- Analytics

- News and Tools

- Market News

CFD Markets News and Forecasts — 02-05-2017

(raw materials / closing price /% change)

Оil 48.08 +0.88%

Gold 1,257.80 +0.06%

(index / closing price / change items /% change)

Nikkei +135.18 19445.70 +0.70%

TOPIX +10.53 1550.30 +0.68%

Hang Seng +81.00 24696.13 +0.33%

CSI 300 -13.17 3426.58 -0.38%

Euro Stoxx 50 +18.62 3578.21 +0.52%

FTSE 100 +46.11 7250.05 +0.64%

DAX +69.89 12507.90 +0.56%

CAC 40 +36.82 5304.15 +0.70%

DJIA +36.43 20949.89 +0.17%

S&P 500 +2.84 2391.17 +0.12%

NASDAQ +3.77 6095.37 +0.06%

S&P/TSX +44.02 15619.65 +0.28%

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0928 +0,28%

GBP/USD $1,2934 +0,39%

USD/CHF Chf0,9915 -0,46%

USD/JPY Y112,01 +0,16%

EUR/JPY Y122,43 +0,44%

GBP/JPY Y144,88 +0,55%

AUD/USD $0,7533 +0,15%

NZD/USD $0,6933 +0,40%

USD/CAD C$1,3709 +0,21%

07:55 Germany Unemployment Rate s.a. April 5.8% 5.8%

07:55 Germany Unemployment Change April -30 -12

08:30 United Kingdom PMI Construction April 52.2 52

09:00 Eurozone Producer Price Index, MoM March 0.0% -0.1%

09:00 Eurozone Producer Price Index (YoY) March 4.5% 4.1%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter I 1.7% 1.7%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter I 0.4% 0.5%

12:15 U.S. ADP Employment Report April 263 180

13:45 U.S. Services PMI (Finally) April 52.8 52.5

14:00 U.S. ISM Non-Manufacturing April 55.2 55.8

14:30 U.S. Crude Oil Inventories April -3.641

18:00 U.S. Fed Interest Rate Decision 1% 1%

18:00 U.S. FOMC Statement

Major US stock indexes finished trading with a weak increase, as significant losses of the conglomerate sector were offset by the growth of other sectors. Investors also were in anticipation of the Fed meeting and analyzed ambiguous corporate reports.

Market participants predict that the Fed will leave interest rates unchanged, and retain the wording of previous statements about a "gradual rate hike," despite a sharp slowdown in the economy. According to the futures market, now the probability of an increase in the rate of the Fed at the meeting in May is 4.8%.

Meanwhile, given that more than two thirds of S & P500 companies have already submitted quarterly results, firms are likely to report the largest increase in earnings per share since the first quarter of 2011. However, some investors consider the shares in the US expensive compared to historical average estimates, and do not rule out a rollback.

Quotes of oil significantly decreased, as positive news about the decline in oil production by Russia and the major exporters of OPEC were offset by signs of increased oil production in the US, Canada and Libya. The National Oil Company of Libya said yesterday that oil production in the country rose above 760,000 barrels per day, reaching the highest level since December 2014. In addition, the company added that they plan to continue to increase oil production.

Most components of the DOW index recorded a rise (19 out of 30). The leader of growth was shares of Intel Corporation (INTC, + 1.94%). More shares fell The Procter & Gamble Company (PG, -1.06%).

Most sectors of the S & P index finished trading in positive territory. The leader of growth was the healthcare sector (+ 0.3%). The conglomerate sector fell most of all (-1.5%).

At closing:

DJIA + 0.17% 20,949.28 +35.82

Nasdaq + 0.06% 6,095.37 +3.77

S & P + 0.12% 2.391.11 + 2.78

-

We have never interfered in other countries' political processes

-

We don't want others to interfere in our politics

-

Discussed anti-Kremlin protests with Merkel

-

Our law enforcement acted within law when breaking up protests

-

Agreed on need for full investigation of attack on Syria's Sheikh Hanoun

-

Death of OSCE observer does significant damage to peace effort

-

Those guilty should be found and punished

-

We decisively condemn any use of chemical

-

OPEC members subject to oil supply targets achieve 90 pct of pledged reductions in april (revised march compliance estimate 92 pct)

EURUSD: 1.0840-50 (EUR 470m) 1.0880 (387m) 1.0900-10 (711m) 1.0945-50 ( 813m) 1.1000 (1.6bln)

USDJPY: 111.25 (USD 912m) 111.50-60 (500m) 111.80 ( 1.9bln) 112.30 (285m)

AUDUSD: 0.7400 (AUD 200m) 0.7500 (321m) 0.7530 (243m) 0.7650 (185m)

NZDUSD 0.6975-85 (NZD (328m) 0.7100 (197m)

U.S. stock-index futures were flat ahead of the start of the Fed's two-day meeting and Apple's (AAPL) quarterly report.

Stocks:

Nikkei 19,445.70 +135.18 +0.70%

Hang Seng 24,696.13 +81.00 +0.33%

Shanghai 3,143.71 -10.95 -0.35%

FTSE 7,251.14 +47.20 +0.66%

CAC5,293.05 +25.72 +0.49%

DAX 12,469.53 +31.52 +0.25%

Crude $49.05 (+0.43%)

Gold $1,253.70 (-0.14%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 195 | 0.19(0.10%) | 300 |

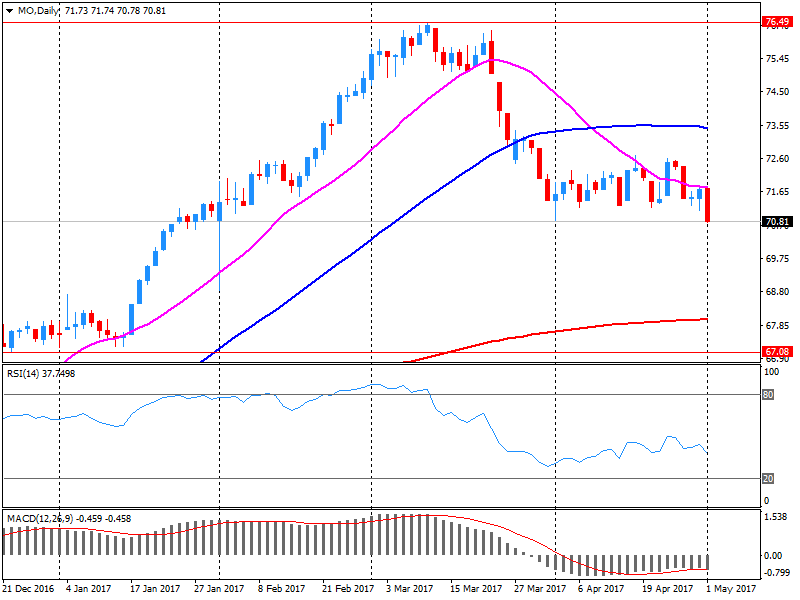

| ALTRIA GROUP INC. | MO | 69.8 | -1.00(-1.41%) | 73908 |

| Amazon.com Inc., NASDAQ | AMZN | 951 | 2.77(0.29%) | 21688 |

| Apple Inc. | AAPL | 147.21 | 0.63(0.43%) | 314183 |

| AT&T Inc | T | 39.16 | 0.06(0.15%) | 897 |

| Barrick Gold Corporation, NYSE | ABX | 16.33 | -0.03(-0.18%) | 66888 |

| Caterpillar Inc | CAT | 102.55 | 0.55(0.54%) | 5827 |

| Cisco Systems Inc | CSCO | 34.02 | 0.05(0.15%) | 665 |

| Exxon Mobil Corp | XOM | 82.21 | 0.15(0.18%) | 1212 |

| Facebook, Inc. | FB | 153.2 | 0.74(0.49%) | 148247 |

| Ford Motor Co. | F | 11.47 | 0.05(0.44%) | 10309 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.46 | -0.08(-0.64%) | 46030 |

| General Electric Co | GE | 29.07 | 0.13(0.45%) | 9192 |

| General Motors Company, NYSE | GM | 34.15 | -0.05(-0.15%) | 2015 |

| Google Inc. | GOOG | 913.56 | 0.99(0.11%) | 3464 |

| Hewlett-Packard Co. | HPQ | 18.97 | 0.04(0.21%) | 2032 |

| Intel Corp | INTC | 36.33 | 0.02(0.06%) | 3505 |

| International Business Machines Co... | IBM | 158.89 | 0.05(0.03%) | 902 |

| JPMorgan Chase and Co | JPM | 86.89 | -0.17(-0.20%) | 3543 |

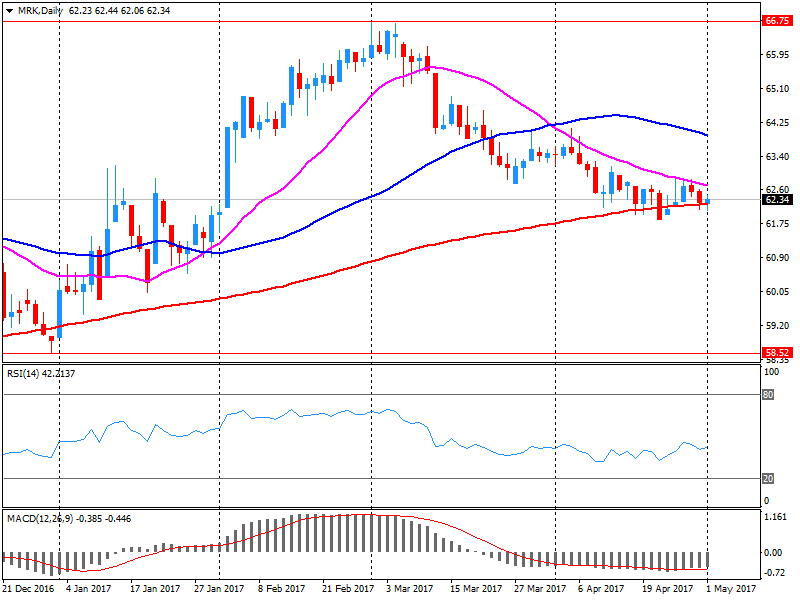

| Merck & Co Inc | MRK | 62.18 | -0.20(-0.32%) | 25802 |

| Microsoft Corp | MSFT | 69.67 | 0.26(0.37%) | 13621 |

| Nike | NKE | 55 | 0.01(0.02%) | 342 |

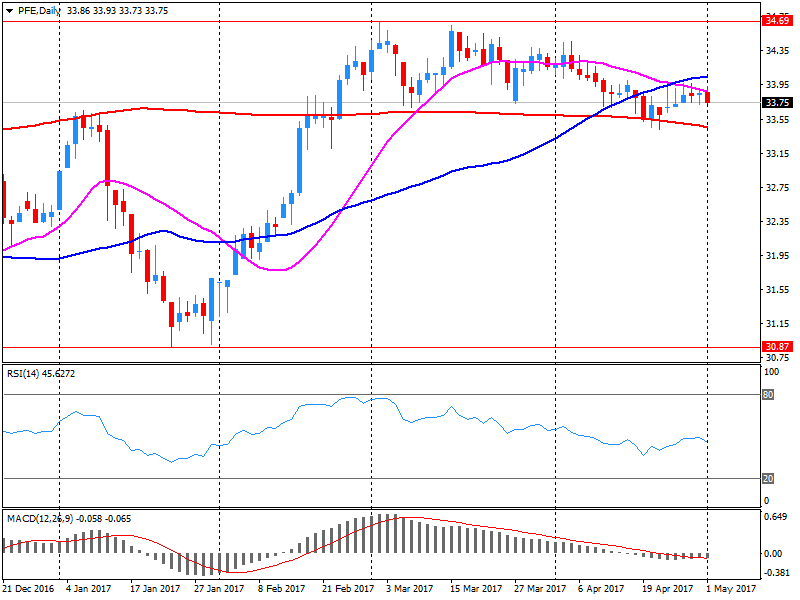

| Pfizer Inc | PFE | 33.64 | -0.14(-0.41%) | 28497 |

| Tesla Motors, Inc., NASDAQ | TSLA | 321.5 | -1.33(-0.41%) | 28257 |

| The Coca-Cola Co | KO | 43.3 | 0.08(0.19%) | 13549 |

| Twitter, Inc., NYSE | TWTR | 17.63 | 0.09(0.51%) | 178324 |

| Verizon Communications Inc | VZ | 45.92 | 0.04(0.09%) | 1091 |

| Visa | V | 91.36 | 0.10(0.11%) | 333 |

| Walt Disney Co | DIS | 114.9 | 0.17(0.15%) | 2054 |

| Yahoo! Inc., NASDAQ | YHOO | 48.72 | 0.11(0.23%) | 1250 |

| Yandex N.V., NASDAQ | YNDX | 27.73 | -0.03(-0.11%) | 4700 |

MasterCard (MA) reported Q1 FY 2017 earnings of $1.00 per share (versus $0.86 in Q1 FY 2016), beating analysts' consensus estimate of $0.95.

The company's quarterly revenues amounted to $2.734 bln (+11.8% y/y), missing analysts' consensus estimate of $2.654 bln.

MA rose to $118.56 (+1.88%) in pre-market trading.

EUR/USD

Offers: 1.0925 1.0935 1.0950-55 1.0980 1.1000 1.1030 1.1050

Bids: 1.0900 1.0885 1.0865 1.0850 1.08201 .0800 1.0780 1.0750 1.0700

GBP/USD

Offers: 1.2900 1.2925-30 1.2950-60 1.2975 1.3000 1.3020 1.3050

Bids: 1.2860 1.2830 1.2800 1.2775-80 1.2760 1.2750

EUR/JPY

Offers: 122.80 123.00 123.30 123.50 123.75 124.00

Bids: 122.30 122.00 121.85 121.65 121.50 121.00 120.75-80 120.50

EUR/GBP

Offers: 0.8485 0.8500 0.8530 0.8550

Bids: 0.8450 0.8430 0.8400 0.8385 0.8350

USD/JPY

Offers: 112.20 112.35 112.50 112.80 113.00

Bids: 112.00 111.80 111.50 111.20 111.00

AUD/USD

Offers: 0.7550 0.7565 0.7585 0.7600 0.7630 0.7650

Bids: 0.7520 0.7500 0.7480 0.7450 0.7430 0.7400

Pfizer (PFE) reported Q1 FY 2017 earnings of $0.69 per share (versus $0.67 in Q1 FY 2016), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $12.779 bln (-1.7% y/y), missing analysts' consensus estimate of $13.089 bln.

PFE fell to $33.50 (-0.83%) in pre-market trading.

Merck (MRK) reported Q1 FY 2017 earnings of $0.88 per share (versus $0.89 in Q1 FY 2016), beating analysts' consensus estimate of $0.83.

The company's quarterly revenues amounted to $9.434 bln (+1.3% y/y), beating analysts' consensus estimate of $9.254 bln.

MRK rose to $62.61 (+0.37%) in pre-market trading.

Altria (MO) reported Q1 FY 2017 earnings of $0.73 per share (versus $0.72 in Q1 FY 2016), missing analysts' consensus estimate of $0.74.

The company's quarterly revenues amounted to $4.589 bln (+1.3% y/y), generally in-line with analysts' consensus estimate of $4.631 bln.

MO fell to $68.50 (-3.25%) in pre-market trading.

-

Says will not appeal court ruling that government must not delay publication of air pollution plan

The euro area (EA19) seasonally-adjusted unemployment rate was 9.5% in March 2017, stable compared to February 2017 and down from 10.2% in March 2016. This is the lowest rate recorded in the euro area since April 2009. The EU28 unemployment rate was 8.0% in March 2017, down from 8.1% in February 2017 and from 8.7% in March 2016. This remains the lowest rate recorded in the EU28 since January 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 19.716 million men and women in the EU28, of whom 15.515 million in the euro area, were unemployed in March 2017. Compared with February 2017, the number of persons unemployed decreased by 56 000 in the EU28 and by 5 000 in the euro area. Compared with March 2016, unemployment fell by 1.647 million in the EU28 and by 991 000 in the euro area.

The start of the second quarter saw a solid improvement in the performance of the UK manufacturing sector. Rates of expansion in output, total new orders and new export work all gathered pace, underpinned by robust business confidence and driving further job creation.

The seasonally adjusted Markit/CIPS Purchasing Managers' Index rose to a three-year high of 57.3 in April, up from March's four-month low of 54.2. Survey data were collected 11-25 April. The PMI has signalled expansion for nine months in a row. The last time the PMI registered below its no-change mark was July 2016, the month following the EU referendum result.

The German manufacturing sector entered the second quarter of 2017 in a high gear, according the latest PMI survey data from IHS Markit and BME. Overall operating conditions improved at a pace that almost matched the near six-year record set in March as output, new orders and employment all continued to grow at historically sharp rates. Cost pressures continued to intensify, however, with the rate of input price inflation accelerating for a survey-record ninth consecutive month to the highest since May 2011.

The PMI registered 58.2 in April, little-changed from March's 58.3 and indicative of a further sharp improvement in manufacturing business conditions in Germany. The downward tick in the PMI reflected slightly weaker growth rates for output, new orders and employment as well as a contraction in stocks of purchases, although these trends were almost wholly offset by the greatest lengthening in suppliers' delivery times in six years. The current 29-month period of overall growth in the goodsproducing sector is the second-longest in the 21- year survey history

The eurozone manufacturing sector continued to gain momentum at the start of the second quarter. At 56.7 in April, up from 56.2 in March, the final Markit Eurozone Manufacturing PMI rose to a six-year high.

The PMI was only a tick below the earlier flash estimate of 56.8. Seven out of the eight nations covered recorded an improvement in operating conditions. The sole exception was Greece, where a deterioration was signalled for the eighth straight month. Growth was led by Germany, which saw its rate of expansion remain close to March's 71-month high.

The Netherlands PMI held steady at its March level. This performance was sufficient to place the Netherlands third in the PMI growth rankings, only slightly behind Austria in second position.

-

Realistic way is to promote regional initiatives and linking with each other those initiatives, rather than having single asian initiative

-

Geopolitical conflict is not good for anyone, must be avoided by political will

-

Establishment of aiib, joining of many asian countries to the aiib, is good because infrastructure needs in asia are huge

EUR/USD

Resistance levels (open interest**, contracts)

$1.1033 (3175)

$1.0997 (4209)

$1.0973 (4186)

Price at time of writing this review: $1.0913

Support levels (open interest**, contracts):

$1.0847 (1147)

$1.0797 (1394)

$1.0767 (1310)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 72964 contracts, with the maximum number of contracts with strike price $1,1100 (7123);

- Overall open interest on the PUT options with the expiration date June, 9 is 75482 contracts, with the maximum number of contracts with strike price $1,0200 (5274);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from May, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.3106 (2139)

$1.3010 (2542)

$1.2915 (1277)

Price at time of writing this review: $1.2876

Support levels (open interest**, contracts):

$1.2792 (1244)

$1.2694 (879)

$1.2596 (1462)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 25212 contracts, with the maximum number of contracts with strike price $1,3000 (2542);

- Overall open interest on the PUT options with the expiration date June, 9 is 29120 contracts, with the maximum number of contracts with strike price $1,2500 (5034);

- The ratio of PUT/CALL was 1.16 versus 1.15 from the previous trading day according to data from May, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

Latest data indicated that Chinese manufacturers started the second quarter with a further slowdown in production and new business growth. Employment across the sector meanwhile declined at the fastest pace since the start of the year and input buying rose only slightly. At the same time, optimism towards the 12-month outlook was the weakest seen in 2017 so far. Cost pressures continued to ease from the peaks seen at the end of last year, and contributed to only a modest rise in prices charged.

The seasonally adjusted Purchasing Managers' Index - a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy - registered 50.3 in April, down from 51.2 in March to signal only a marginal improvement in overall operating conditions. Moreover, the latest upturn in the health of the sector was the weakest seen since last September.

Slower increases in output and new orders were key factors weighing on the headline index reading in April. Production growth softened for the second month running and rose only marginally overall. Total new business followed a similar trend, and rose at weakest pace since last September.

"At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent.

There has been a broad-based pick-up in the global economy since last year. Labour markets have tightened further in many countries and forecasts for global growth have been revised up. Above-trend growth is expected in a number of advanced economies, although uncertainties remain. In China, growth is being supported by increased spending on infrastructure and property construction, with the high level of debt continuing to present a medium-term risk. The improvement in the global economy has contributed to higher commodity prices, which are providing a significant boost to Australia's national income. Australia's terms of trade have increased, although some reversal of this is occurring.

Headline inflation rates have moved higher in most countries, partly reflecting the higher commodity prices. Core inflation remains low. Long-term bond yields are higher than last year, although in a historical context they remain low. Interest rates have increased in the United States and there is no longer an expectation of additional monetary easing in other major economies. Financial markets have been functioning effectively.

The Bank's forecasts for the Australian economy are little changed. Growth is expected to increase gradually over the next couple of years to a little above 3 per cent. The economy is continuing its transition following the end of the mining investment boom, with the drag from the decline in mining investment coming to an end and exports of resources picking up. Growth in consumption is expected to remain moderate and broadly in line with incomes. Non-mining investment remains low as a share of GDP and a stronger pick-up would be welcome".

The Nasdaq rallied on Monday to a new record on the back of strong gains in large-cap tech shares even as the broader market finished out the session mixed. Big gains in Amazon.com Inc. AMZN, +2.51% Apple Inc. appl and Netflix Inc. NFLX, +2.07% underpinned the Nasdaq's rise in a day devoid of big earnings or economic data.

Asian equities broadly rose Tuesday, with strong earnings from technology companies in the U.S. overnight providing a shot in the arm to regional technology companies. Investors also sought to reposition themselves as many markets returned from the Labor Day holiday. In Japan, Tuesday is the last trading day of the week before holidays there.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.