which shows the drop in oil prices during the global financial crisis, which - being a negative demand shock originating in the US - moved rate differentials against the Dollar, and the pronounced drop in oil prices in 2014, which coincided with the BoJ and ECB increasing monetary stimulus, moving rate differentials in favor of the Dollar. This is perhaps one reason why the correlation of the Dollar with oil prices is less pronounced in changes than in levels

We examine the correlation of the Dollar with oil prices using daily data, controlling for interest differentials, risk appetite and other factors. It concludes that rate differentials are the most important driver behind recent Dollar moves, followed by oil prices.

We conclude that it is primarily the forces of economic divergence that are driving recent Dollar direction, in line with our forecasts which anticipate more Dollar appreciation (around 7 percent) on these grounds".

Copyright © 2016 Goldman Sachs, eFXnews™

The 2017 outlook for Spanish regions is stable but fiscal consolidation pressures will continue and structural reforms may be deferred under the minority government, Moody's Investors cited by rttnews.

"Spain's improving economic prospects will help reduce budgetary pressure for the regions," Marisol Blázquez, a Moody's Analyst and author of the report, said.

"Spain's positive economic growth should gradually increase the regions' tax revenues and central government transfers, helping them to rebalance their budgets."

The annual growth rate of the broad monetary aggregate M3 decreased to 4.4% in October 2016, from 5.1% in September, averaging 4.8% in the three months up to October. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate, including currency in circulation and overnight deposits (M1), decreased to 7.9% in October, from 8.4% in September.

The annual growth rate of short-term deposits other than overnight deposits (M2-M1) was more negative at -1.5% in October, from -1.0% in September. The annual growth rate of marketable instruments (M3-M2) decreased to 1.7% in October, from 5.5% in September. Within M3, the annual growth rate of deposits placed by households stood at 5.2% in October, compared with 5.1% in September, while the annual growth rate of deposits placed by non-financial corporations decreased to 5.5% in October, from 7.4% in September.

EUR/USD 1.0500 (EUR 3.1bln) 1.0600 (656m) 1.0650 (1.43bln) 1.0700 (2.8bln)

USD/JPY 112.00 (USD 534m)

USD/CAD 1.3800 (USD 562m)

-

At 09:00 GMT the ECB Board Member Peter Preat will make a speech

-

At 12:15 GMT the ECB board member Benoit Coeure deliver a speech

-

At 14:00 GMT the ECB president Mario Draghi will deliver a speech

-

At 15:30 GMT the Bank of England Member of the Commission Gertjan Vlige deliver a speech

-

At 16:00 GMT the ECB president Mario Draghi will deliver a speech

Among the events of the weekend, Saudi Arabia has refused to take part in the scheduled meeting of OPEC+, including Russia. Yesterday, the energy Minister Khalid al-Falih said that the oil market will balance by a natural way in 2017, even if the producers did not intervene, and therefore to maintain the current level of production can be justified. This statement has increased doubts about the achievement of productive arrangements to cut oil production at the OPEC meeting on Wednesday.

The US dollar fell sharply against all major currencies against the backdrop of profit taking after a strong US dollar exchange rate over the past three weeks. According to the futures market a Fed hike has 93.5% probability so dollar gains caused by rate hike pricing can be limited.

EUR / USD: during the Asian session, the pair rose to $ 1.0685

GBP / USD: during the Asian session, the pair rose to $ 1.2530

USD / JPY: fell to Y113.35

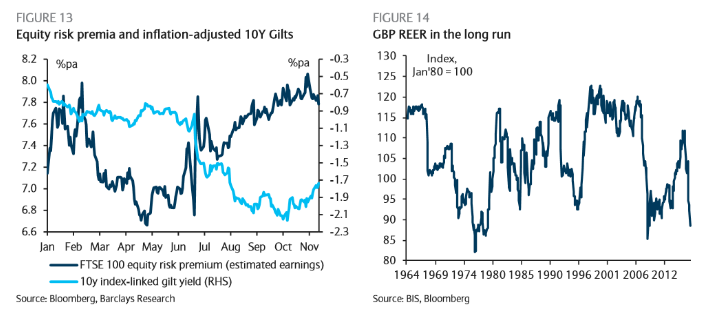

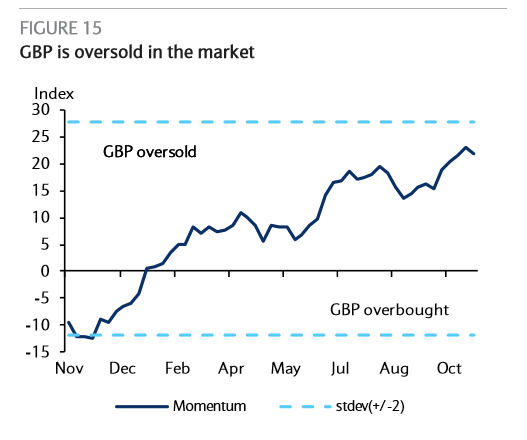

"The key question for sterling's evolution from here is whether or not the Brexit uncertainty discount is sufficient.

While the ultimate resolution of Brexit may have an impact on GBP's equilibrium value, at current levels, GBP represents clear long-term value, having been cheaper on a real effective basis only twice in the last half century: briefly at the depths of the Global Financial Crisis, and during its mid-70s balance of payments crisis (Figure 14).

In our view, this is more than sufficient discount, but that does not mean that GBP cannot get cheaper still.

While the medium-term value of GBP is extremely compelling, there is a strong incentive for buyers of long-term UK investments to wait for the Government to announce its Brexit negotiation plans. This leaves GBP exposed to further "flash crashes", particularly in periods of illiquidity as important constitutional questions regarding the Government's path to trigger Article 50 remain in question.

That said, positioning in GBP appears quite short and momentum indicators are indicative of oversold GBP positions (Figure 15),limiting the ability of GBP to extend significantly lower, even over short horizons".

Copyright © 2016 Barclays Capital, eFXnews™

EUR/USD

Resistance levels (open interest**, contracts)

$1.0830 (3541)

$1.0758 (1334)

$1.0703 (1096)

Price at time of writing this review: $1.0652

Support levels (open interest**, contracts):

$1.0497 (4514)

$1.0435 (4443)

$1.0360 (2126)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 76928 contracts, with the maximum number of contracts with strike price $1,1400 (6380);

- Overall open interest on the PUT options with the expiration date December, 9 is 68079 contracts, with the maximum number of contracts with strike price $1,0600 (4514);

- The ratio of PUT/CALL was 0.88 versus 0.85 from the previous trading day according to data from November, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.2801 (1189)

$1.2702 (1930)

$1.2604 (1431)

Price at time of writing this review: $1.2496

Support levels (open interest**, contracts):

$1.2393 (1413)

$1.2296 (4036)

$1.2198 (1048)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35084 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36704 contracts, with the maximum number of contracts with strike price $1,2300 (4036);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from November, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.