- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: currency news — 29-09-2017.

The resilience of consumers has again been demonstrated as concerns about the impact of the hurricanes on the national economy have quickly faded.

Given that the survey was able to reach most households in Florida and Texas in late September, it should be no surprise that small declines were recorded in the current financial situation of households. In the past year, there has been a long list of issues that could have derailed the overall level of consumer confidence, including the unprecedented partisan divide, North Korea, Charlottesville, and the hurricanes.

Confidence has nonetheless remained very favorable, moving sideward in a very narrow positive range. In the first nine months of 2017, the Sentiment Index averaged 96.2, just ahead of averages of 91.9 and 92.9 recorded in the prior two years, making 2017 the highest recorded since 2000

The MNI Chicago Business Barometer rose to 65.2 in September, up from 58.9 in August, hitting the highest level in three months and the second highest level in more than three years. Optimism among firms about business conditions was bolstered in September after August's flat showing, with each of the Barometer's sub-components strengthening. A marked rise in Order Backlogs, up to a 29-year high, was among the month's highlights. September's survey result left the Q3 calendar average of the Barometer at 61.0, virtually unchanged from Q2's three-year high of 61.1.

EURUSD: 1.1600 (EUR 770m) 1.1700 (380m) 1.1750 (400m) 1.1800 (680m) 1.1830 (450m) 1.1850-55 (980m) 1.1875 (920m) 1.1900 (1.75bln) 1.1950 (630m)

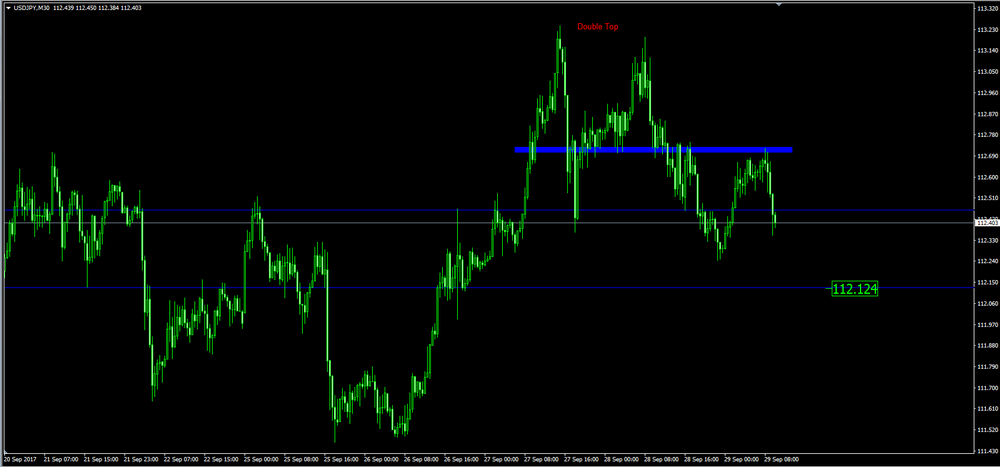

USDJPY: 111.50 (USD 1.2bln) 112.00 (1.2bln)

GBPUSD: 1.3365 (GBP 275m ) 1.3385 ( 540m)

AUDUSD: 0.7995-00 (AUSD 235m)

The Industrial Product Price Index (IPPI) rose 0.3% in August, mainly due to higher prices for energy and petroleum products. The Raw Materials Price Index (RMPI) increased 1.0%, primarily due to higher prices for crude energy products.

The IPPI increased 0.3% in August, following a 1.6% decrease in July. Of the 21 major commodity groups, 6 were up, 13 were down and 2 were unchanged.

After rising for eight consecutive months, real gross domestic product (GDP) was essentially unchanged in July as 11 of 20 industrial sectors grew.

Goods-producing industries contracted 0.5%, the first decrease in five months, largely as a result of declines in mining, quarrying and oil and gas extraction and in manufacturing. Services-producing industries increased 0.2%.

The mining, quarrying, and oil and gas extraction sector contracted 1.2% in July, mainly due to a 1.8% decline in the oil and gas extraction subsector.

Non-conventional oil extraction was down for the fourth time in five months, decreasing 3.0%. Conventional oil and gas extraction decreased for the first time in five months, declining 0.8% as a result of lower crude petroleum extraction.

Personal income increased $28.6 billion (0.2 percent) in August according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $14.9 billion (0.1 percent) and personal consumption expenditures (PCE) increased $18.0 billion (0.1 percent).

Real DPI decreased 0.1 percent in August and Real PCE decreased 0.1 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.1 percent.

The increase in personal income in August primarily reflected an increase in government social benefits to persons and compensation of employees.

Real PCE spending in August decreased $8.4 billion due to a decrease of $20.2 billion in spending for goods that was partially offset by a $9.2 billion increase in spending for services. Within goods, spending on new motor vehicles was the leading contributor to the decrease. Within services, healthcare spending was a leading contributor to the increase

Euro area annual inflation is expected to be 1.5% in September 2017, stable compared to August 2017, according to a flash estimate from Eurostat, the statistical office of the European Union. Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in September (3.9%, compared with 4.0% in August), followed by food, alcohol & tobacco (1.9%, compared with 1.4% in August), services (1.5%, compared with 1.6% in August) and non-energy industrial goods (0.5%, stable compared with August).

The UK's current account deficit was £23.2 billion (4.6% of gross domestic product) in Quarter 2 (Apr to June) 2017, a widening of £0.9 billion from a revised deficit of £22.3 billion (4.4% of gross domestic product) in Quarter 1 (Jan to Mar) 2017.

The widening in the current account deficit was driven by a widening to the deficit on primary and secondary incomes, which widened £1.4 billion and £1.9 billion respectively; these were mostly offset by a narrowing of the deficit on trade in goods which narrowed £2.3 billion in Quarter 2 2017.

The primary income deficit widened to £10.2 billion in Quarter 2 2017 due to foreign earnings on direct investment and portfolio investment in the UK increasing more than UK earnings on direct investment and portfolio investment abroad between Quarter 1 2017 and Quarter 2 2017.

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.3% between Quarter 1 (Jan to Mar) and Quarter 2 (Apr to June) 2017, unrevised from the second estimate of GDP.

Services provided the only positive contribution to growth in Quarter 2 2017, with output unrevised at 0.3%.

Despite some small downward revisions to quarter-on-quarter growth in 2016, between 2015 and 2016, UK GDP grew by 1.8%, unrevised from the previous estimate.

Business investment growth in 2016 has been revised up by 1.1 percentage points but still fell in 2016 compared with 2015 by 0.4%; quarter-on-quarter growth was also revised from flat to 0.5% growth in Quarter 2 2017.

Household expenditure growth slowed to 0.2% in Quarter 2 2017 and was revised downwards in the second half of 2016.

Gross fixed capital formation (GFCF), in volume terms, was estimated to have increased by 0.6% to £81.2 billion in Quarter 2 (Apr to Jun) 2017 from £80.7 billion in Quarter 1 (Jan to Mar) 2017.

Business investment was estimated to have increased by 0.5% to £45.7 billion in Quarter 2 2017 from £45.4 billion in Quarter 1 2017.

Between Quarter 2 2016 and Quarter 2 2017, GFCF was estimated to have increased by 2.4%, from £79.3 billion and business investment was estimated to have increased by 2.5%, from £44.5 billion.

The sectors contributing most to GFCF growth between Quarter 1 2017 and Quarter 2 2017 were general government and business investment.

-

Says we don't have a household debt bubble in UK

-

Interest rate increases if and when they come will be limited and gradual

-

All indications are that UK economy is on the kind of track for rates to increase in relatively near future

-

Worried about a pocket of risk in consumer debt

In September 2017, the KOF Economic Barometer increases compared to the previous month (revised from 104.1 to 104.2) by 1.6 points to a level of 105.8. Accordingly, it partially reverses its decline in August. The Barometer still stands markedly above its long-term average. It thus indicates a continuation of growth with rates above average, even though the last few months do not reveal any clear up- or downward trend.

The strongest positive contributions come from the manufacturing sector. The indicators relating to the hotel and catering industry also show a slight upward tendency. At the same time, the outlook for domestic consumption, the export industry, the financial sector and construction has deteriorated somewhat.

Over a year, the Consumer Price Index (CPI) should rise by 1.0% in September 2017, after +0.9% in the previous month, according to the provisional estimate made at the end of the month. This increase in year-on-year inflation should come from an acceleration in food prices and in energy prices and also a lesser drop in manufactured product prices. Services prices should slow down slightly.

Over one month, consumer prices should edge down (-0.1%) after a rebound in August. This decline should mainly come from a seasonal rebound in services prices, essentially those of tourism-related services. Moreover, food prices should fall after a stability in the previous month. Energy prices should slow a little, the stability in gas and electricity prices moderating a sharp rise in the prices of petroleum products. On the other hand, manufactured product prices should accelerate after a seasonal rebound in August.

Year on year, the Harmonised Index of Consumer Prices should increase a little faster, to +1.1% after +1.0% in August. Over one month, it should edge down: -0.1% after a rebound to +0.6% in the previous month.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1899 (1206)

$1.1876 (1971)

$1.1841 (620)

Price at time of writing this review: $1.1777

Support levels (open interest**, contracts):

$1.1731 (3548)

$1.1690 (3631)

$1.1645 (3404)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date October, 6 is 101992 contracts (according to data from September, 28) with the maximum number of contracts with strike price $1,1800 (5677);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3585 (1219)

$1.3529 (1073)

$1.3499 (1442)

Price at time of writing this review: $1.3412

Support levels (open interest**, contracts):

$1.3329 (617)

$1.3288 (974)

$1.3243 (720)

Comments:

- Overall open interest on the CALL options with the expiration date October, 6 is 35215 contracts, with the maximum number of contracts with strike price $1,3700 (3022);

- Overall open interest on the PUT options with the expiration date September, 8 is 39472 contracts, with the maximum number of contracts with strike price $1,3150 (3162);

- The ratio of PUT/CALL was 1.12 versus 1.07 from the previous trading day according to data from September, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Overall nationwide consumer prices in Japan were up 0.7 percent on year in August, the Ministry of Internal Affairs and Communications cited by rttnews.

That exceeded forecasts for 0.6 percent and was up from 0.4 percent in July.

Core CPI, which excludes food prices, also advanced 0.7 percent - in line with forecasts and up from 0.5 percent in the previous month.

On a monthly basis, overall inflation was up 0.2 percent and core CPI added 0.1 percent.

Overall inflation for the Tokyo region, considered a leading indicator for the nationwide trend, gained 0.5 percent on year in September. That was unchanged, although it missed forecasts for 0.6 percent.

Core CPI for Tokyo also was up 0.5 percent on year - matching forecasts and up from 0.4 percent in August.

On a monthly basis, overall inflation fell 0.1 percent and core CPI was flat.

UK annual house price growth stable at 2.0% in September.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: "The annual rate of house price growth remained broadly stable in September at 2.0%, compared with 2.1% in August. "Housing market activity, as measured by the number of housing transactions and mortgage approvals, has strengthened a little in recent months, though remains relatively subdued by historic standards. "Low mortgage rates and healthy rates of employment growth are providing some support for demand, but this is being partly offset by pressure on household incomes, which appear to be weighing on confidence. The lack of homes on the market is providing ongoing support to prices".

According to provisional data turnover in retail trade in August 2017 was in real terms 2.8% and in nominal terms 4.7% larger than that in August 2016. The number of days open for sale was 27 in August 2017 and in August 2016.

Compared with the previous year, turnover in retail trade was in the first eight months of 2017 in real terms 3.0% and in nominal terms 4.8% larger than in in the corresponding period of the previous year.

-

BoJ must be ready to take necessary action if geopolitical risks heighten and threaten to revive deflation

-

Chance of inflation accelerating toward 2 pct from next year is low

-

BoJ needs to ease policy further to prop up demand given expected impact on economy from scheduled sales tax hike

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.